Trading Results Overview December 2022 + Year Summary

Dear Traders,

As we are restoring trading on Monday, in the meantime, let’s take a look at the results for December and 2022 as a whole.

Summary December 2022

Retail Accounts

| Method | Performance (all-time) |

Days Active | Comment |

| Athena EA | +4.1% (+360%) |

730 | Excellently handled the US dollar weakness delivering benchmark performance. |

| Portfolio ECS | +29% (830%) |

190 | Explosive month for Portfolio ECS with EUS/JPY and US stocks after the December CPI report. |

| Chris Mix | -13% (-9.8%) |

170 | December has been the worst month for the approach, although the drawdown is within the parameters. |

|

ECS Live (Telegram Signals)

|

+12% (+29%) |

84 | Recently introduced “freemium” signal service that runs by our top Expert Advisors suitable for intra-day manual copy-trading. Now available via VT Markets & RannForex. |

Performance in the table is reported based on aggregated results across (sometimes) multiple brokers, to make it easier to understand, we take a weighted mean average. Keep in mind that in some cases, on a monthly scale, the results across different brokers may vary, but not significantly. Feel free to reach out for more info.

Institutional Accounts

| Method | Performance (all-time) |

Days Active | Comment |

| Portfolio ECS (eToro Pro) |

+28% (+1,088%) |

190 | For more info on this account (how to join as well), take a look at this announcement (pre-december). |

|

Portfolio ECS (Yamarkets) |

+928% (+765%) |

160 | Paused in December. Keep in mind that the DD in the account is shown incorrectly. We’v reached out to Myfxbook and YaMarkets to fix it. |

|

Zeus EA EUR/USD (Yamarkets) |

+5.64% (+51.5%) |

185 | No trading this month. |

|

Zeus EA Gold (YaMarkets) |

-90% (-99%) |

185 | No trading this month. |

|

Zeus EA Gold (RannForex) |

-90% (-99%) |

175 | No trading this month. |

|

Athena EA (RannForex) |

+3.7% (+71%) |

175 | More aggressive setting + some trades were out of scope of the Athena EA that currently runs for retail and institutions. |

If you are looking for more aggressive trading or a more tailored approach, similar to that of institutional clients, please reach out via [email protected] for our account manager to help you out.

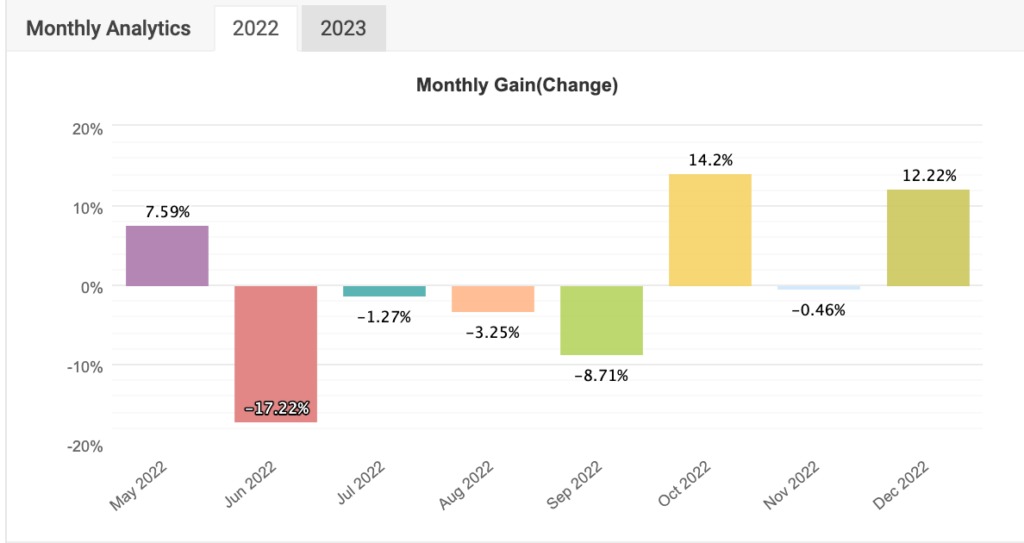

Athena EA

Athena EA had an ok month again. The trading system secured nearly +4% with VT Markets, +3.7% with RannForex, and +2.3% with KTM in the month of November. This grid MT4 EA is running for nearly 750 days and has so far generated more than 360% profit.

The best overall performance is clearly with RannForex, which is now approaching the +80% profit mark; another good news is that the broker has been greenlit for FSA (Seychelles) license and will not offer even more security. You can join Athena EA via RannForex today as well.

The best monthly performance goes to VT Markets, the broker we have added for retail clients only recently, but the one already shows promise to be the best environment for the approach. To celebrate a good start, we let you lock in a 20% lifetime profit share for depositing above €1,000 (33% smaller fees).

KTM offers a steady performance of 3% in December and has been our broker of choice for several years, we encourage new clients to look into our other brokers – diversification rarely hurts.

| YaMarkets | +1.6% (+20.4%) |

Paused mid-November by a client due to a drawdown on Zeus EA Gold. Clients from India can only join via this broker. |

| RannForex | +4.7% (+66%) |

Has been granted approval for an FSA license in November💪 Our technology providers & good friends. |

| KTM | +4% (+24.35%) |

Available only to existing members. New members are welcome via VT Markets & RannForex. |

| VT Markets | +6.3% (7.6%) |

Join in December to lock 20% profit share fee indefinitely🔥. |

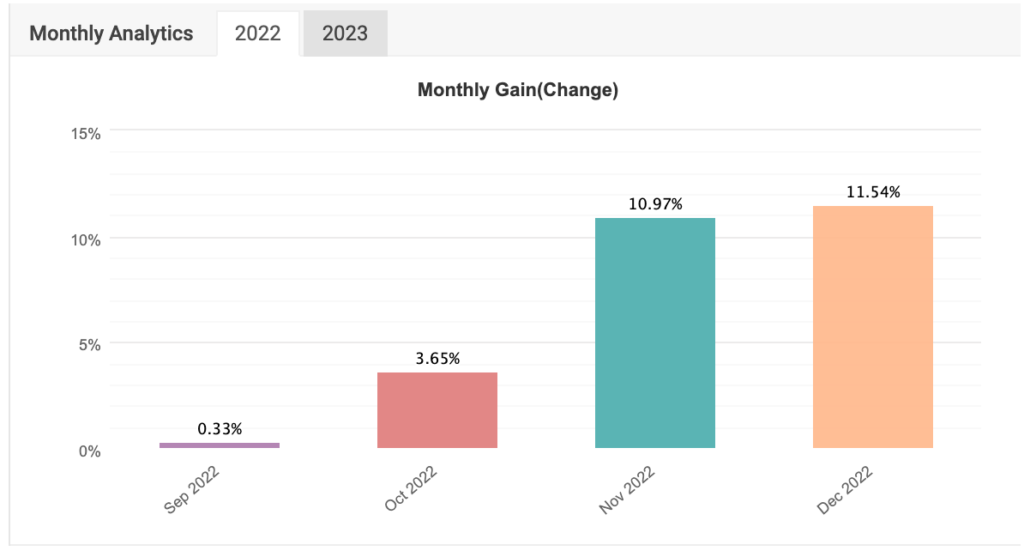

Chris’ Mix

Chris’ Mix of best trading systems hit a drawdown with the RannForex: -12% profits in December. The results differed from the KTM account which has made nearly 12% for a different set of EAs chosen to trade other broker accounts in December.

The trading on YaMarkets has been idle since November. We are negotiating the terms to obtain more capital from the investor under conditions that should contribute to our total assets under management.

| YaMarkets | +1.3% (-2.4%) |

Also, paused mid-November by a client due to a drawdown on Zeus EA Gold. Clients from India can only join via this broker. |

| RannForex | -12% (-9%) |

Month with a DD. Some changes were made to the composition of the EAs. The results are similar to ECS Live (telegram). |

| KTM | +12% (+2%) |

A slightly different set of EAs. |

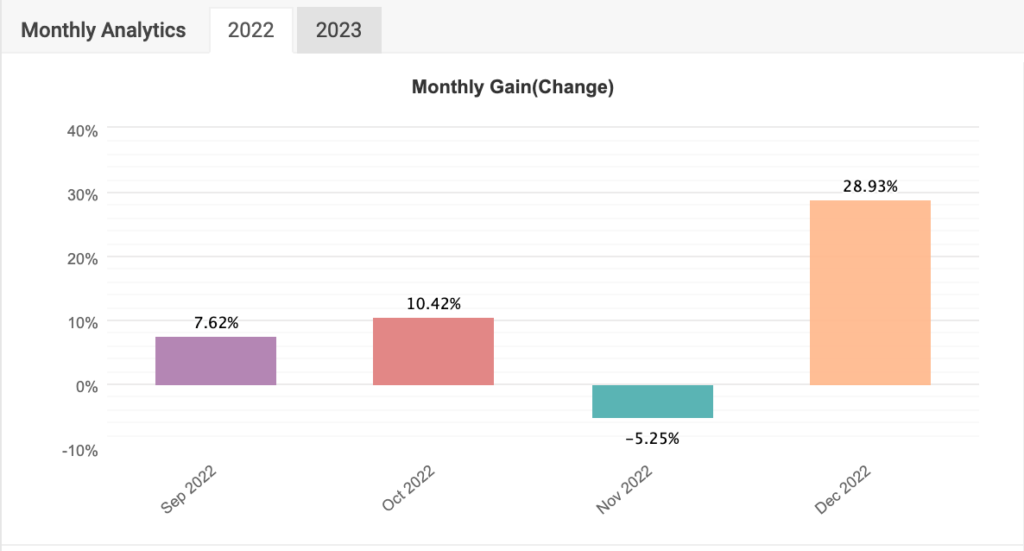

Portfolio Method

ECS Portfolio its current configuration for retail has only completed its 3nd month of live trading available for retail, but the impressive gains from September were replicated in October and November has been complimented by the +30% in December on RannForex, 39% on personal eToro Pro account.

🔥After a rough start in 2021, in 2022, Portfolio ECS generated the most profit per year (1,110% on eToro and 800% on Yamarkets + other managed accounts across four brokers) in ECS history.

To make sure, our target per month on the account is up to 14%, and we don’t want to go under a 20%-25% drawdown.

Portfolio ECS is a discretionary news-based approach, the performance spike on the Yamarkets account, for instance, is a result of our calculated bet on the US CPI report boosting NASDAQ and JPY/USD.

| YaMarkets | +928% (+765%) |

Best performing institutional account thanks to YaMarket’s interest in a more outside-the-box approach to risk. |

| eToro Pro (private) |

+29% (+1,010%) |

Stellar results are largely due to trading more exotic instruments. |

| Exness | 21.85% (+21.85) |

Best for non-EU clients. |

| VT Markets |

21.4% (+18.8%) |

Launched in late November captured US CPI moves (also captured on other Portfolio ECS accounts). |

| RannForex | +29% (+45%) |

Institutional trading + retail. The broker received FSA license approval in the meantime. |

ECS Live (Telegram Signals)

The new kid in town is getting up to speed. Our EA-powered signal group climbed 12% in December, bringing the total performance to nearly 30% (3 months since launch).

The account trades, currencies, commodities, and indexes and can be also joined via a managed offer or by tapping into our new MT4/5 EAs.

If you are looking to replicate the results by copying the signals, you can join the freemium channel here.

| ECS Live | +12% (+29.5%) |

You can copy signals manually, join via a managed account, or purchase the EAs that run the account. |

You can read more about the method here.

Options Trading

Having not reached the above-market returns, we are discontinuing the method as of the end of October 2022 to fully focus on Portfolio ECS discretionary method.

The former approach wouldn’t be possible without our foray into options trading. For now, though, we will stick to CFD as the main means for leveraged trading.

Zeus EA (GOLD & EUR/USD)

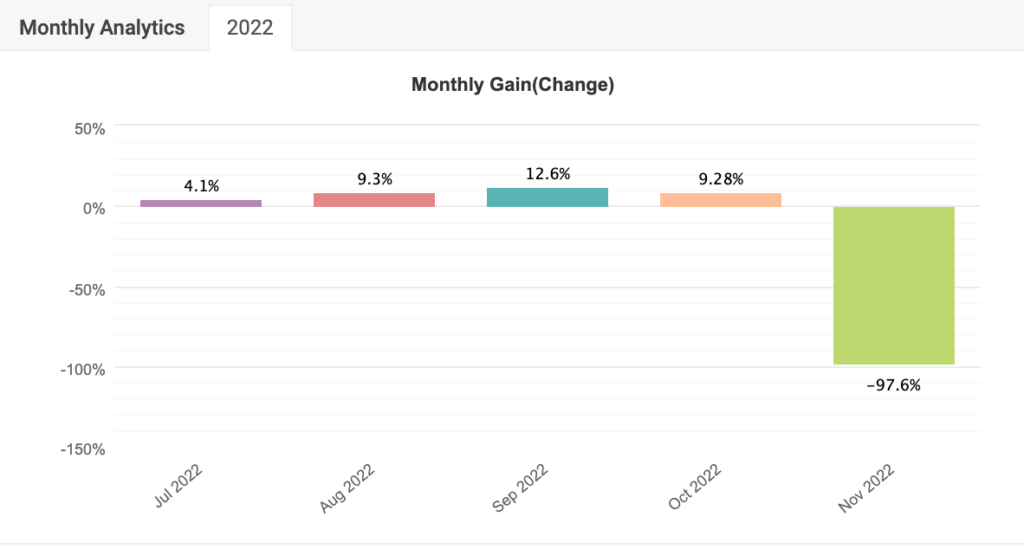

Despite consistent results in October, with RannForex showing the best result (9.3%) but KTM and markets were not far behind with +8.7% and +6.3%, as well as overall promises, this account has not proven successful after the November Gold spikes.

Consequently, our smaller accounts for Zeus EA with RannForex and YaMarkets are now stopped.

We still consider running Zeus EA EUR/USD grid with YaMarkets, but the decision will be made early into January, after we finish testing the method (the same goes for Gold).

For now, we have scrapped Gold grid trading, but you can still benefit from trading gold using Apollo EA – our latest MT4/5 Expert Advisor that instead relies on breakout trading. You can see glimpses of its trading by joining a freemium telegram signal channel – ecs.LIVE.

| Yamarkets Gold | -90% (-80%) |

Halted until 2023 |

| Yamarkets EUR/USD | 5.6% (+52%) |

Halted until 2023 |

| RannForex Gold | -90% (-80%) |

Halted until 2023 |

Final Words about 2022

Despite its bittersweet nature, 2022 has been the best trading year in our 8+ years of trading under ECS. The capital under trading is slowly returning to pre-war highs.

We are grateful to both retail, institutional clients, as well as partners and of course the team of Elite CurrenSea, some of whom had to work under tough conditions, while also looking for a new home.

What to Expect in 2023?

Well, we’v started “grooming” your earlier, but lets quickly catch up on our plans for the first half of 2023.

- Reaching $1.5mln (currently +$0.5mln) in active funds (Q2)

- Simplify onboarding (Q1)

- Better matching clients vs relevant methods

- Performance Tracking

- Better interface to track your investment (Q2)

- Trading (Q1-Q2)

- Adding new EAs for Commodities, Currencies, Indices

- Looking into more simple Grid EAs

- Improvements to signal service

- Institutional Trading (Q3-Q4)

- Launching an ETF (Q3)

Overall, our goal is to remove as many unnecessary steps, for you to invest and comfortably follow your bets with us.

We will continue to communicate with you on a daily basis via blog and telegram channels.

Safe Trading

Mykyta Barabanov & Chris Svorcik

Team of Elite CurrenSea ❤️

Leave a Reply