🎯 US30 Enters Range But Remains Bullish and Aims at $36-38k 🎯

Dear traders,

the Dow Jones Index (US30) has been taking a few weeks break since its last high. But the consolidation zone is simply going sideways, which is a bullish signal.

This article reviews the bullish scenarios, targets, and invalidation levels.

Price Charts and Technical Analysis

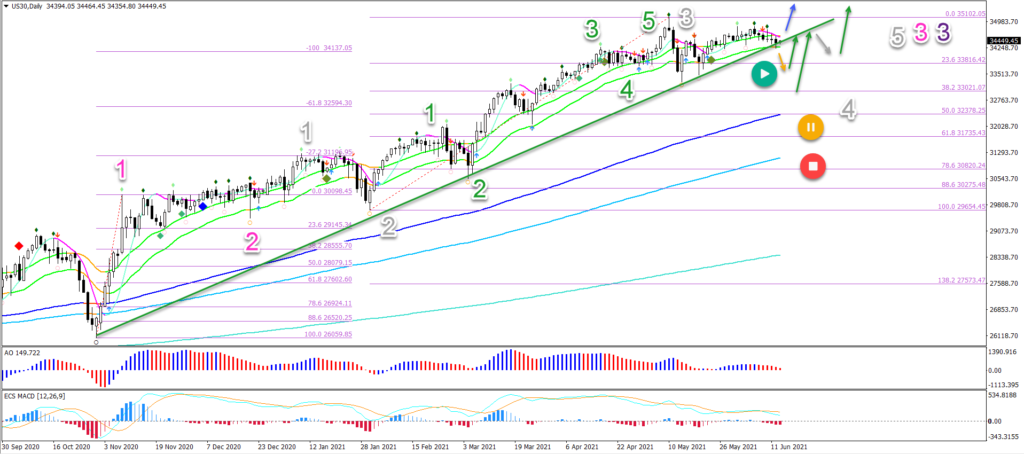

The US30 daily chart has been in a strong uptrend. All of the moving averages are neatly aligned with lots of space in between. This indicates a strong momentum and trend:

- The bullish price swing is therefore likely some type of wave 3 (grey).

- Considering the overall uptrend strength, the wave 3 is probably a wave 3 on a higher degree (pink/purple).

- The current sideways consolidation fits well within the expected wave 4 (grey) pattern.

- A break above the 21 ema high could confirm a bullish breakout (blue arrow) and the end of the wave 4 and start of wave 5 (grey).

- A break below the support trend line (green) and 21 ema low could indicate a pullback (orange arrow).

- The pullback will test the previous low or 38.2% Fibonacci level where a bullish bounce is expected (green arrows).

- A deeper pullback places the wave 4 (grey) on hold (orange circle) and a very deep retracement invalidates it (red circle).

- The main targets are $36,600 and $38,000.

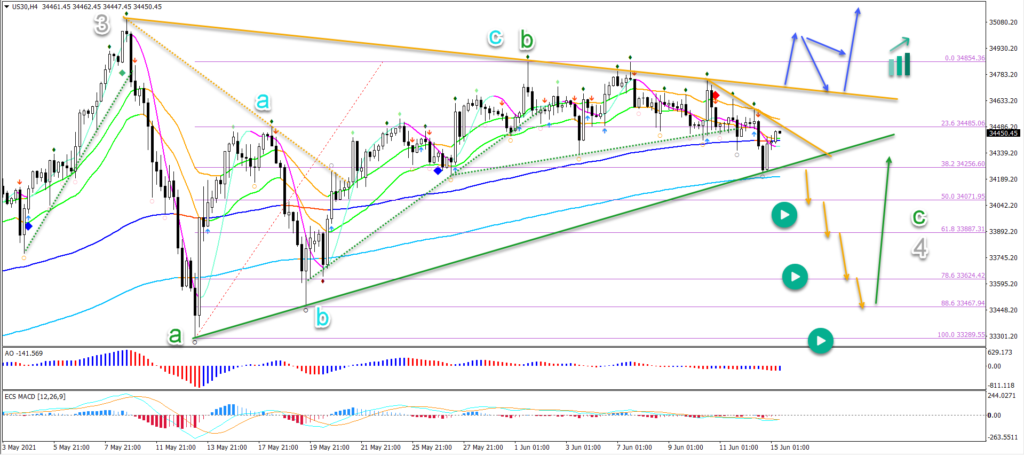

On the 4 hour chart, price action is testing the long-term moving averages:

- A bearish breakout (orange arrows) could indicate a deeper wave C (green) within wave 4 (grey).

- The main targets for the bearish wave C (green) are the Fibonacci levels where a bullish bounce could take place (green arrow).

- A bullish breakout (blue arrows) could indicate an immediate uptrend continuation.

The analysis has been done with the indicators and template from the SWAT method (simple wave analysis and trading). For more daily technical and wave analysis and updates, sign-up to our newsletter.

Leave a Reply