CAMMACD Offers Complete Trading Method for All Experience Levels

Dear Traders,

Trading is something you really want to try. Especially with cryptocurrency hype, now is the time to take trading to a higher level.

But trading is not easy and requires a lot of experience. There is however one short-cut, which is using the CAMMACD method.

CAMMACD provides well respected, simple, and automated levels of support and resistance, entries, and targets. This article explains the trading method from A to Z.

Main Benefits of CAMMACD

CAMMACD is the pinnacle in trading methods. It allows for an unpreceded accuracy in the markets taking all most important factors in overall trading:

- Candlesticks

- Trend Lines

- Camarilla pivots

- OB/OS levels

- MTF trend

- Super-Dot

- ATR Pivots

- Algo indicators

- Money management

- Psychology

There are more key benefits:

- Levels are generated automatically each trading day.

- Systems require no adjustment or manual tuning by the trader.

- The chart stays simple and clean with no memory hogging.

- It is created by the award winning trader for traders.

Simply put, the CAMMACD method provides well respected, simple, and automated levels of support and resistance, entries, and targets. It is unprecedented what one system can do, right?

Why would a trader need ten different types of indicators for trend, three kinds of filters, and four extra tools for intraday trading if there was a simpler yet more effective solution? Pay attention, because the CAMMACD might be the only method you would need to turn a profit. CAMMACD keeps our trading simple.

CAMMACD Covers All Trading Types

In trading we always want to buy low and sell high. With the ecs.CCI indicator and other CAMMACD proprietary indicators, it has never been easier. When we define the zone, we just need to wait for the confirmation and pull the trigger.

How? It is easily explained in the CAMMACD course. I have personally taken all important things when I made trading modules. Have in mind that not every trader can trade the same way. That is why we need to have a modern approach to trading dividing the same core principles into different trading modules.

So the CAMMACD is completely suitable for:

- Intraday traders

- Scalpers

- Counter trend traders

- Breakout traders

- Momentum traders

- Swing traders

CAMMACD consists of 3 different trading strategies:

- Core system with SIT module – semi automated for 4 hour trading and Scalping

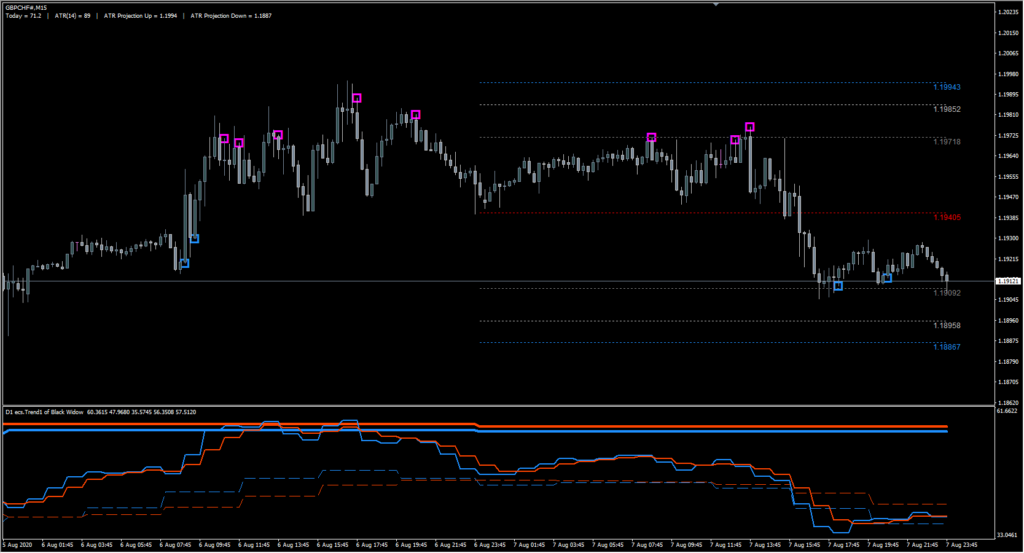

- The Black Widow – algorithmic trading on 15m TF

- London Open Advanced – automated 15 min trading exclusively for London Open

Most traders are just confused and lost in the ‘noise’ but CAMMACD removes that confusion (‘noise’) and offers a clear plan and signals. In fact, we are not the only ones…

Many of the big institutional traders and banks use the Camarilla because of its superior information and accuracy.

We recommend the CAMMACD for every type of trader – regardless of style, time frame, approach or system you are using now. With this method, your approach will be clear, consistent, and duplicable.

Another benefit of trading CAMMACD is its consistency. All CAMMACD traders will have a complete support meaning all future updates will be free. How the things are at this point, with the release of the newest breakthrough in trading – The Black Widow method, there won’t be any updates. With the Black Widow the circle has been completed.

Lowering Your Drawdown and Complete Market Correlation

To lessen the likelihood that we mistake many of those unprofitable systems for profitable ones like the CAMMACD, I ensured to develop the systems on multiple markets using the same rules and parameters. This provides a much larger trade sample than a single market.

So effectively the CAMMACD can be traded with Forex, Commodities, Cryptos and Equities. Although it is primarily created for the Forex market, it has also shown great initial results with cryptos such as BTC/USD, ETH/USD, XRP/USD and LTC/USD.

The independence of individual trades is related to the markets and time frame you are trading. CAMMACD intraday method is used mostly on 1h time frame but positional trades are made on 4h time frame. Staying focused on the CAMMACD Core module adding correlated markets is the best way to trade the price action and stay on the profitable side of the market.

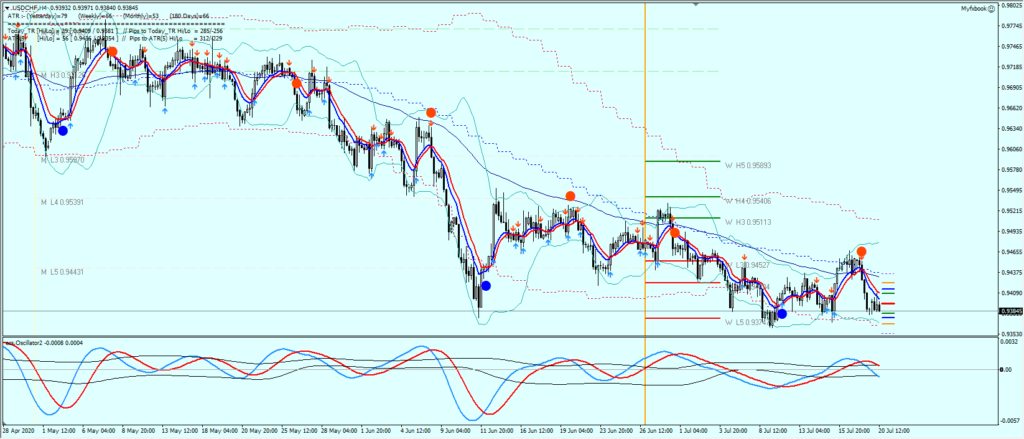

This means that a CAMMACD system, using the same rules and parameters, can trade three similar markets — say, the JPY225, GBP/JPY and USD/JPY and profit in all three with a small increase the maximum drawdown by, say, 5-10% due to sheer volume and volatility of JPY carry trades. That drawdown can even be lower as shown in the screenshot above that shows trading during a typical holiday month – August.

Additionally, by trading three markets, the trade sample is potentially three times larger, meaning the results are more statistically significant.

For example, it is important to note that based on its historical relationship, when oil prices rise, the USD/CAD falls and vice versa: when the price of oil goes down, the USD/CAD rises.

The Canadian economy is highly dependent on its exports, and 85% of its exports go to the United States. For this reason, the USD/CAD can be greatly affected by how American consumers react to changes in oil prices. When U.S. demand increases, the price of oil rises and the price of the USD/CAD goes down. When the U.S. demand falls, the price of oil decreases and the USD/CAD price rises.

Historical Strength

Source: 290 trades on CAMMACD method, Nenad’s personal account

The CAMMACD has shown historically good results as it also uses the “historical vs now moment” approach. The approach is based on the fact that in Forex trading history repeats itself. Usually buyers and sellers will appear at similar spots as in history.

That is why we use order blocks that are easily spotted with ecs.DOTS indicator. Price action defined by CAMMACD has withstood the test of time and it is future-proof due to all important factors that shape up the price action.

Everything is explained in the CAMMACD course and it also is explained in live CAMMACD webinars.

Fundamental Behaviour Is Reflected On the Price

The CAMMACD method uses basic economic principles that are firmly integrated in the trading behavioural patterns. Let’s use the standard risk of sentiment matrix.

Yen strength:

- 100% risk off sentiment

- Gold up

- Commodities prices down

- Equities down

- Yen strengthens as a result

Because the Japanese can get cheap credit, they invest overseas heavily. When it is risky, they bring the money back creating demand for Yen and vice versa, when it is bullish Equities, they pump their money overseas, which means they sell Yen and buy foreign currency.

You don’t need to understand this basic principle if you want to make money on Yen strength. It’s enough to look at charts, see the Yen basket and trade. The main principle of selling the XYZ/JPY pair (due to Yen strength) applies and it is easily spotted by zones, camarilla levels, order blocks and ecs.cci indicator.

Risk Control

In financial markets trading there are 3 types of risk:

- Market

- Event

- Liquidity

Market risks can always happen during low liquidity time. The solution is simple – we don’t trade then.

Event risk occurs at scheduled times but can also occur at unscheduled times – like in the example of a poll. There can also be rumors too that cause unexpected swings. They usually happen during low liquidity periods. (Monday open, Friday close or early Wellington session). With the CAMMACD thing like that should happen with a minimum risk. That is why we trade with conservative risk and dynamic stop loss.

The rules with CAMMACD are there to keep us out of trades when volatility is low.

Suitable For All Account Types

CAMMACD works on big and small accounts. The most important factor is money management and that is what the CAMMACD is taking very seriously. With correct money management as it is explained on CAMMACD course the only thing which we pay attention should be the gross profit but you really need to follow the rules religiously.

In trading, we always want to buy low and sell high. With the ecs.Oscillator and ecs.MACD indicators trading is easier, even in these hard market conditions. When we define the zone, we just need to wait for the signal and the rules to align and pull the trigger.

How? It is easily explained in the cammacd.CORE course and the video.

The Black Widow – The Breakthrough in Trading

The market changes all the time, so we must change with the market. The movement and behaviour of financial instruments, including currency pairs, depend primarily on the macro environment at the time.

The players involved keep changing their behaviour according to the broader economic climate. Whether a currency pair is reacting to a news release, a technical level, or manipulation, the nature and severity of its price reaction depends on many things, such as inflationary cycles, bull/bear market conditions in equities, and global macro themes. Because of that, a lot of perfectly fine technical trading systems suddenly stopped working, and their creators probably still don’t know why.

Simply put, markets are much different in 2019 than they were a few years ago. We have something which we have never experienced before and that COVID-19. With the virus outbreak, markets have drastically changed and trading has been much harder. Then it happened – The Black Widow. With more than 300 hours put in the work of this algo trading approach, Nenad managed to unite all the main aspects of successful trading

- The MTF Trend

- Camarilla Hourly Pivot Points

- ATR Pivots and Trading Zones

- Controlled Risk Approach

The Black Widow is entirely suitable for Intraday and Momentum traders. Around 300h have been invested into the fully developed proprietary indicators which have the algo trading power.

Source: The Black Widow

We need to adapt to current market conditions that are usually in the form of ranging consolidation-breakout. So if the market is willing to provide 70 pips from top to bottom, we should be happy if we take 30 pips in a single trade. With the Black Widow, we have finally solved a piece of the problem traders have been trying to solve for ages.

We accept only trades that have been confirmed by multiple algo filtering. We also added a reverse zonal entry that allows us to go with more significant risk due to extreme accuracy. The indicator has been hard coded with hourly camarilla pivots which are an exclusive part of Nenad’s knowledge of Camarillas. At this point, the Black Widow is suitable for both low volatile and highly volatile markets, as well as ranging markets. There is no stop for the Black Widow. Since the release of the Black Widow we have had excellent comments via traders at our Live channel.

Momentum and the ATR

We traders usually say that the price frequently lies, but momentum generally speaks the truth. The faster the price increase, the higher the increase in momentum. The quicker the price decreases, the more substantial decline in momentum. For me, momentum is significant as it tends to propel the price directly in profits, provided that we have picked a clear and accurate entry. If the entry is bad, your position might be at a loss.

However, the worst trades are made when the market is stuck in a range, and it only goes nowhere. Novice traders are usually caught in those rangy market moves, and they tend to quickly revenge their trades, thinking that the market changes direction when it stays effective in the range.

In terms of intraday trading, this can be devastating. The lack of patience, especially for new traders, is a sure sign to lose money. The good news is that you can avoid that.

For intraday trading, we need to pick up markets with good momentum and big ATR. This is where our systems come in play

The ATR value is crucial to a trader as volatility increases, so will a charts ATR value. If volatility declines, and the difference between the markets’ highs and lows decreases, the ATR will drop, too. We have our ecs.ATR indicator (article) that is one of the best tools for intraday trading and you can buy it in our ECS shop.

However the slightly modified version of the indicator is used with the Black Widow method -which is and will be the best system for intraday trading ever.

(The ATR is a volatility indicator developed by J. Welles Wilder. The primary function of the ATR indicator is to gauge the distance between the previous highs and lows, for a given number of periods. The ATR is displayed with a decimal to indicate the number of pips between the highs and lows. But it can also be shown as digits… as I use it for our webinars and analyses.)

Super-Dot

A Super-Dot happens when the algorithm in our system detects a few variables that are confirmed by ecs.MACD and ecs.Oscillator. The code is running in the background, and traders see the signal as it is shown in a few examples below. The Super Dot is a part of the CAMMACD.Core system.

Source: CAMMACD. Core

1-2-3 Patterns via CAMMACD.SIT

CAMMACD.SIT (Scalp and Intraday) is where scalpers come to trade. The system generates 1-2-3 patterns based on our proprietary indicator in combination with the MTF approach. Trades are taken with clear rules of 1-2-3 patten trading. CAMMACD.SIT requires focus and the proper timing. If you are a scalper, this system is for you.

Source: CAMMACD.SIT

Safe trading,

Nenad Kerkez

Leave a Reply