Why Options Are the Best Weapon for Today’s Market

Dear traders,

Have you seen your portfolio swing 1% to 5%, or even 8% in one day? In today’s market, the BEST WAY to protect and hedge your investments is to learn how to use options.

Options are a very versatile financial instrument. You can apply them in any market condition and potentially profit. But when the market drops, big, as shown in the last two months, then the true and great power of options becomes apparent.

This article explains why learning to trade options is critical and crucial for any serious trader and investor. Learn more with Elite CurrenSea and Marco Doni about options.

Why Options are a Fundamental Pillar of Trading

Most people who approach trading start with stocks. Why is this? Well, trading stocks is easy to understand and grasp with very little knowledge of capital markets.

Also, buying stock is the most common used trading strategy. I agree, buying stocks is a good strategy. Especially if you know how to select and diversify among the sectors and if you have enough risk capital. Even with my portfolio, I have personally selected stocks from different sectors with medium and long term goals.

But what happens if the market crashes? What if your portfolio is based on stocks only? What if your retirement account is on the line? Well, this can’t be good!

You might incur a large loss of more than 50% on the overall portfolio. Imagine that your portfolio consists of airline stocks. As of recently, the travel industry dropped and major airlines plummeted. American Airlines lost 70% of its value in 3 months and Delta decreased 63% in 4 months. Or what if you owned shares of McDonalds or Starbucks, you would have lost almost 50% in 2 months.

So, what is the best solution to such a catastrophic event? Well some of you might think that patience is the answer in a long term investment and just to ride out the market swings. And I partially agree. But it may take years for the stock to rebound and recoup your losses.

But if you are like me, you are not willing to wait to get that money back. I want to reinvest now and have my money to continue to work for me. Every month of every year! In the past, I learned the hard way and this wasn’t the best approach.

Actually, a catastrophic event of losing a large investment in the markets is what led me to consider a different approach with trading. And this approach was on my EDUCATION.

What could I have done to avoid such losses and protect my portfolio?

Some of the best investors in the world: Warren Buffet, Ray Dalio, and Mark Cuban, learned how to manage their portfolios during market downturns and they don’t incur such exorbitant losses. They know how to protect and hedge their investments and even know how to squeeze a profit in a bear market.

You may be asking, what are the financial instruments they use to achieve these results? Take a guess? If you said OPTIONS, you are right!

As I said before, Options can be used to speculate in any market condition, but the best scenario is during a market crash.

Education in options is fundamental, if you want to become a profitable trader and investor. Knowing how to protect your trades and investments is crucial and can save you from a lot of pain.

So how can I use Options to protect my investments such as a stock portfolio?

Most traders know the basics of Options, like how to use a PUT and CALL. But this is not enough. If you want to achieve maximum efficiency, you must learn how to use them with the right strategies.

Strategies for Becoming a Smart Investor and Trader

Indeed, buying a PUT is a good strategy and better than doing nothing… But it may not be the best approach.

Buying a PUT costs money. It is similar to buying insurance. Insurance policies will cost you money.

So, the first question to ask yourself, is how long do I want this protection on a stock?

Usually, we want at least 90-days of protection, and ready to roll-out further, if necessary.

Buying a PUT is good protection for the short-term. But as I said before, the cost of the PUT might be a lot, and what if the market bounces back? Initially, the PUT protected you and recovered your losses, however in a rebound market, it would start to lose value. So, how do we manage this?

- What I would do is buy a PUT VERTICAL DEBIT SPREAD, one of my favorite strategies with Options.

- It is a combination of a buy and sold PUT.

- With this strategy, the cost of the insurance is dramatically reduced and we still have downside protection.

Can you see the beauty of options? When you have the right knowledge, you can play with them and create the right strategy for that particular market condition.

There are also other strategies that can be used, like PUT RATIO BACKSPREAD, but they require more experience.

For now a PUT VERTICAL DEBIT SPREAD with 90 days expiration is the right combination, in terms of cost and protection, for your portfolio.

Knowing how to manage OPTIONS VERTICAL SPREAD could be the difference between a 50% loss and a 20% profit on your investments.

How to Start with Options!

Thinking about options but not sure yet? There are a couple of ways to move forward before committing to the course or educational signal service. Here is how you can stay in touch:

- Join the free ecs.OPTIONS telegram channel

- Sign-up to the ECS newsletter with trading ideas in your email inbox

- Join the free live webinar options webinar with Marco & Chris

If you are ready to move forward, then you can choose from:

- €899 one time fee for Options course in English – this includes 1 month of option trading ideas (option.SWINGS).

Option trading ideas (option.SWINGS) – experience is required: - €97 per month (including VAT)

- €289 per quarter (including VAT) – receive 1 month for free for a total of 4 months

- €899 per year (including VAT) – receive 2 months for free for a total of 14 months

Subscribe to the live webinar now!

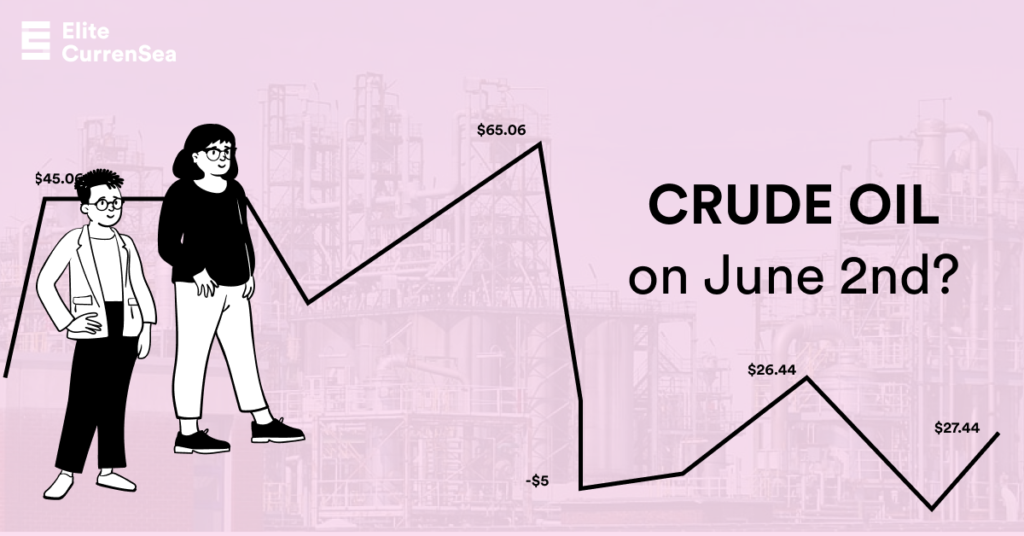

Win US Options Course

Make the most of options & participate in a US Options giveaway contest.

To be eligible you need to:

- Be a member of ECS community (newsletter or telegram)

- Predict the price correctly via facebook or twitter

- attend the webinar on june 2nd

Good trading,

Marco Doni – ecs.OPTIONS expert and CNBC contributor

Chris Svorcik – Elite CurrenSea

Leave a Reply