Tesla Shares Split Gives More Buying Opportunities for Smaller Investors

Dear Traders,

The Tesla announced the split around August 11 and the 5 for 1 split happened dropping the share price to 444 USD. However, this is a logical move which is not uncommon.

The total value of a publicly traded company is represented by a number of stocks or shares. When a company does a stock split, the value doesn’t change. What we get is actually more stocks at the better price. The move is usually done when prices are very high so there is no demand from smaller investors as smaller investors find it hard to pay 2000 USD per stock.

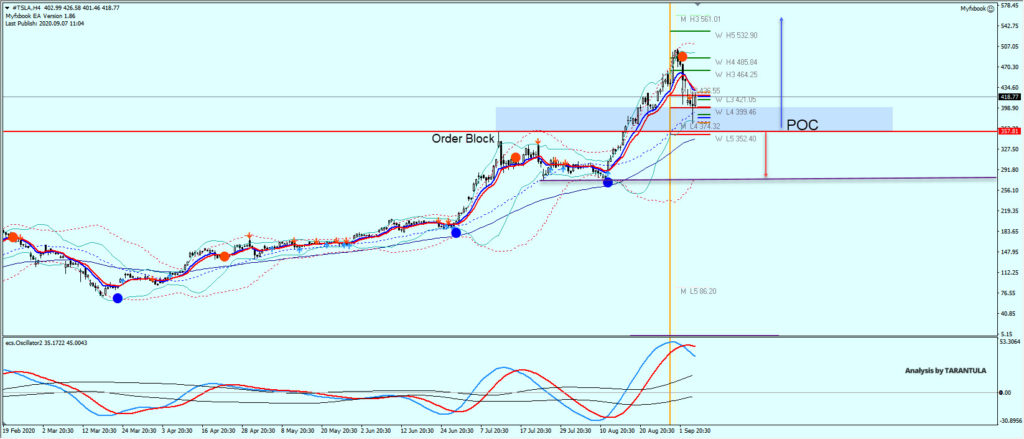

For CFD traders this can be slightly different. As the price of Tesla stocks was divided by 5, traders who entered at a higher price than 444 USD per stock are still in profit but there might be big SWAP costs which balance out those profits. However, this is going to create new demand for Tesla stocks and CFDs. As we can see after the split, the price has already gained bullish momentum as seen in the chart (bullish wick off the M L4 support).

As new investors might be joining we can see that 350-400 is the zone where buyers are. New swing to the upside is going to aim for 464, 485, 532 and eventually 561. Tesla is a tech company and during COVID crisis tech companies performed the best. However, if the price drops below 350 we might see a further weakness towards 295 where strong support is. Buying also from this leve can be a valid option for investors too.

The analysis has been done with the CAMMACD system.

For more daily technical and wave analysis and updates, sign-up up to our ecs.LIVE channel.

Many green pips,

Nenad Kerkez aka Tarantula FX

Elite CurrenSea

Leave a Reply