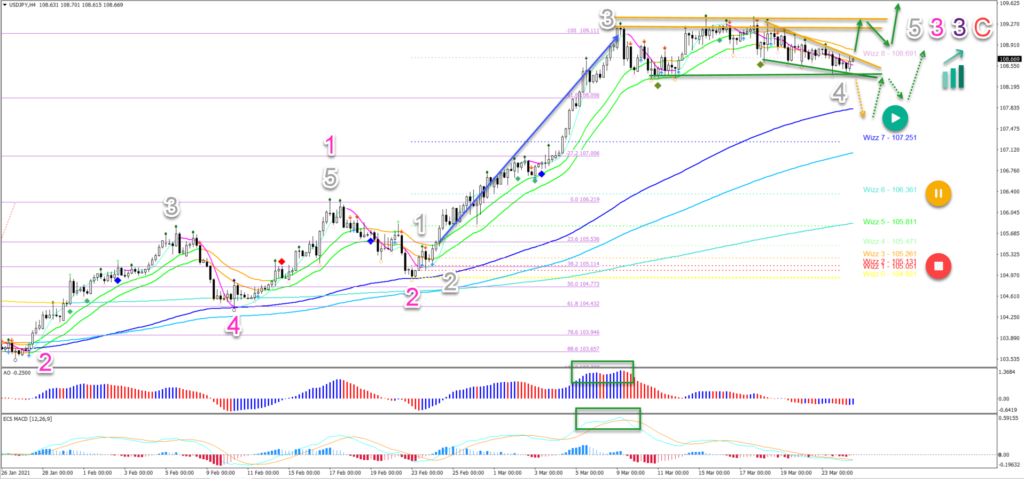

🎯 USD/JPY Shallow Wave-4 Correction Indicates Bullish Targets at 110 🎯

Dear traders,

the USD/JPY is creating a sideways correction after a massive impulse upwards (blue arrow as expected in the previous analysis). The bulls are expected to push price action even higher.

This article examines the potential breakout and targets.

Price Charts and Technical Analysis

The USD/JPY bullish momentum is probably a wave 3 (grey). The strong AO (awesome oscillator) and ecs.MACD bars are typical for such an impulse.

- The sideways correction makes a wave 3 pattern more likely, because it confirms a potential wave 4 pattern (grey).

- Waves 4 are usually shallow and choppy. The current wave 4 seems to be a sideways range.

- A bullish breakout (green arrows) above the resistance (orange lines) could confirm the bullish continuation in wave 5 (grey).

- More upside is possible if price action is indeed in a wave 3 (pink) of wave 3 (purple).

- A bearish breakout below the zone (green line) could indicate a deeper pullback (orange dotted arrow). In that case, the long-term 144 moving average should stop price and create a new bounce up (green dotted arrow).

- Only a deeper retracement places the uptrend on hold (yellow button) or invalidates it (red circle).

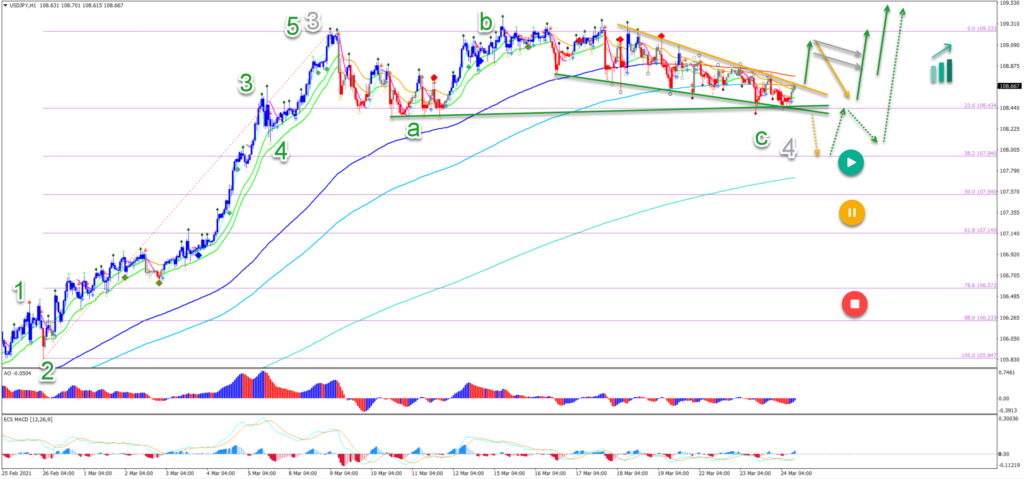

On the 1 hour chart, the wave 4 (grey) could soon be completed because price action is finishing an ABC (green) correction.

- The wave 4 (grey) is respecting the 23.6% Fibonacci level of the wave 3 (grey).

- A bearish breakout below the support is aiming for the 38.2% Fibonacci retracement level.

- The 38.2% (and 50%) Fib are support levels which could create a bullish bounce (dotted green arrows).

- Only a deeper breakout places the uptrend view in danger (yellow and red circles).

- The immediate target for the wave 5 (grey) is the round level of 110. The second target is located at 111, which is the -1.618% Fib target of the 4 hour chart.

The analysis has been done with the indicators and template from the SWAT method (simple wave analysis and trading). For more daily technical and wave analysis and updates, sign-up to our newsletter.

Leave a Reply