Strategy Behind Ultima EA Automated Trading System Revealed

Dear traders,

Curious to look underneath the hood of the Ultima EA to understand how the strategy works?

Then buckle up because this article will explain the system behind the Ultima EA. For the live and testing results, please review the main Ultima EA article for all of the details.

Now it is time to explain the Ultima strategy and why the system does such a good job in the long run.

The Strategy Behind Ultima EA

We are sharing part of the Ultima rules so you understand the logic and can see for yourself that the EA is built on sound tactics and strategies. Ultima is a robust trading strategy with excellent offensive and defensive methods.

A few comments before we start. The rules might seem simple, but keep in mind that we are not revealing all the rules. Just the main ones so you understand the principles and have confidence in the Ultima EA. For each of the steps we have sub rules that are not revealed because we want to protect the intellectual property.

Please keep in mind that:

- Back testing was performed with 99.9% modelling accuracy

- There are no upfront costs to using the Ultima EA – you only pay when profits are made

- Live trading and testing are showing sizeable returns

- The Ultima EA is 100% fully automated. It does all of the trading decisions, including entry, exit (stop loss and take profit), and trade management (trail stop loss)

Let’s now review the rules:

Step 1: TREND.

Ultima EA is a trend system.

The trend is determined by comparing price versus the long-term MA (144 ema). Candles above the 144 ema are considered an uptrend whereas candles below the 144 ema are a downtrend.

Ultima EA also uses the ecs.WIZZ indicator for filtering out when to trade and when not to trade. The ecs.WIZZ indicator is valuable for 1) understanding the trend and 2) knowing how much space is available (within the trend).

Step 2: PULLBACK.

Ultima EA then waits for a pullback.

It measures the pullback by waiting for the HMA (Hull moving average) to point in the opposite direction of the trend. This indicates that a retracement is taking place. A bearish HMA is needed in an uptrend and a bullish HMA is needed in a downtrend.

We have special rules in place how to calculate the correct pullback, which allows us to avoid too shallow pullbacks, too deep retracements, or reversals.

Step 3: CONTINUATION.

We are looking for price to confirm a breakout.

The continuation occurs after price action has made a pullback in a trend.

We have special rules how to avoid weak breakouts and how to avoid reversals.

Step 4: FILTERS.

There are a number of filters that are used so that the Ultima EA skips the weakest setups and only enters trades with decent long-term profitability expectancy.

One of the filters used is that we skip trades which do not meet our reward to risk requirement. For instance, aiming for 2 pips while using a 50 pip stop loss is not something that the Ultima EA would ever do. The Ultima EA also uses other filters but we cannot mention all the exact rules.

Step 5: ENTRY, EXIT, and TRADE MANAGEMENT.

The system is dynamic, which means that the strategy will adjust its targets and trail stop loss depending on the price volatility. This an important ‘defensive’ mechanism of the system.

Ultima also does a great job on ‘offense’ too. At the right times, it aims for substantial wins that can push the equity curve up.

Ultima Prices and How to Join

The development work cost Mislav and myself 100s of hours so please do not waste time on trying to replicate it yourself (we did not share all of the rules). Joining the Ultima EA is much easier.

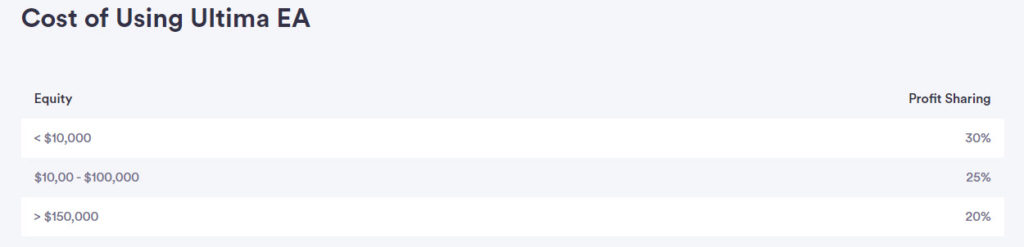

Ultima EA does not require any upfront fees or costs at the moment until you make profit (profit sharing module), which means that you only pay when profit is made with Ultima EA (on a monthly basis).

Not only that but an account has to make a new equity high (compared to the previous peak) before the profits are split. See the image for the structure.

How can you join?

It takes only 3 steps which can be found on the Ultima page too:

- Open and verify an ECN account with FXDD Trading via this link

- Fill in LPOA (limited power of attorney) form with FXDD Trading

→ write Ultima as trading agent - Fund your account (use risk capital)

By using the link in step 1, your account is automatically connected to our master account.

Once you add funds to your account, your account will automatically start following trades and trading decisions by the master account.

Please be aware that your account will not show pending orders, entries, stop loss, or take profit. This is OK. Why? Because the main account always has a stop loss or take profit. The main account will send the trade information to your account.

Advantages of Ultima EA

Here are the main advantages:

- Proven strategy with live trading and high quality back testing (99.9%modeling accuracy)

- Automated: no manual errors and non-stop 24-5 Forex trading

- No costs, only pay when in profit and easy to setup

- Uses tested SWAT tools and concepts

Key tools:

- SWAT method like Fibonacci moving averages

- The ecs.WIZZ indicator

- New Fibonacci target tool

- Solid trading rules

Once again, profit sharing means that no payment is made upfront and that the profit is shared on a monthly basis, if the account is earning profits and has made a new equity high. We think it’s only fair that we earn a little bit but ONLY when you earn.

Best Regards

Team of Elite CurenSea

Leave a Reply