Learn Manual Trading From 2020 Best Trader and Service

Hi Traders,

We can see that the global pandemic of Coronavirus implied many states to act by adopting a state of emergency. This means isolation, lockdown and work at home.

In addition the markets haven’t been better to trade for many years and we at the ecs.LIVE and Elite CurrenSea are fully enjoying it. With markets, I mean specifically the Forex market. The results speak for themselves.

Fantastic Results During the Three week Period

Since the start of the Coronavirus pandemic we were able to constantly make pips, week after week. The last week yielded 14 wins with only 2 losses, making the total pip count of 531 pips.

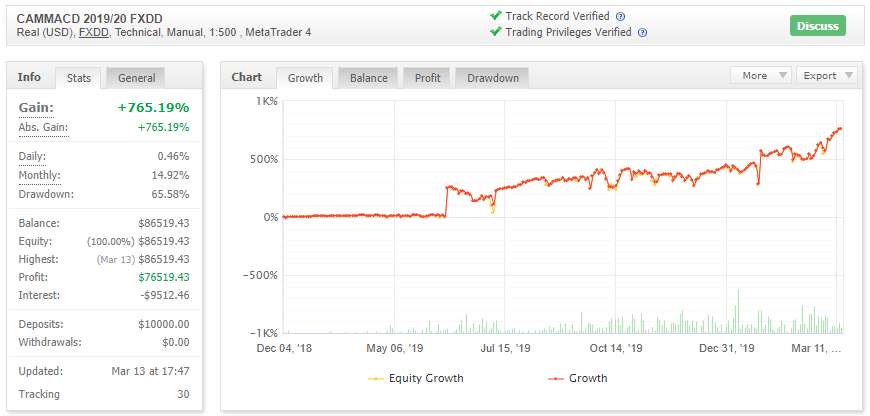

Last 3 weeks gained a total 1018 pips with a total of 41 wins and only 9 losses(!). See the screenshot and the link to myfxbook Live Account (Verified).

You can get both the setups and system that generates them at a 42% discount before march 31.

Source: MyFXBook

Coronavirus Wreaks Havoc in the Stock Markets but the Forex Market Has Never Been Better to Trade

While most of the week was made up of sickening falls due to rapidly increasing worries around the coronavirus, the staggering comeback on Friday from losses of more than 8% to a market close of up 4.4% is one of the fastest and strongest moves in living memory.

Indices traded through the massive points range

By the end of the day’s trade the ASX 200 had gained an impressive 234.7 points, or 4.4%, to close at 5539.3 points.

The whipsaw trading saw the index tumble as low as 4873.7 points in early trade, which represents a drop of more than 30% from the record high of 7199.79 points set in what seems like a lifetime ago back in February.

At that point the index and many individual stocks were hitting levels as low as they had been since early 2016. It was a disaster to all traders of stock markets. Then came the massive rally which saw the market gain an amazing 10% in just 90 minutes. This rollercoaster caused a havoc in the markets as many traders have been unprepared for major moves and volatility which has been record skyhigh.

The source of the above mentioned information is here.

The S&P 500 had its best day since 2008. The S&P 500 rose more than 9 percent, making Friday its best day since 2008, with most of the gains coming late in the day as government officials and business executives spoke at a news conference at the White House.

Forex market is the Best Market to Trade

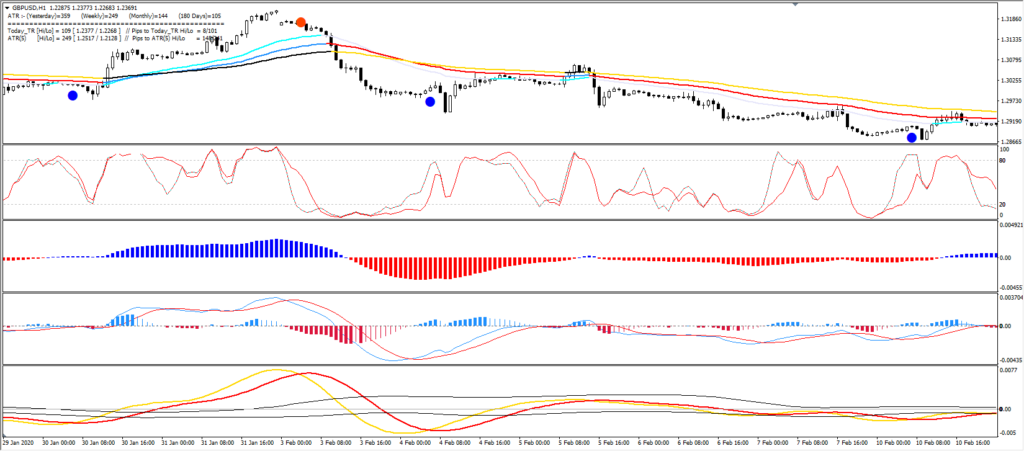

Thanks to massive moves in Forex markets and our unique ATR indicator we have been able to capture a whooping 1018 pips since the start of Coronavirus hype 3 weeks ago.

Forex is the best market to trade. The market changes all the time, so we must change accordingly. The nature of financial instruments largely depends on the macro environment at the time. The traders change their behaviour according to the broader economic climate. A currency may react to a news release, technical level or manipulation.

The nature and severity of this reaction depend on many things:

- inflationary cycles

- Natural disasters such as Covid

- bull/bear market conditions in equities

- global macro themes.

- A lot of perfectly fine trading systems suddenly stop working due to changing market conditions.

You have to take this into account if you want an effective trading system. Fortunately we have the remedy and cure for all you as a trader might suffer from. It is called the CAMMACD and ecs.LIVE.

Let’s be honest. Many of the systems out there sell without any substantial proof of their effectiveness. Let’s assume you have bought a new system and it shows a nice PDF with results. But that PDF doesn’t contain any info about the trader, the system or the account.

It also lacks a link to any third-party tools such as Myfxbook. All in all, this system might be right but it lacks a proper money management component. The best way to learn money management is by trial-and-error or by visiting webinars and learning from experienced traders.

Start thinking in big sample sizes. Instead of analysing one or two trades, collect a database of at least 100 trades.

Forex IS and WILL always BE the Best Market to Trade. Those big moves during the day are what I have been trading in 2009 2010 2011 during the GFC (Global Financial Crisis) and finally we have the volatility to deal with.

CAMMACD.EA is the Future of Automated Trading

One of the main “culprits” for awesome ecs.LIVE trading results is the CAMMACD.EA – Nenad’s Manual Trading system which has been backtested for 5 years and currently it has been traded live on ecs.LIVE channel. The system is not available for purchase because our aim is to develop it into the fully fledged EA. The system uses OUR custom indicators which are copyrighted and will be featured into the EA once the EA is available. We are in the process of forward testing it by trading it live. The system produced a whooping 32 wins and 8 losses over 4 weeks.

Thank you Forex Market for being so awesome!

Source: CAMMACD.EA

What About the Future of CoronaVirus

The following information is sourced from a cabinet minister in Australian parliament. The future looks bright ahead but we need not to panic and act seriously.

This is a one hour briefing from a cabinet minister after their full day on Covid-19 with the chief medical officers of aus, uk, USA and Israel and the prime minister yesterday. Summary as follows:

– 60% of Aussies will be infected

– South Korea is testing 15,000 per day. Mortality rate there is 0.6%. This makes it a bad flu (10X normal flu rate). That’s the expected mortality rate in Australia.

– mortality rate grows exponentially from age of 70 as per normal flu. Mortality rates there are 10-15%

– so deaths in Australia to be tens of thousands, mainly aged

– mortality is not out and out their main concern, it’s a third of the workforce being sick and economic impact

– there is no stopping the virus, masks limited use, advice is to get it early while there are hospital beds. Masks are only useful to stop infected people infecting others. There is one mask factory in Australia which the Australian defence force has now taken over to produce 5m masks per month

– vaccine up to a year away

– Govt response is not to stop the virus but to flatten the peak of the bell curve, so to have only 1-2m infected per month. Worst month is expected to be June, easing by September and all done by December .

– there will be a recession next quarter. This is a 1 in 100 year economic event but we are going to manage it much better than in past

– tomorrow the government will announce a whopping 1% of GDP fiscal injection to prop up the economy. This will be focussed on small business investment. This Is the biggest Govt spend over our history (to be spent over a 90 day period). The banks will come to the party passing on rate cuts.

– hospitals are cancelling elective surgeries to make bed space for the aged infected

– the difference between this and SARS for instance is that China failed to act for 6 weeks. It could have been contained

– however China sees the end in sight. Iron etc prices have not dropped.

From this information we can see that the govts will do their best to keep the epidemic contained. Fiscal and monetary policies will be the primary focus of central banks. Rate cuts will be imposed in order to save the economies from collapsing.

Cheers and safe trading,

Nenad

Leave a Reply