☝️ EUR/AUD Bullish Retracement or Reversal Despite Downtrend ☝️

Dear traders,

the EUR/AUD is showing bullish reversal or retracement signals. This article reviews the reversal signs and analyses the two main scenarios for this currency pair.

Price Charts and Technical Analysis

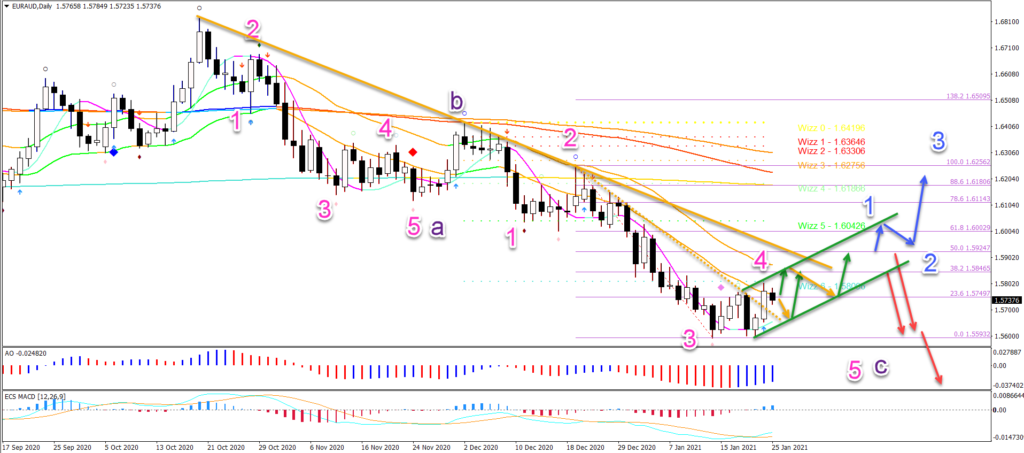

The EUR/AUD has 6 daily candles failing to break for a new low. This indicates the end of the bearish price swing and the start of a bullish price swing.

There are also other signals that confirm this:

- Double bottom pattern

- Break above the resistance trend line

- Bullish daily candles

- HMA 20 is up

- Oscillator momentum is bullish (blue)

- Higher high

The overall direction, however, could remain bearish due to the lack of divergence. This is why the bearish swing has been labelled as a wave 3 (pink) of wave C (purple).

The current bullish swing is likely to be a retracement. The main target is the 38.2% Fibonacci retracement level where a new downtrend could emerge (red arrows).

Only a break above the resistance trend line (orange) plus the 21 ema zone and the emergence of an uptrend channel (green lines) could indicate an uptrend (blue arrows). This indicates the end of the downtrend and wave C (purple).

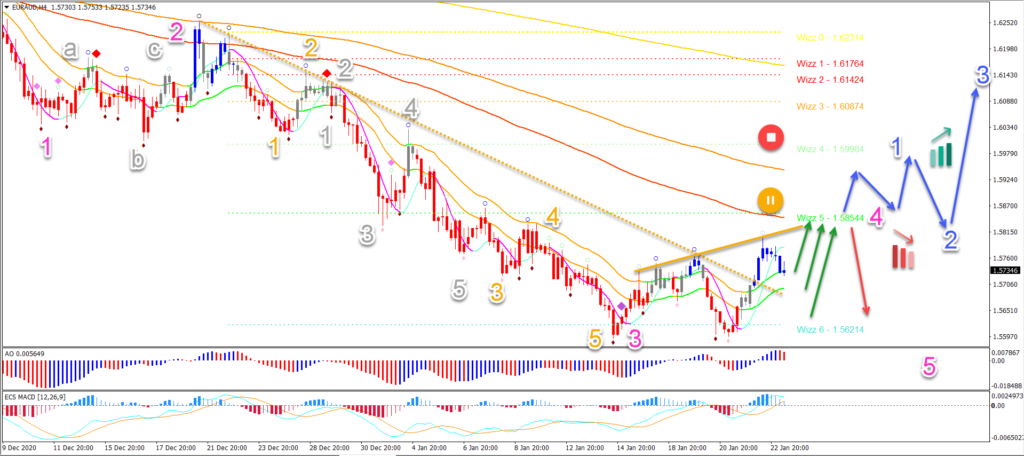

On the 4 hour chart, price action is expected to make one push up (green arrows). Although price could dip first to test support. The bullish retracement remains likely as long as price action stays above the Wizz 6 level.

The Wizz 5 level and 144 ema zone could act as a key resistance. A strong bearish bounce confirms the downtrend (red arrows). A break above the Wizz 5 level indicates a new uptrend (blue arrows).

The analysis has been done with the indicators and template from the SWAT method (simple wave analysis and trading). For more daily technical and wave analysis and updates, sign-up to our newsletter.

Leave a Reply