☝️ FedEx Builds Bullish Channel After Bouncing at 38.2% Fibonacci ☝️

Dear traders,

the FedEx corporation (FDX) made a strong bullish bounce at the 144 ema. Price has also broken above the 21 ema zone. Plus an uptrend channel is now established.

What are the main targets for this chart? And what kind of price patterns do we expect?

Price Charts and Technical Analysis

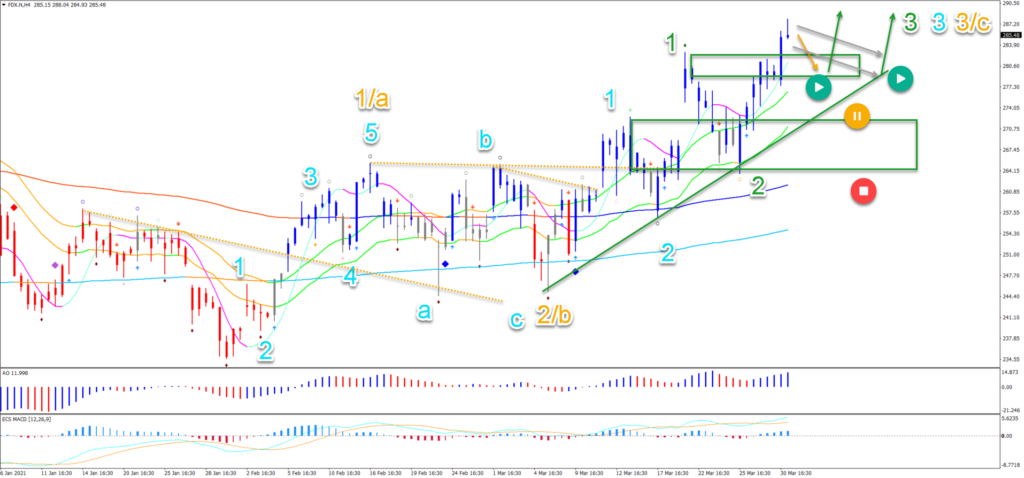

The FDX daily chart had a strong impulse up. This has been labeled as wave 3 (pink). Let’s review what’s going right now:

- The current pullback completed at the 144 ema zone and 38.2% Fibonacci retracement level (green box).

- This retrace could either complete the wave 4 (pink) or be part of a larger ABC (grey) correction in wave 4’ (pink).

- In both cases price action is expected to reach the previous top at $305 (red line).

- A bearish bounce (orange arrow) could indicate a retest of the previous bottom within a larger wave 4’ (pink).

- A bull flag chart pattern (grey arrows), however, could indicate that the bulls remain in control and indicate a bullish breakout.

- The main target area is the previous top at $305. A break above the top should aim at the -27.2% Fib target at $350 followed by the -61.8% Fib target at $400. Although the first Fib target zone at $350 could start another wave 4 pattern.

On the 4 hour chart, price action seems to have completed 5 waves up (blue) and then followed by an ABC correction (blue). This could be part of a wave 1-2 or a-b.

- The continuous higher highs and higher lows confirms an uptrend channel.

- Any pullback towards the previous candle highs and 21 ema zone should create support (green arrows) at around $280.

- A deeper pullback places the uptrend scenario on hold (yellow/red circles).

- Price is not expected to decline below $264 or otherwise the uptrend is in trouble.

The analysis has been done with the indicators and template from the SWAT method (simple wave analysis and trading). For more daily technical and wave analysis and updates, sign-up to our newsletter.

Leave a Reply