GBP/JPY – Bearish Reversal in Progress

Dear Traders,

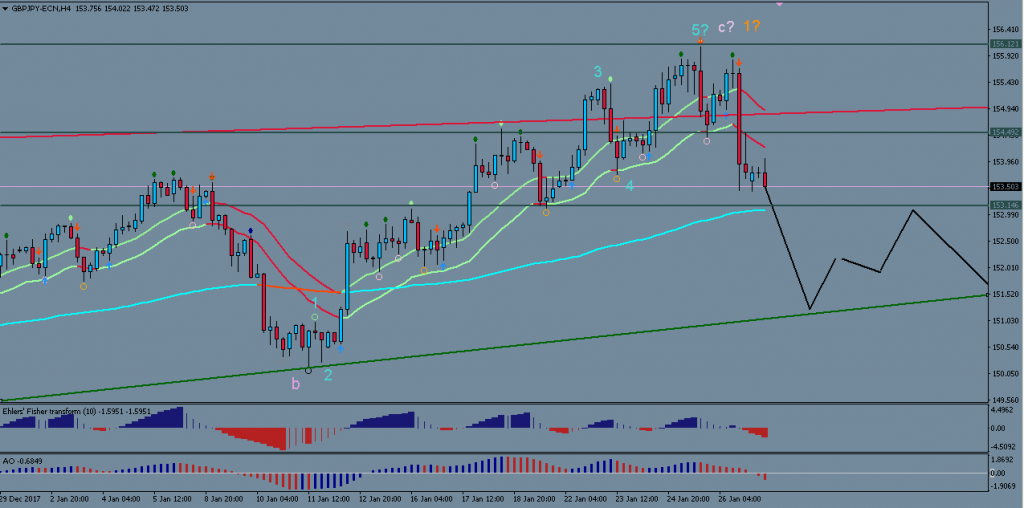

The GBP/JPY has acted according to our previous analysis so far and is beginning to show early signs of a bearish reversal.

This analysis will take a quick look at the most recent price-action of the GBP/JPY and highlight potential trade setups.

Bearish Pressure is Mounting

The GBP/JPY is showing the first signs of a reversal since Friday. Price broke very strongly below the 21 EMA of the 4-hour chart and shows a complete wave count. It overshot the resistance trendline (red) of the rising wedge (as is common with these chart patterns) before swiftly reversing back down.

Here is what we are looking at for a potential short entry:

- A pull back towards the 21 EMA of the 4 hour chart, followed by a bearish bounce. A good bearish 4hour candle close, near the low, would be ideal to confirm more downside, but a strong 1 hour candle may already be enough for some traders. The pullback towards the 21 EMA of the 4hour chart may not occur immediately if the downwards momentum continues strongly.

- Potential targets for short entries are:

- 150.00 and 147.20 (initial interim targets due to previous support)

- 140.00 (50% Fib level of the entire leading diagonal)

- 137.00 (61.8% Fib level of the entire leading diagonal)

- Invalidation of this analysis would occur if price breaks above the last high at 156.083

All the best along your trading journey

Hubert

.

Leave a Reply