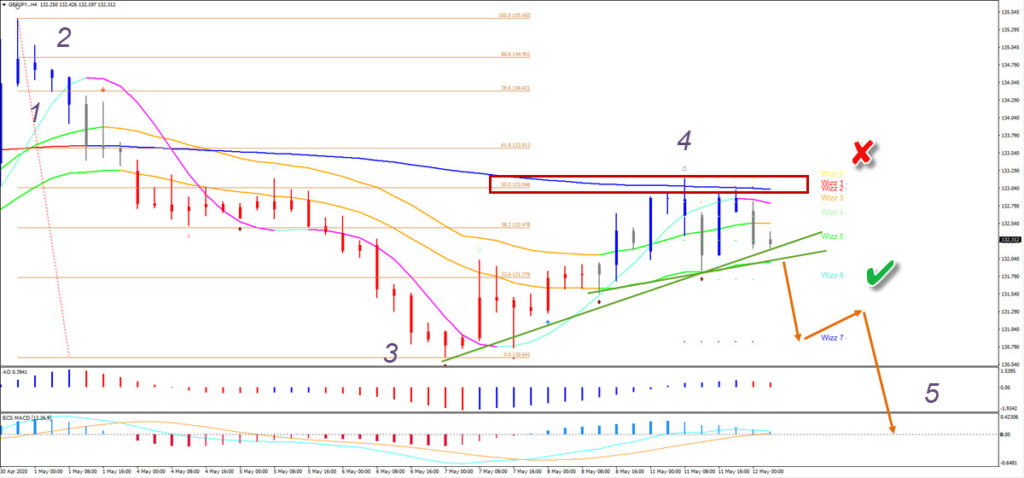

? GBP/JPY Pullback Reaches 144 ema and 50% Fibonacci Resistance ?

Dear traders,

the GBP/JPY made a bullish pullback after a strong downtrend (red candles). The bears could soon regain control again and aim for the 130 target.

GBP/JPY

4 hour chart

The GBP/JPY pullback reached the 50% Fibonacci and 144 ema resistance confluence, which could end the pullback. A breakout below the support trend lines (green) and the 21 ema zone would confirm the downtrend (orange arrows and green check)).

The first target is the Wizz 7 level at 130.80 but an extension towards the Wizz 8 target at 130 is likely too. Once price breaks below the 21 ema zone, price should stay under it. A re-break above the 21 ema zone and 144 ema could invalidate (red x) the bearish outlook.

The analysis has been done with SWAT method (simple wave analysis and trading).

For more daily technical and wave analysis and updates, sign-up up to our newsletter.

Good trading,

Chris Svorcik

Elite CurrenSea

Leave a Reply