🔍 Bitcoin’s Doji on Daily Chart Indicates ABC Pullback 🔍

Dear traders,

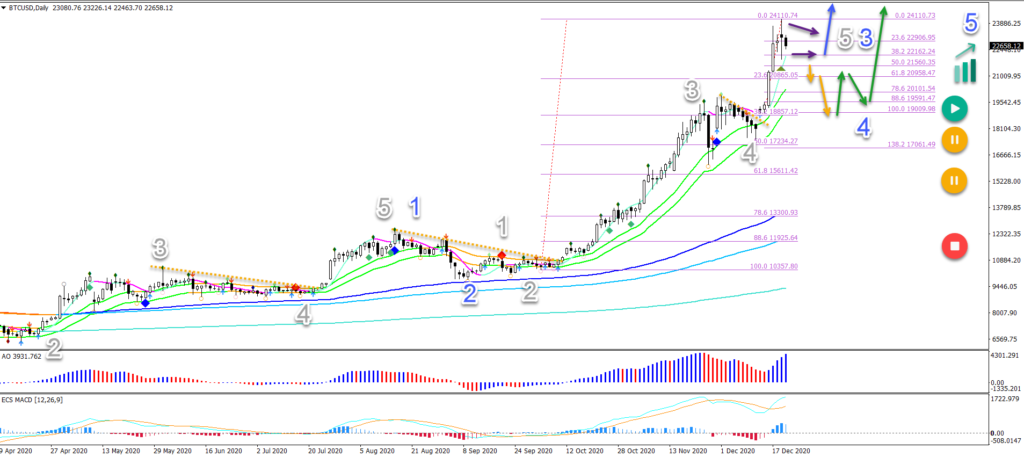

Bitcoin (BTC/USD) closed with a Doji candle yesterday. This indicates indecision after several bullish daily candles made an impressive new all-time high at $24,000.

The angle of and distance between the moving averages confirm the massive uptrend at the moment. But is it time for some type of pullback? Let’s review.

Price Charts and Technical Analysis

BTC/USD is currently developing a wave 3 (blue). As long as price action stays above the smaller 38.2-50% Fibonacci support zone, then price action is expected to stay in that wave 3.

In that case, price could easily go sideways and then break up north (blue arrow) for a new all-time high at the round psychological level of $25,000.

A bearish breakout, however, could indicate a larger retracement. This could start a wave 4 (blue) pattern:

- The main targets are the 23.6% and 38.2% Fibonacci retracement levels.

- A bullish bounce is expected at the Fib support (blue arrows).

- Only a break below these Fibs places the uptrend on hold (yellow circles).

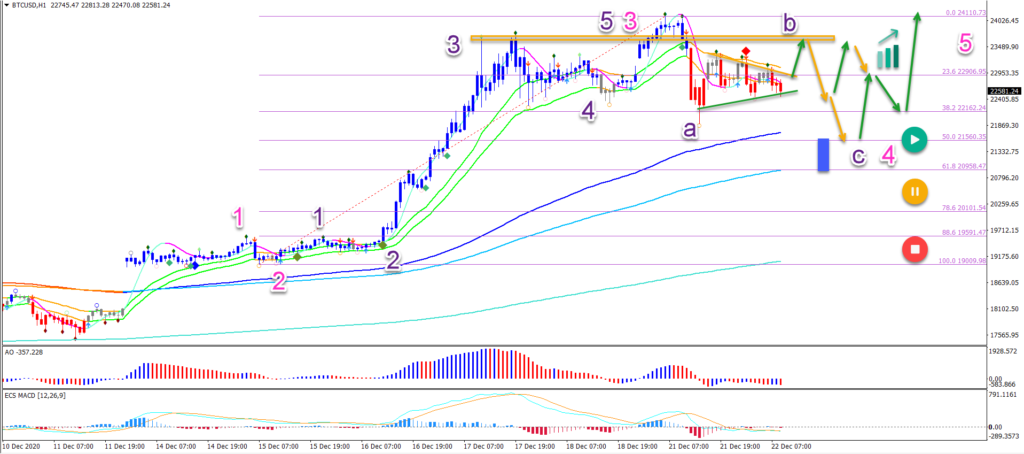

On the 4 hour chart, price action has completed a wave 5 (purple) of wave 3 (pink) at the recent high.

The current retracement seems to be a wave A (purple). Price action will probably build an ABC correction or ABCDE triangle pattern.

After the consolidation pattern is completed, a breakout above the resistance would confirm the continuation of the uptrend within wave 5 (pink).

Price action should bounce at the long-term moving averages (blue box) and Fibonacci support zone, otherwise a larger retracement is taking place on the daily chart.

The analysis has been done with the indicators and template from the SWAT method (simple wave analysis and trading). For more daily technical and wave analysis and updates, sign-up to our newsletter.

Leave a Reply