🎯 GBP/JPY Bullish Impulse Aiming at 156.50 Fib Targets 🎯

Dear traders,

the GBP/JPY bullish momentum is super strong. More than 35 daily candles have been above the 21 ema zone.

Can the uptrend continue even higher? Let’s review the chart patterns.

Price Charts and Technical Analysis

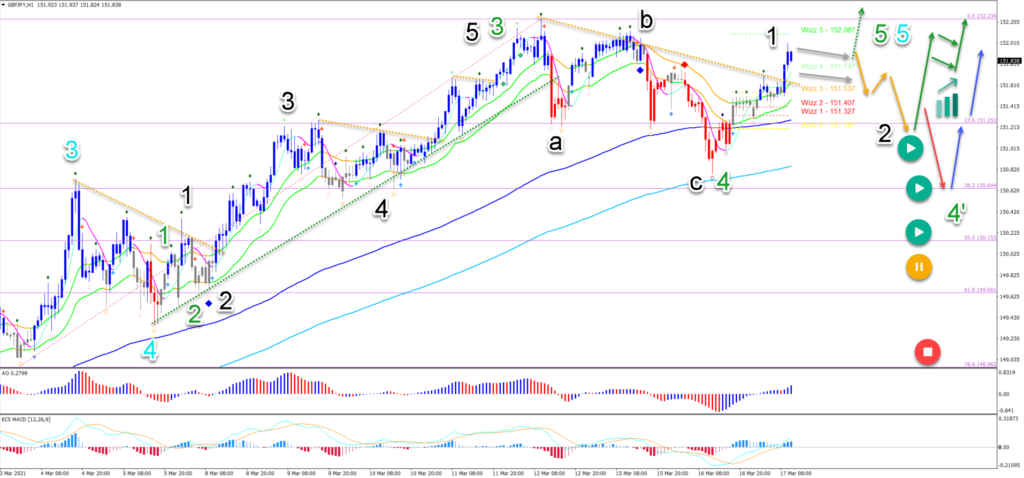

The GBP/JPY strength is typical for a wave 3. In fact, there could be multiple wave 3s developing with the current bullish move. Let’s review:

- The current wave 3 (grey) is still ongoing.

- An immediate continuation (green arrows) should take price action towards the next targets at 155 and 156.50, which is the confluence of Fib targets of waves 1-2.

- The wave 3 (grey) will only be completed once price action retraces back (dotted orange arrow) to the 21 ema zone.

- A bullish bounce at the 21 ema zone (dotted blue arrow) is expected to confirm the wave 4 (grey) pattern.

On the 1 hour chart, a deeper pullback took price back to the long-term moving average zone (144-233 EMAs). Price action seems to have completed a wave 3 (green) and the pullback was probably a wave 4 (green). What can we expect next?

- The bullish breakout above the resistance trend line (dotted orange) is probably a wave 1 (black).

- A bearish ABC (orange arrows) could take price action lower in wave 2 (black).

- A bullish bounce (green arrows) could indicate the continuation of the uptrend.

- A bull flag pattern (grey arrows) however could indicate an immediate uptrend (dotted green arrow).

- Only a strong bearish decline (red arrow) invalidates the wave 1-2 (black) but not the larger wave 4 (green) pattern.

- In this case, the wave 4’ (green) is expected to bounce (blue arrow) at the 38.2% Fibonacci retracement level.

- A deeper pullback places the current wave outlook on hold (yellow button) or invalidates it (red button).

The analysis has been done with the indicators and template from the SWAT method (simple wave analysis and trading). For more daily technical and wave analysis and updates, sign-up to our newsletter.

Leave a Reply