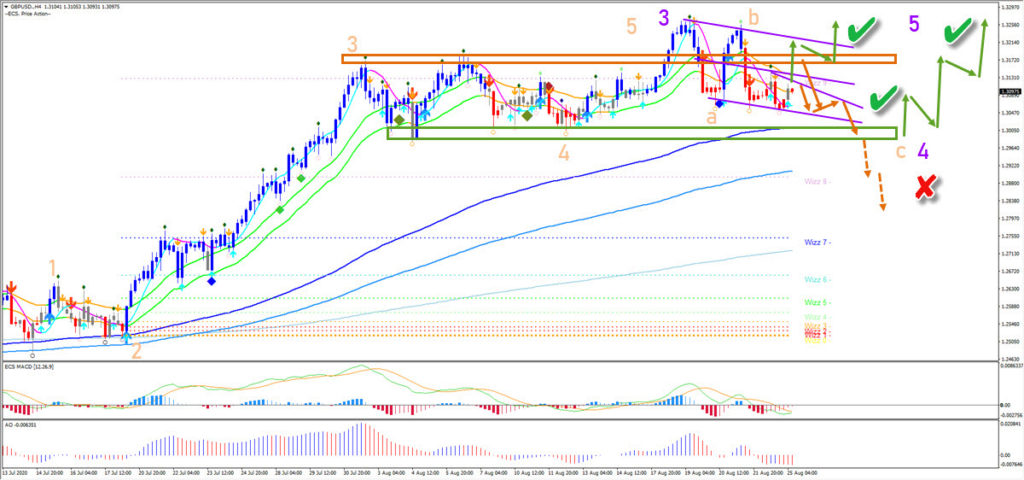

? GBP/USD Pullback Aiming at 1.30 Support & 144 MA ?

Dear traders,

the GBP/USD broke above the Wizz 9 level but is in retracement mode ever since. Will the Cable build a reversal? Or will the uptrend continue?

GBP/USD

Price Charts and Technical Analysis

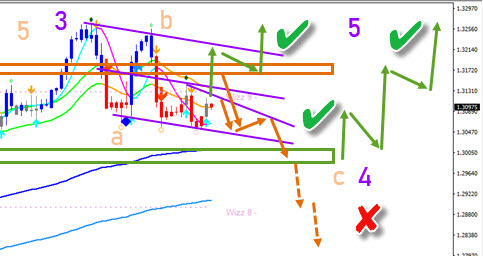

The GBP/USD is below the 21 ema. This indicates a short-term bearish outlook. But the long-term moving averages remain bullish. Also, price action remains well above those MAs. The long-term trend is therefore certainly bullish. But price could create a deeper pullback. The main target of the pullback is the 144 ema, which should act as a support zone for a bullish bounce.

The GU remains bullish as long as price breaks the bearish channel immediately or bounces at the support zone (green box). There is also the round level of 1.30, which should act as support. A break below this zone would invalidate (red x) that bullish outlook. The main targets of the upside are aiming at 1.3325 and 1.35.

The analysis has been done with SWAT method (simple wave analysis and trading).

For more daily technical and wave analysis and updates, sign-up up to our newsletter.

Good trading,

Chris Svorcik

Elite CurrenSea

Leave a Reply