? DAX30 Breaks Resistance but Faces Critical Fib Levels ?

Hi traders,

The German stock index DAX 30 has broken above the resistance trend lines (dotted) but price action is still facing key Fibonacci resistance levels of wave B (blue).

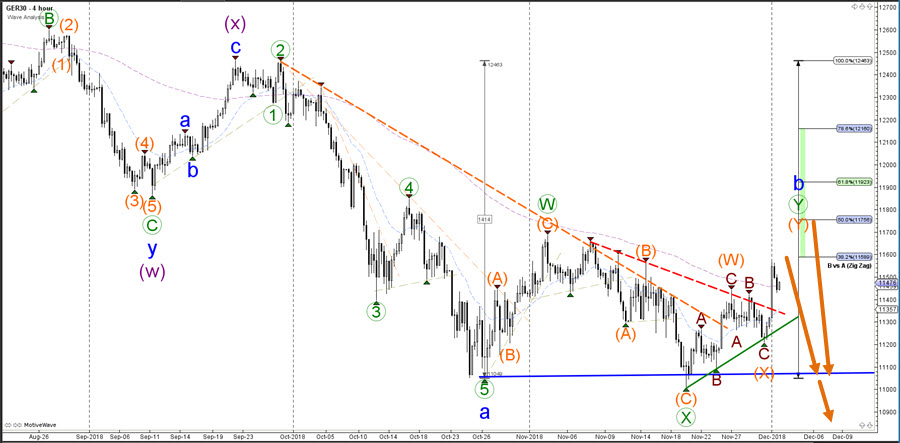

DAX 30

4 hour

The DAX 30 is expected to make a bearish bounce at the Fibonacci retracement levels of wave B vs A and then re-challenge the support level (blue). A break above the 100% Fibonacci level invalidates the expected bearish ABC (blue) zigzag pattern.

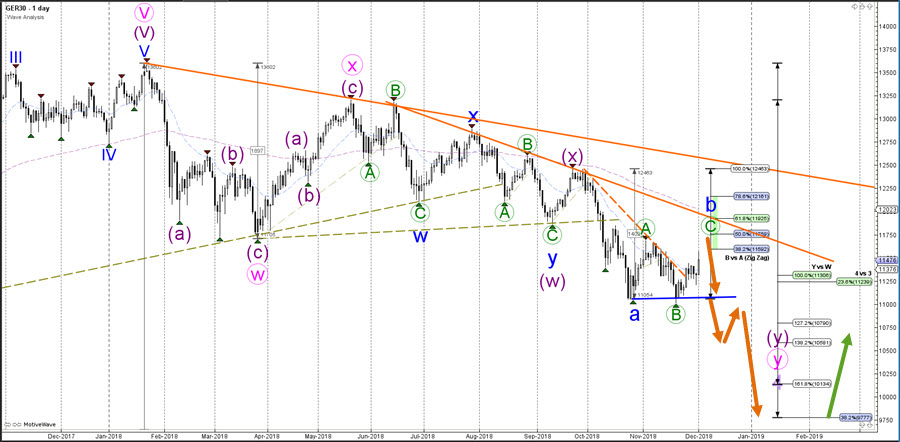

Daily

The DAX 30 is in a long-term downtrend but overall the price action movement is choppy and corrective, which could indicate a larger bullish wave 4 (light purple) pattern. For the moment, a bearish ABC (blue) is expected to take price down lower unless price manages to break above the resistance trend lines and Fibs levels.

For more daily wave analysis and updates, sign-up up to our ecs.LIVE channel.

Good trading,

Chris Svorcik

Elite CurrenSea

Leave a Reply