Trading Results Overview January 2023

Dear Traders,

We are starting 2023 with the strongest offer up to date; below are the results on all our action methods. As you can see, we hit a bit of a roadblock with non-grid EAs, while little manual trading took place on Portfolio ECS accounts.

Summary January 2023

Retail Accounts

| Method | Performance (all-time) |

Days Active | Comment |

| Athena EA | +4.2% (+370%) |

760 | Excellently handled the US dollar ambivalence delivering benchmark performance. |

| Portfolio ECS | +25% (+860%) |

1 | No trading on publicly managed accounts, with growth coming from eToro private account. Reach out if you are eligible for eToro PRO program. |

|

Algo (ECS Live & Telegram Signals)

|

-6.5% (+20%) |

115 | First month with a DD for the account. Mostly due to indices trading. The account has been reconfigured to catch up on performance. |

| Chris Mix* | –6% (-9.8%) |

170 | Private accounts used for testing different EA configurations. Account is not open available to public. |

Performance in the table is reported based on aggregated results across (sometimes) multiple brokers, to make it easier to understand, we take a weighted mean average. Keep in mind that in some cases, on a monthly scale, the results across different brokers may vary, but not significantly. Feel free to reach out for more info.

Athena EA

Athena EA had an ok month again. The trading system secured nearly +4.2% with VT Markets, +3.8% with RannForex, and +1.8% with KTM in the month of February. This grid MT4 EA has been running for nearly 760 days and has so far generated more than 360% profit.

The best overall performance is clearly with RannForex, which is now approaching the +80% profit mark; another good news is that the broker has been greenlit for FSA (Seychelles) license and will not offer even more security. You can join Athena EA via RannForex today as well.

The best monthly performance goes to VT Markets, the broker we have added for retail clients only recently, but the one already shows promise to be the best environment for the approach.

| Broker | Performance (all-time) | Comment |

| RannForex | +3.8% (+78%) |

Has been granted approval for an FSA license in November💪 Our technology providers & good friends. |

| KTM | +1.2% (+30%) |

Available only to existing members. New members are welcome via VT Markets & RannForex. |

| VT Markets | +6.3% (16.4%) |

Join to lock in a profit share fee indefinitely🔥. |

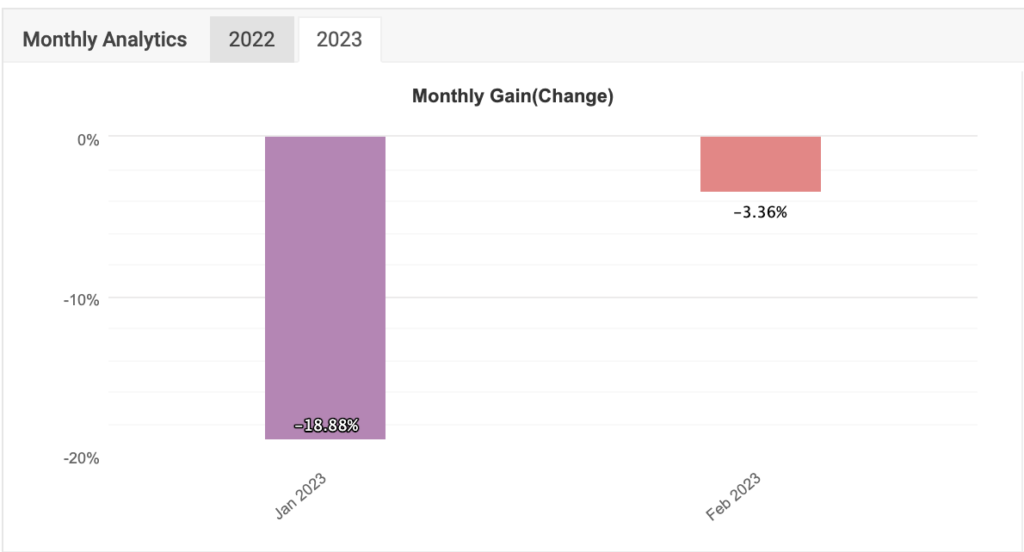

Chris’ Mix

Chris’ Mix of best trading systems hit a drawdown with the RannForex: -24% in January. The results differed from the KTM account, which had a DD of -18% for slightly different trading conditions.

Both accounts are used primarily to test new settings and configurations for active Expert Advisors.

In a nutshell, “Chris Mix” a more experimental version of the Algo (ECS Live Telegram signals). Higher growth comes at a chance for a higher DD, overall the account is trading within the settings and will serve a similar purpose in 2023.

| Broker | Performance (all-time) | Comment |

| RannForex | -24% (-30%) |

Another month with a DD. Some changes were made to the composition of the EAs. |

| KTM | -18% (-22%) |

A slightly different set of EAs from RannForex. Used for testing new configurations. |

| YaMarkets | 0% (-2.4%) |

Currently on pause due to the broker changing a liquidity provider. |

Portfolio Method

ECS Portfolio its current configuration for retail has only completed its 4th month of live trading available for retail, but the impressive gains from in 202 have been complimented by the +25% in January on the personal eToro Pro account (you can tap into similar numbers if you are eligible for eToro PRO account).

To make sure, our target per month on the account is up to 14%, and we don’t want to go under a 20%-25% drawdown.

Portfolio ECS is a discretionary news-based approach, the performance spike on the YaMarkets account, for instance, is a result of our calculated bet on the US CPI report boosting NASDAQ and JPY/USD.

| Broker |

Performance (all-time) | Comment |

| YaMarkets | +0% (+765%) |

Currently on pause due to the broker changing a liquidity provider. |

| eToro Pro (private) |

+25% (+1,160%) |

Stellar results are largely due to trading more exotic instruments. |

| Exness | +0% (+21.85%) |

No trading took place in January. Best for non-EU clients. |

| VT Markets |

+0% (+21%) |

No trading took place in January. Best for EU clients. |

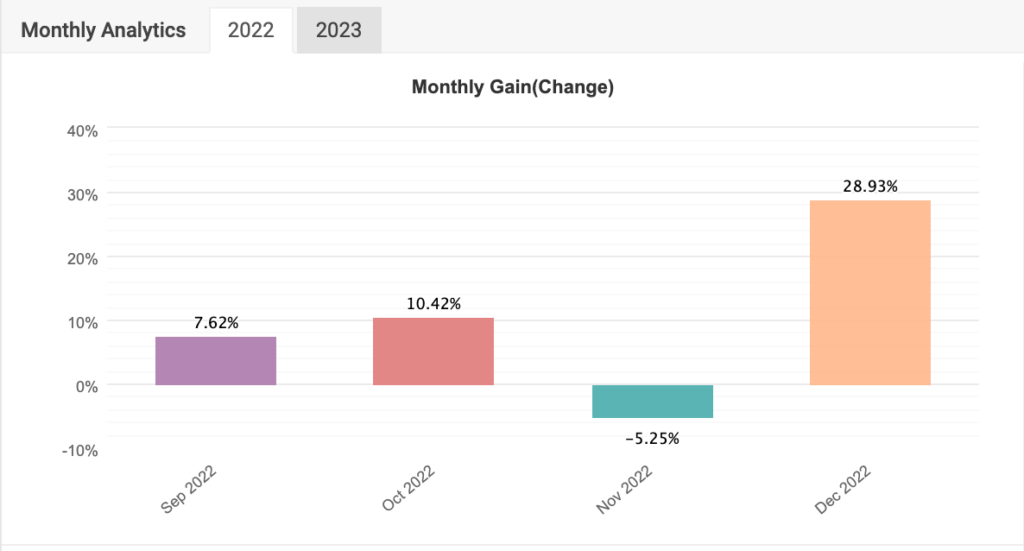

| RannForex | +29% (+45%) |

Best performance available for retail clients (non eToro pro). |

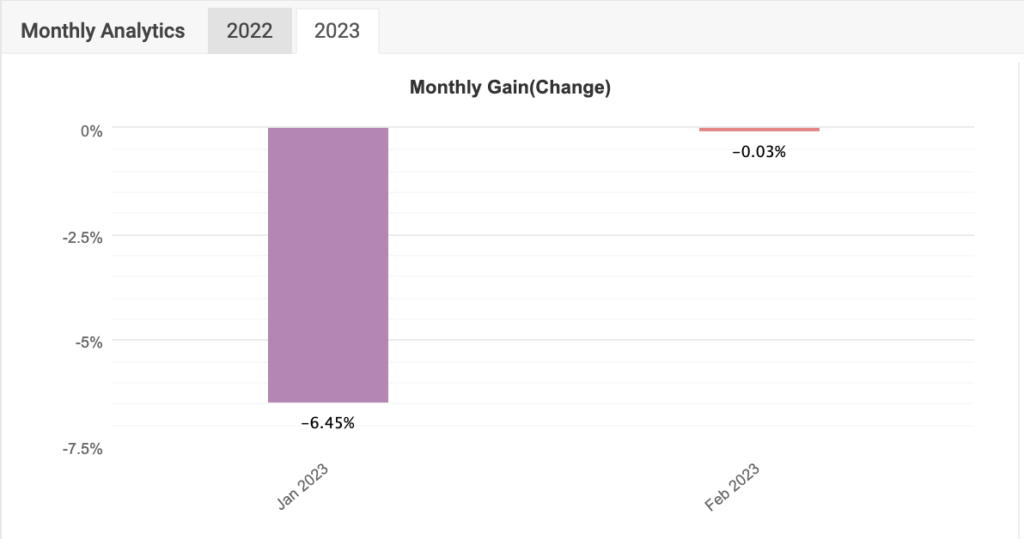

Algo (ECS Live: Telegram Signals)

Our EA-powered signal group lost -6.45% in January, bringing the total performance down to 20% (four months active since launch).

The account trades, currencies, commodities, and indexes and can also be joined via a managed offer or by tapping into our new MT4/5 EAs.

If you are looking to replicate the results by copying the signals, you can join the channel here.

| ECS Live | -6.45% (+21.5%) |

You can copy signals manually, join via a managed account, or purchase the EAs that run the account. |

You can read more about the method here.

What to Expect in 2023?

Well, we’ve started “grooming” you earlier, but lets quickly catch up on our plans for the first half of 2023.

- Reaching $1.5mln (currently +$0.5mln) in active funds (Q2)

- Simplify onboarding (Q1)

- Better matching clients vs relevant methods

- Performance Tracking

- Better interface to track your investment (Q2)

- Trading (Q1-Q2)

- Adding new EAs for Commodities, Currencies, Indices

- Looking into more simple Grid EAs

- Improvements to signal service

- Institutional Trading (Q3-Q4)

- Launching an ETF (Q3)

Overall, our goal is to remove as many unnecessary steps, for you to invest and comfortably follow your bets with us.

We will continue to communicate with you on a daily basis via blog and telegram channels.

Safe Trading

Mykyta Barabanov & Chris Svorcik

Team of Elite CurrenSea ❤️

Leave a Reply