Trading Journal: CAMMACD Strikes Back

Dear traders,

Last week’s price action started the same as the market three weeks ago. Trades that we carried over the weekend ended with stop loss.

The key in successful Forex trading is adapting. CAMMACD offers a variety of trading tools to trade each market condition and to adapt to markets as they change.

Live Account: 8 Wins, 6 Losses

Initially we had some losses from last Friday. The GBP/USD continued to move inside a choppy range before returning back to normal.

After initial losses we have managed to cover all the losses with very good money management. 403 pips have been lost this week but with total 7.9 % risk. 363 pips have been made with 9.7 % risk total, making this pips negative in count -40, but positive on the overall trading account.

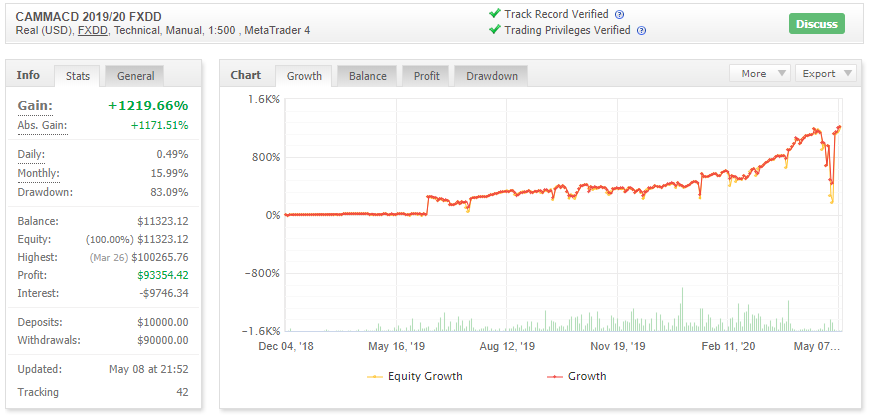

See the screenshot (above) of the myfxbook Live Account (Verified).

*Drawdown is from profits, not from the deposit as 90.000USD profits have been withdrawn, so I’m trading with 10k only.

CAMMACD.CORE V2 Template Has the Knockout Power

Last week we witnessed extremely good results with trading CAMMACD.Core. Actually I have presented a lighter version of CAMMACD.Core template with less indicators and some new rules which make CORE trading even more automated and easy.

The template is named CORE V2 and I will soon make the video for it. It’s very easy to trade. New template introduced so-called “Slingshot” trades where traders wait for the dot to appear and trade the arrows in the dot direction. This might also be the basis for the CAMMACD trading robot. We will also have many CORE setups from now on.

If you are interested in taking your trading to the next level with me as your mentor, then you can get both the live trading setups and CAMMACD system that generates them via our website.

Cheers and safe trading,

Nenad

Leave a Reply