GBP/JPY – Bullish Bounce Targeting 155

Dear Trader,

the GBP/JPY was in a very strong uptrend last week but has been correcting for several days. It is approaching critical levels now where it could be resuming its bullish course again.

This article will take a look at the GBP/JPY price action and highlight hot spots for potential bullish trade setups.

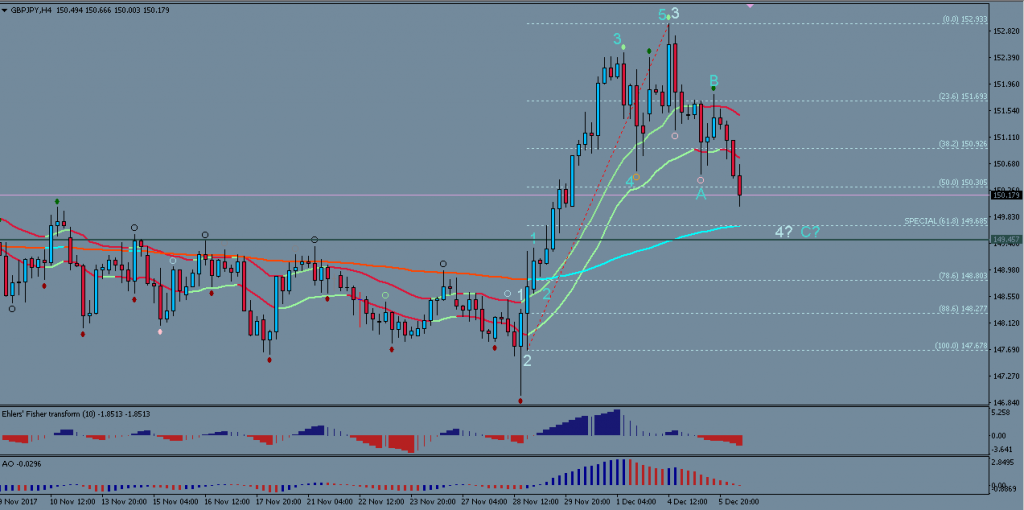

The Daily chart gives us a clear indication that a 5-Wave impulse is in the process of completing. The bullish momentum of last week forms part of a large Wave 5 (Orange) which should break the high of 152.90 (from Sep 2017) in order to complete itself fully.

Bearish correction could finish soon…

The 4 hour chart shows the strong bullish push that tested the 152.90 level. This indicates that Wave 3 has probably finished at that high and a further bullish Wave 5 is to be expected, given the larger picture of this pair. A bearish Wave 4 correction has been in progress since then and is about to reach the 61.8% Fibnoacci retracement level, which coincides with the 144 EMA as well as a support level just below. This provides a point of confluence (POC) that could act as a bouncing spot for initiating Wave 5.

Bullish Bounce Trade Option

A large bullish 4 hour candle with a close near the high of the candle, could be a good starting point for a confirmation of this scenario. Price would need to break and close above the 21 EMA again for additional confirmation to appear.

Long Entries could then be taken, with the final target being around 155 – 155.90, (-27.2 % Fibonacci Level of Orange Wave 3.)

If price were to break below 148.90 the bullish scenario would be invalidated.

All the best along your trading journey…

Hubert

Follow Hubert on Twitter

Leave a Reply