AUD/USD ? Extended Correction Offers Setups ? for Buyers and Sellers

Dear Trader,

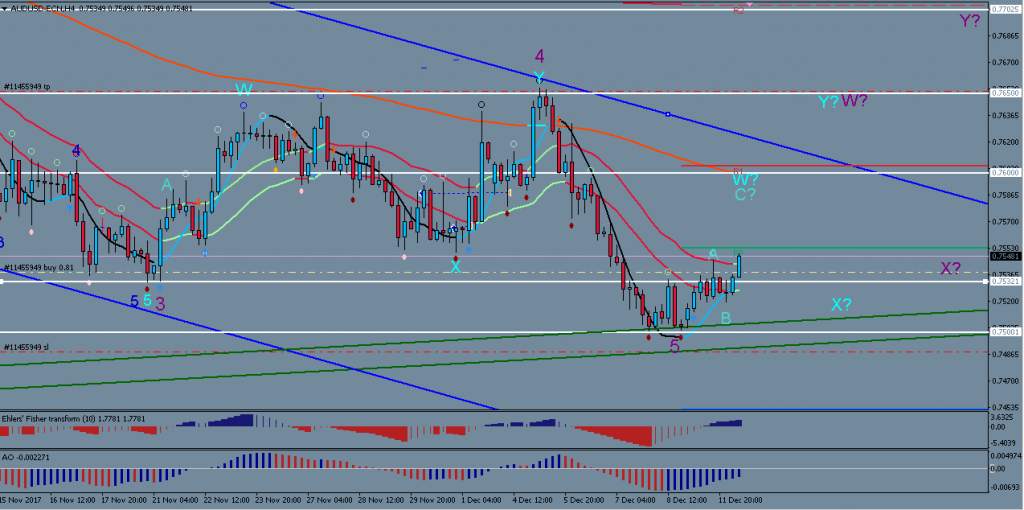

the AUD/USD has been in a significant downtrend throughout the later part of 2017. Price is now within important support and resistance zones, which could provide trade options for both, buyers and sellers.

This analysis will take a closer look at what we can expect for the AUD/USD over the coming weeks.

Overview

The 4 hour chart shows that the last bearish move in early December could have completed another degree of the longer-term downtrend (i.e. completion of purple Wave 5). My bias is that Purple Wave 5 has finished because it abruptly stopped at the significant support zone of 0.7500 which is a confluence zone of longterm trendlines (green), and the round number 0.7500 itself. The move established one last slightly lower low relative to the mid November low, which completed a lesser degree of impulsive waves (turquoise 5).

Price could now begin an extended period of correction between the support of 0.7500 and the resistance of 0.7650 – 0.77. This should allow for various long and short opportunities at key levels.

Potential Bounce Setups

Various interesting points emerge for potential trade setups if we apply corrective Elliot wave structures in combination with support and resistance levels as a prediction tool.

I have highlighted a possible complex corrective wave structure (turquoise and purple WXY), plus some key support and resistance levels (white) that could act as bouncing spots (see chart above).

It will be important to be able to recognize a 3-wave pattern that makes up the internal structure of each W,X, and Y. If a 3 wave pattern finishes at one of the support/resistance levels, we have the basis for potential bounce trades.

Trades could be entered at those levels if there are reversal signs present, such as significant slowdown of momentum and reversal candlestick patterns. Aim for the next support/resistance zone relative to the direction you are trading.

All the best along your trading journey…

Hubert

Follow Hubert on Twitter

Leave a Reply