❗️ EUR/USD Testing 1.1180 Support Before Key FOMC Event ❗️

Hi traders,

the EUR/USD is challenging a key support zone at 1.1180, which is critical decision zone for a bullish reversal or bearish breakout. How will the FOMC meeting minutes push the US Dollar and EUR/USD pair?

EUR/USD

4 hour

The EUR/USD could in fact break into both directions and will probably depend on the FOMC news event later on Wednesday 10th of July in the US. A bullish USD could mean that the EUR/USD breaks lower and aims for 1.11 and 1.10 whereas a bearish USD could translate into a bullish reversal on the EUR/USD with an aim at the Fibonacci targets around 1.1450-1.15.

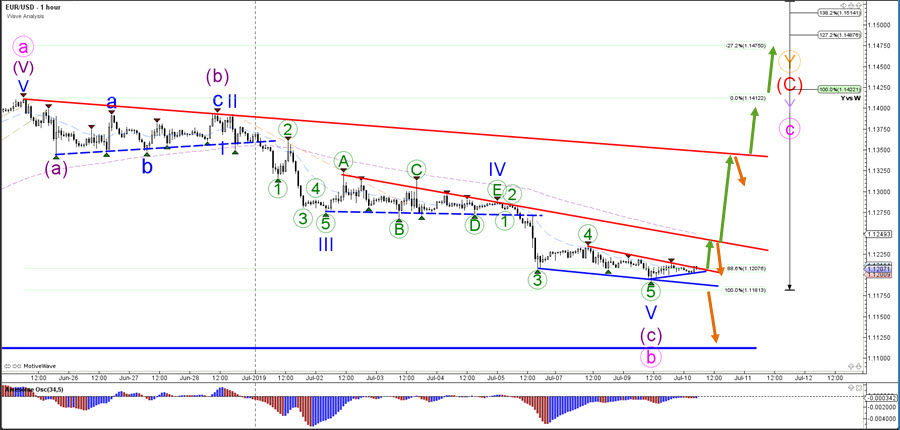

1 hour

From a wave perspective, the EUR/USD seems to have completed a bearish ABC wave (purple) but this wave outlook is only valid if price stays above the 100% Fibonacci level and 1.1180 support. For price to confirm this wave pattern, it would need to break above 1.1250 and 1.13 resistance levels with decently strong impulsive price action.

For more daily wave analysis and updates, sign-up up to our ecs.LIVE channel.

Good trading, Chris Svorcik

Leave a Reply