Weekly Waves 26 September: EUR/USD, GBP/USD and Bitcoin

September 26, 2022

4 min read

Hi Traders,

Our weekly Elliott Wave analysis reviews the EUR/USD 1 hour chart, the GBP/USD 1 hour chart, and the Bitcoin crypto currency daily chart.

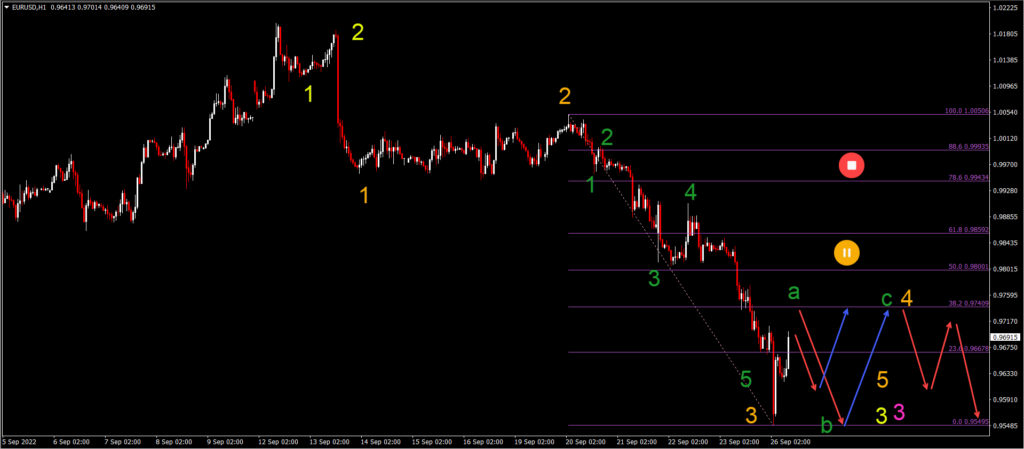

EUR/USD Bearish Impulse Takes a Small Break

The EUR/USD almost reached 0.95 in early trading this morning:

- The EUR/USD could have completed wave 5 (green) of wave 3 (orange).

- The strong bullish bounce once price action reached the strong support at the 0.95 round level probably is a wave A (green) retracement.

- Price action could face difficulties to move much higher. The Fibonacci retracement levels should act as a strong resistance.

- A bearish reaction at the Fibonacci levels could confirm the end of wave A and the start of wave B (green).

- A larger ABC (green) pattern would fit within an expected wave 4 (orange).

- A downtrend is expected to resume and take price action at 0.94 and 0.9250 within wave 5 (orange) of waves 3.

GBP/USD Crashes 550 Pips in Early Trading

The GBP/USD made a huge drop from 1.0850 down to 1.03 earlier this morning:

- The GBP/USD 550 pip decline this morning seems to be part of an impulsive wave 3 (yellow).

- The strong bullish push upwards after the decline is expected to be a wave A (orange) of a larger ABC (orange) within a wave 4 (yellow).

- The Fibonacci levels are expected to be a resistance zone.

- A break above the 50% Fibonacci level makes it less likely that the current Elliott Wave analysis – indicating a wave 3 and 4 (yellow) – is correct.

- A bullish ABC (orange) is expected within the wave 4 (yellow).

- A downtrend continuation should aim at parity (1.00).

BTC/USD

Bitcoin (BTC/USD) is unable to break through the previous bottom (green lines):

- The BTC/USD is at an important decision zone: a bearish breakout confirms the downtrend (red arrows).

- A bullish bounce (blue arrows) could indicate a larger wave C (orange C’) towards the 23.6% and 38.2% Fibonacci resistance zone.

- A break above the 38.2-50% Fibonacci levels could indicate that the wave 5 (yellow) of wave C (pink) has been completed.

- A bearish bounce at the Fibonacci resistance levels should signal the end of the wave 4 (yellow).

- downtrend continuation aims at $15k and $12.5k within wave C (pink).

Good trading,

Chris Svorcik

Leave a Reply