Learn Why Ultima EA Avoids Using a Tight Trail Stop Loss

Dear traders,

What do you think is better: to use tight or loose trailing stop loss? Or perhaps none at all?

This is one of most complicated questions and debates within the world of trading. Mislav Nikolic and Chris Svorcik will explain their views and experiences for both manual and automated trading.

This article reviews the performance difference for the Ultima EA when comparing a trail and no trail. We also explain the difference between manual and automated trading.

Why Ultima EA Uses an Extremely Light Trail SL

Trading is an emotional game. Seeing your profits dwindle is not fun. Watching a profitable trade turn into a loss can create strong feelings in traders. Continuing to trade after a hefty drawdown and losing multiple trades in a row is difficult.

But traders sometimes need to lose small battles to win the overall war (for lack of a better example). Traders will not be able to win enough if they micromanage each price movement and trade decision. Their trading will ultimately cut winners short and let losses run too often. Keep in mind that the main rule for trading is the opposite: let your winners run and cut your losses short.

The Ultima EA had 2 trade setups in May where a decent part of the profit from the open trade turned into a full loss. This particular event is often the most difficult outcome to accept for traders. We received an email asking why the Ultima EA did not use a trail stop loss. This was a perfect time to explain the method in more detail via this article.

Here is the question from our member: “Hello, I would like to understand how the robot’s stop loss works. Do you use a trailing stop loss or a fixed stop loss. Friday night the robot won about three hundred euros and today we are in loss. We give back the money earned to the market. I thought the stop was there to protect the winnings but it’s not. I would like the creator of the robot to explain to me how the stop loss works thank you.”

How the Ultima EA Trail Works

The Ultima EA does use a trail stop loss (SL) but a very loose one. It gives the trade enough space to manoeuvre and does not cut the trade short.

The Ultima EA only moves the trail SL to break-even + 1 pip (above entry for long setups and below entry for short setups) if the price is within a couple of pips of the target. This means that the trail SL is not always activated. Why?

The Ultima EA is a 100% automated trading system. The main advantage is that Mislav and I (Chris) could rigorously test the rules with years of data.

The reason why we choose this type of loose trail is based on back-testing. The current configuration provides much better results in the long run than any other type of trailing stops. How do we know?

Because we tested over 14,000 scenarios and for more than 10 years. We even rented a supercomputer to run all of the tests.

So even though a tighter trail SL might work well in the short run with a few trades, the problem is that it caps the profitability in the long-run. Our goal with the EA is long-term profitability. Trailing gives you in the long term much worse results. (To see the live results, check out these links from Ultima EA co-creator Chris Svorcik made a total gain of more then 750% and the account of Mislav Nikolic, the Ultima EA creator, who is breaking above the round 1000% level).

Performance Difference in 1 Year?

To show our audience the difference between a tight trail stop loss and a very loose one, we tested two different scenarios for one year.

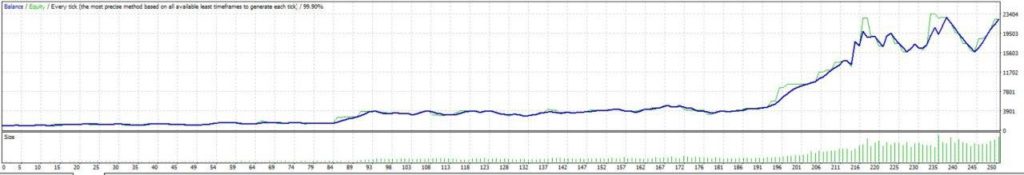

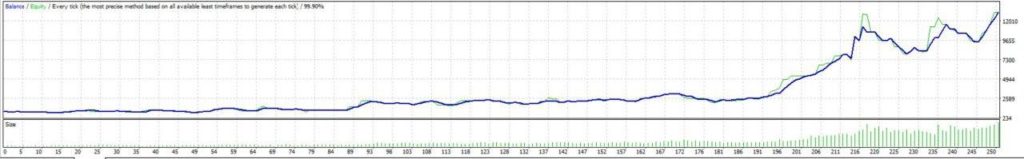

The loose trail stop loss earned twice (!) as much profit as the tighter trail SL approach. The tighter trail saw the account grow from 1,000 to more then 12,000 (see image below).

The loose trail stop loss saw the profits move up from 1,000 to more then 23,000. The testing was done in both cases from May 2019 to April 2020.

The data clearly indicates that a loose trail stop loss is better, certainly for Ultima EA. Traders need to carefully decide and consider whether using a trail stop loss is worth it in the long run.

Trail Stop Loss with Manual Trading

The way Ultima EA uses trail SL is a very specific method for automated trading. The same approach is probably less desirable and doable for manual trading methods.

The reason is simple: manual trading lacks the years of back-testing that automated trading can accomplish. With a shorter track record and history, traders are best advised to protect some of their profits at an appropriate time.

That said, traders still need to find a balance in their usage of a trail SL. If traders move their SL to break-even after price has moved 2 pips in their favour after 2 minutes, then they are cutting the trade short. The disadvantage of this tactic is that winners will almost always be small and losses will be much larger.

Manual traders will need to find a middle ground and balance their trade management decisions. In my ecs.SWAT course 2.0, I recommend using the following approach for a manual trail SL:

Phase 1: patience and wait.

When the trade just opens, traders need to give time and space for the trade setup to develop. If you just entered now or a few candles ago, then there should be a clear reason for the trade. There is usually no reason to exit very soon after entry unless entering the setup was an error.

Let the trade develop and give yourself time. Review the new candles but always keep in mind that the market makes a ton of ups and downs (consolidate) before you can expect any strong price movement. Keep in mind that it’s best to monitor the trade on the same time frame of entry or 1 higher but certainly not on a lower time frame. Continuously watching lower time frames will only make a trader more nervous with irrelevant price action.

Phase 2: reduce the risk.

After giving the trade usually 5 to 15 candles of space, it’s time to evaluate how the trade is going. The trade is either at a full loss (no action needed), large floating loss, small floating loss, at break-even, small floating win, large floating win, or has hit the target (no action needed).

In all cases, it would be good to move the trail SL to a strong support or resistance spot that can reduce the loss, if possible. If the trade is in a floating loss or at break-even, the best we can do is to reduce the loss. If the trade has a floating profit, then the best is to move the SL to BE+1 pip or as close to BE+1 pip as possible.

But keep in mind that you always want to use technical levels for placing the trail SL such as fractals, candles lows and highs, Fibs levels, moving averages, etc.

Phase 3: patience and wait.

Once the risk has either been reduced or fully removed, it’s time again to be patient and wait for the trade to develop towards the main targets. This is a moment when and where you do not want to over crowd your trade and grab the first 10 pips that are available. Take a deep breath and step back. Wait for the trade to develop and give it some more time like 5-15 candles again.

Phase 4: lock in profit.

Last but not least, it’s profit grabbing time. After the trade had another 5-15 candles to develop, it’s time to evaluate the new status. If the trade is going sideways and is still looking good, we can give the trade more time. But if the price action is not moving as nice, then using a tighter trail SL certainly makes sense.

If the price action on the other hand has moved in our direction a lot and price is getting closer and closer to the target, then traders have the option to start using a very tight trail SL. We can then use candle highs and lows or even Fractals, support & resistance levels, and candle highs & lows of lower time frames.

The main benefit of this 4 step trail stop loss plan is adjust your approach depending on the life cycle of a trade setup.

Check out the Ultima EA page for more details on automated trading.

Check out the ecs.SWAT course 2.0 for more details on manual trading.

Good trading,

Chris Svorcik & Mislav Nikolic

This is an excellent and helpful article. I will use its points in my manual trading. Thank you

Thank you! happy to hear it 🙂

Very good explanation and thank you for your answer

Excellent! Glad it helped 🙂