? GBP/JPY Head & Shoulders Pattern Aims at 134.50 Target ?

Dear traders,

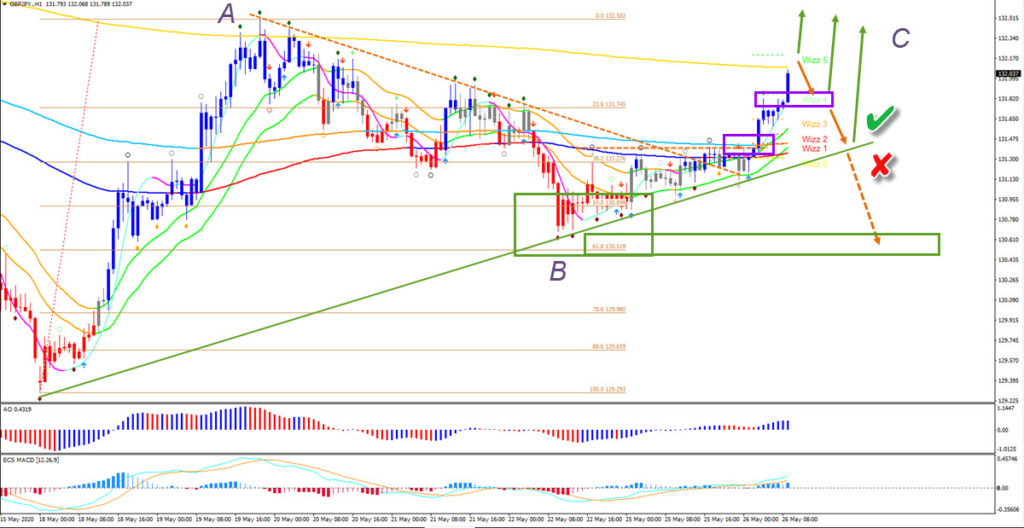

the GBP/JPY has bounced at the 61.8% Fib and 21 ema zone. This could indicate a bullish ABC (purple) pattern.

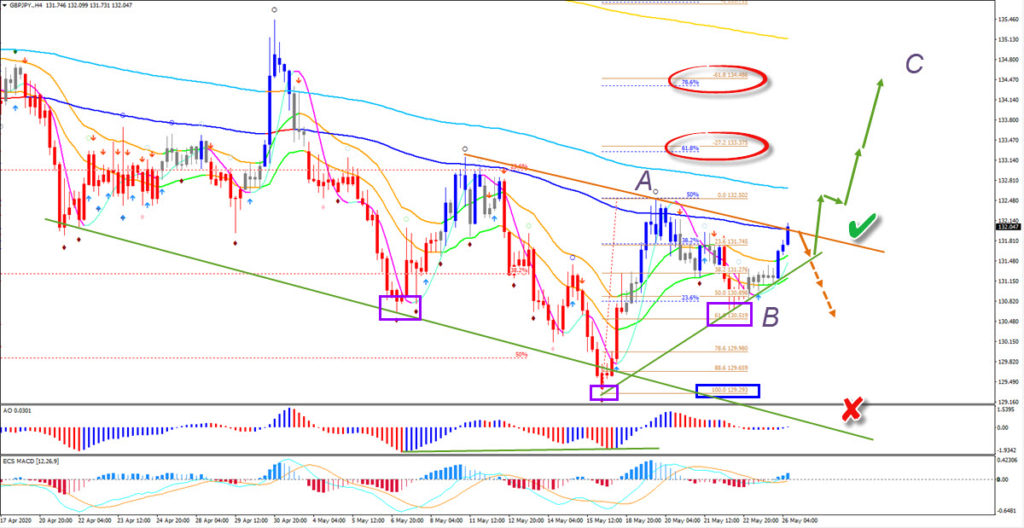

GBP/JPY

4 hour chart

The GBP/JPY seems to have completed an inverted head and shoulders (purple boxes) reversal chart pattern. Price could aim for the Fibonacci confluence zones. One target zone is around 133.25 with a 61.8% Fib and -27.2% target. The second zone is at +/- 134.50 with 78.6% Fib and -61.8% Fib target.

Price will need to break above the resistance trend line and long-term moving averages first to confirm swing (green check). A re break below the 21 ema could indicate a deeper retracement within wave B. A break below the 100% Fib invalidates (red x) the ABC pattern.

1 hour chart

The GBP/JPY is showing strong bullish impulsiveness, which could kick off an immediate breakout. But chances of a small pullback and return into the support zone around 131.80 remain decent. Only a break below 131.25 should worry the bulls and could indicate a deeper retracement (orange arrow and red x).

The analysis has been done with SWAT method (simple wave analysis and trading).

For more daily technical and wave analysis and updates, sign-up up to our newsletter.

Good trading,

Chris Svorcik

Elite CurrenSea

Leave a Reply