Trading Results Overview – March 2021

Dear Traders,

the month of March 2021 offered a decent total result for Elite CurrenSea. A total of more than +20% was achieved with 7 methods. Although March was average, the entire first quarter of 2021 was very positive (more than +100%).

Let’s review all of the systems from Carlos Cordero, Nenad Kerkez, Mislav Nikolic (Bull Capital), Marco Doni and Chris Svorcik. Feel free to watch the recording of our live webinar as well.

Also, there is a special 5% discount on the profit share for the 2nd quarter 2021 for Zeus EA if you deposit at least €2,5k of new capital in Zeus EA.

Summary of All Systems in February 2021

First of all, we will start with a table that shows the performance of all systems. March 2021 (+109+%) was not as great as Feb 2021 but overall, there was a clear plus of almost +17%.

To see more information per system, please scroll lower in this article to see the breakdown and graphs.

| System | Performance March 2021 |

Draw-down March 2021 |

Total running performance |

| SWAT EA EUR/USD 1H | -4.83% | 10.0% | +15.9% |

| SWAT EA DAX 15M | -5.61% | 10.2% | +3.86% |

| SWAT EA DAX 1H | +8.67% | 3.5% | +5.32% |

| Zeus EA 1 (PAMM) | +4.0% | 2.0% | +34.96% |

| Zeus EA 2 | +3.7% | 3.9% | +67.32% |

| ecsLIVE | -4.85% | 11.0% | +34.19% |

| LOA EA | -11.05% | 13.4% | -36.23% |

| Ultima EA (Bull Capital) | +28.2% | 9.3% | +12.94%(4.2020) +851% (8.2019) |

| Rush EA (Bull Capital) | -1.4% | 37.1% | -13.06% |

| Options | +3.7% | – | – |

| Total March 2021 | +20.5% | – | – |

| Total Feb 2021 | +108.6% | – | – |

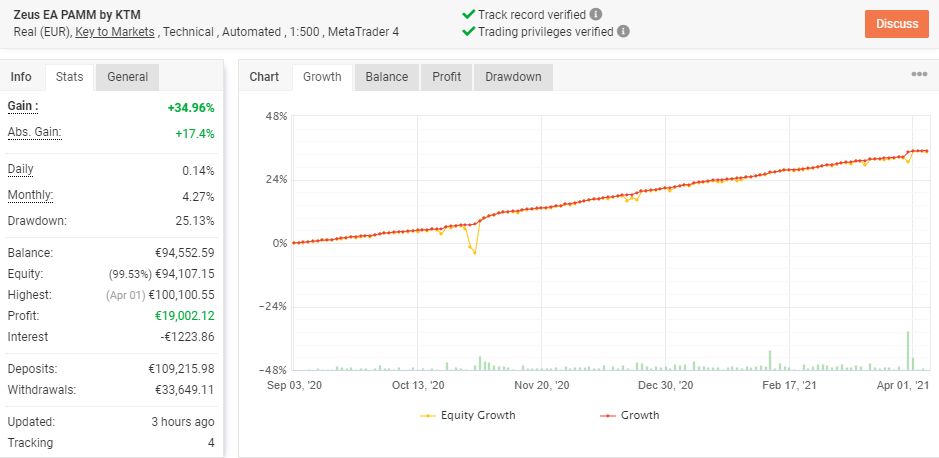

Zeus EA

The Zeus EA remains very consistent in its performance. So far, the EA did not have a single losing month.

Recently the Zeus EA (ZEA) managed account reached €100k in trading capital 🥳.

To celebrate both news, we are cutting the profit share for Zeus EA by 5% (20% in costs for traders) for the next three month (q2).

To qualify, you need to invest at least €2,5k of new capital in ZEA.

| Performance | +3.96% |

| Total performance | +35% |

| Win Rate | 69% |

| Reward-To-Risk | 0.61:1 |

| Draw-Down | 1.98% |

| Net Pips | -12.6k |

What’s the main take?

March 2021 was the same as always. Again Zeus EA managed to gain 3.7-4.0% return in just one month.

All of our Zeus EA accounts (first and second accounts) are doing very well.

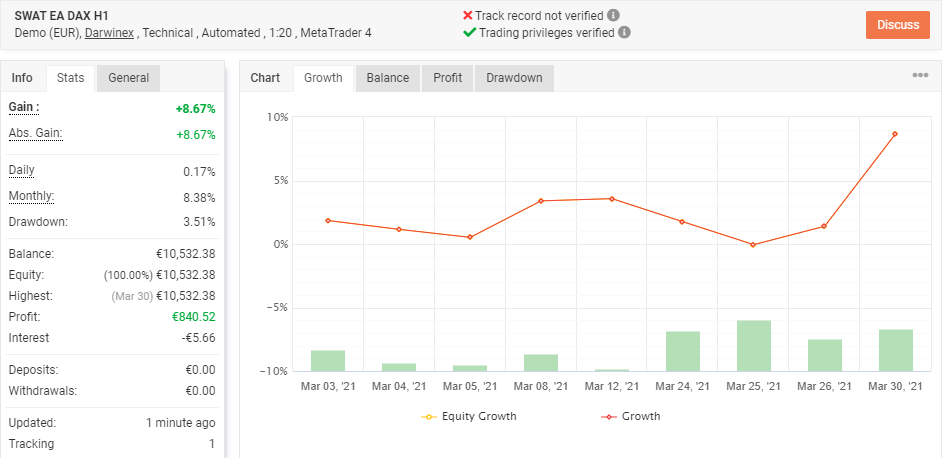

SWAT EA

Our newest SWAT EA is a breakout strategy using our own ECS Fractal indicator. Two months ago we completed back-testing on EUR/USD 1H, DAX 1H, DAX 15M, and DAX 5M.

We are currently demo testing the SWAT EA on 3 different combinations of time frames and pairs, including EUR/USD 1 hour, DAX 1 hour, and DAX 15 minute chart.

| SWAT EA | EUR/USD 1H | DAX 1H | DAX 15M |

| Performance | -4.83% | -3.08% | +8.67% |

| Total performance | +15.9% | +3.86% | +5.32% |

| Win Rate | 22% | 28% | 50% |

| Reward-To-Risk | 2.3:1 | 3.1:1 | 2.0:1 |

| Draw-Down | 10.04% | 3.91% | 3.5% |

| Net Pips | -128 | -807 | +692 |

What’s the main take?

Although the EUR/USD 1 hour and DAX 1 hour charts had a loss in March 2021, the total result still remains positive. The DAX 15 min chart did have a clear win with +8.67% and its total now is also positive at +5.32%.

This means that the total performance of all 3 pairs and time frames is +26.1% in just 2 months of trading.

Live Webinar Discusses the Performance

Feel free to also check out the recording of our live webinar. Here we discuss the performance in March 2021 and the first quarter 2021.

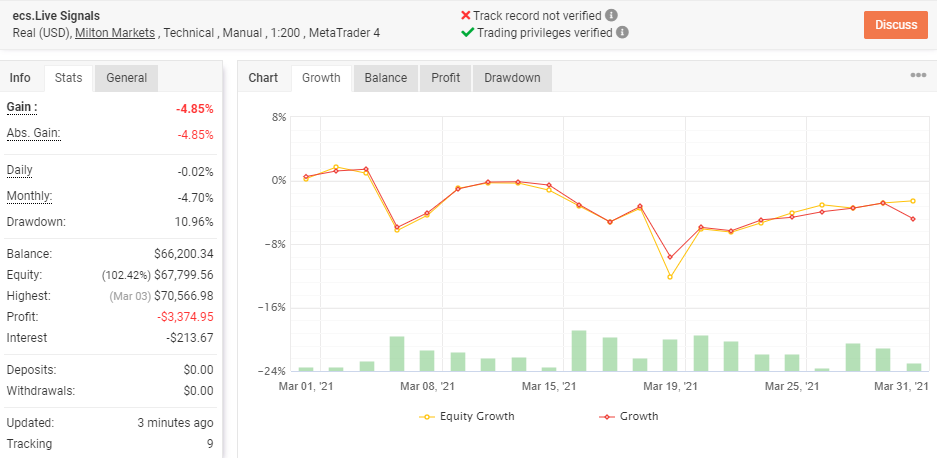

ecs.LIVE (by cammacd.BlackWidow)

The Black Widow made a slight loss in March 2021. But the overall result in quarter 1 was slightly positive.

| Performance | -4.85% |

| Total performance | +34.19% |

| Win Rate | 55% |

| Reward-To-Risk | 0.74 |

| Draw-Down | 10.96% |

| Net Pips | -306 |

What’s the main take?

All in all, the account is up almost 35%, although it had some strong downs and ups since July 2020.

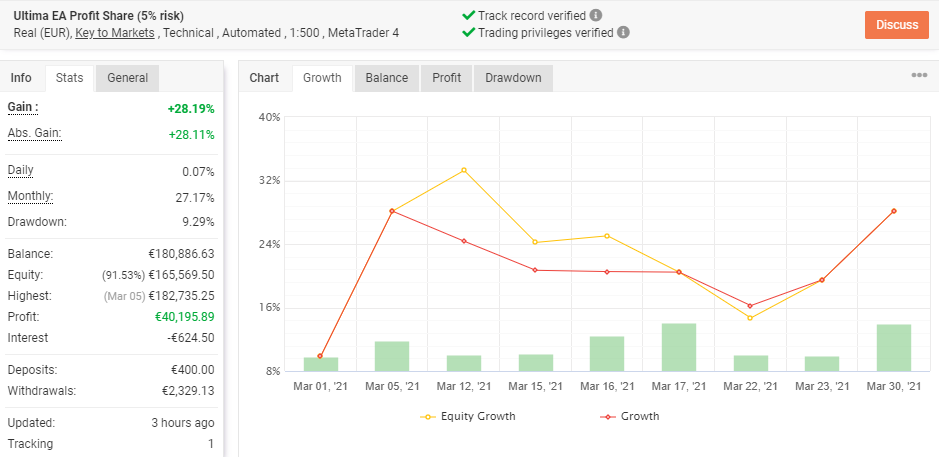

Ultima EA

The Ultima EA from Mislav Nikolic and Bull Capital had a fantastic first quarter 2021. January started off well but the gains were lost at the end of the month. The total result ended up just above break-even at +1%.

But both February and March had wonderful gains. And these gains were made with 3% risk per setup rather than the usual 5% risk per setup. The risk was lowered from 5 to 3% because of the breach of the max historical draw-down.

Luckily, our fears were not needed as Ultima EA has managed to recover in Q1 2021.

| Performance | +28.19% (3% risk per setup) |

| Total performance | +12.94%(4.2020) +851% (8.2019 |

| Win Rate | 67% |

| Reward-To-Risk | 2.7:1 |

| Draw-Down | 9.29% |

| Net Pips | +377 |

What’s the main take?

Although most of our traders are still around break-even or in a small loss (depending when you started in the draw-down), the recent positive performances have helped to narrow the deficit. The next positive month(s) could place more and more traders into profits again.

Rush EA

The Rush EA from Mislav Nikolic and Bull Capital had a very slight loss of -1.39%. But generally speaking, the EA is recovering nicely from its previous losses.

| Performance | -1.39% |

| Total performance | -13.06% |

| Win Rate | 49% |

| Reward-To-Risk | 1.22:1 |

| Draw-Down | 37.1% |

| Net Pips | +117 |

What’s the main take?

Despite the small loss in March, an overall uptrend is now visible and we hope to see further gains in the 2nd quarter 2021.

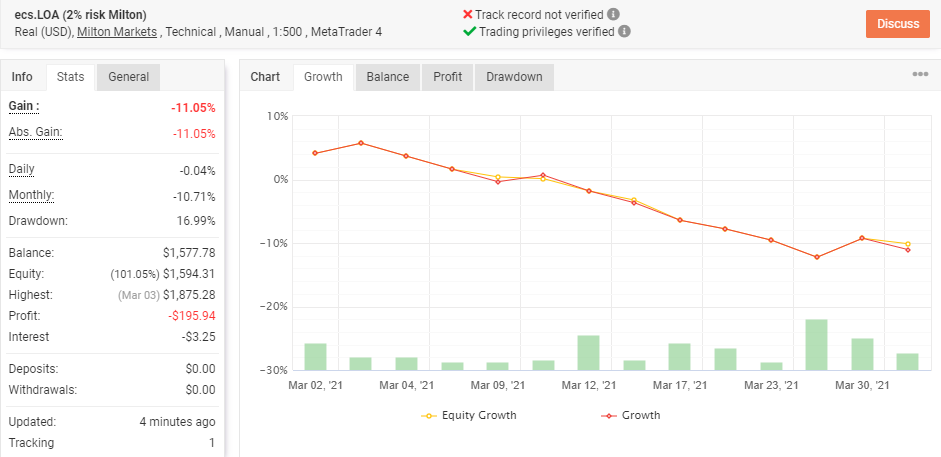

LOA.EA

The LOA.EA is going through a major draw-down as the total DD approaches the key boundary of 40-50. Hefty draw-downs did occur in the 10 years of back-testing but certainly, this is one of the most challenging ones. Time will tell if the EA is able to pull itself out of the weak performance during quarter 2.

| Performance EUR/AUD | -11.05% |

| Total performance | -36.23% |

| Win Rate | 38% |

| Reward-To-Risk | 0.76:1 |

| Draw-Down | 17.0% |

| Net Pips | -358 |

What’s the main take?

The LOA.EA had a good second half of February 2021 but the reversal did not continue in March 2021.

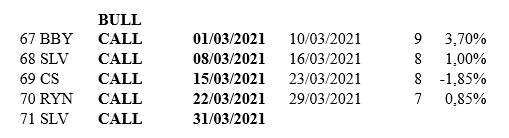

Options Trading

March saw new highs in the 3974 area for S&P 500. These highs have already been broken at the beginning of April.

The positive outlook is driven by optimism regarding a rapid reopening of the economy thanks to a vaccination plan which is at a much more advanced stage in the United States.

This is overshadowing some elements that could instead play against the growth of the main American stock index, such as the fears of a rise in inflation or the increase in corporate taxes forecast by the Biden government, whose effects will all be discovered.

During March the index swing movement was more accentuated and accompanied, moreover by a sector investment rotation which allowed the creation of favourable opportunities for entering positions in favour of the general trend according to the logic of ‘Trend is your friend’ .

| Performance | +3.7% |

| Win rate | 75% |

| Reward to risk | 0.74:1 |

| Draw-Down/Loss | 1.85% |

What’s the main take?

We have entered 5 positions, all long. At the time of writing, four of these closed in the month with an average profit of 1.9%. Only one position was not profitable.

The latest position, SLV, came close to a close at a slight profit on April 5, but at the close of the market the silver ETF with a backlash originated a move that gave the possibility to remain in the market and postpone the assessment of the position to the following days.

Check out our option strategies from options expert Marco Doni !

Thanks and good trading,

Carlos Cordero

Mislav Nikolic

Marco Doni

Nenad Kerkez

Chris Svorcik

ECS team

Leave a Reply