EUR/GBP Bearish Candlesticks ? Threaten Critical Support Zone ?

Dear Traders,

The upcoming trading week promises lots of fireworks with multiple data points being released in the next days. The USD will be impacted by ADP, FOMC and NFP. The GBP and JPY will see interest rate decisions by their central bank. Also note that the last and friday trading days of the month typically are more difficult to trade. This of course happens on Tuesday 31st of October (last day) and Wednesday the 1st of November (first day).

Price action and long-term traders will appreciate the availability of a new October monthly candle on Wednesday. Of course, we will be analysing the candlestick of the major currency pairs and translating their importance for you via EliteCurrenSea and ecs.LIVE.

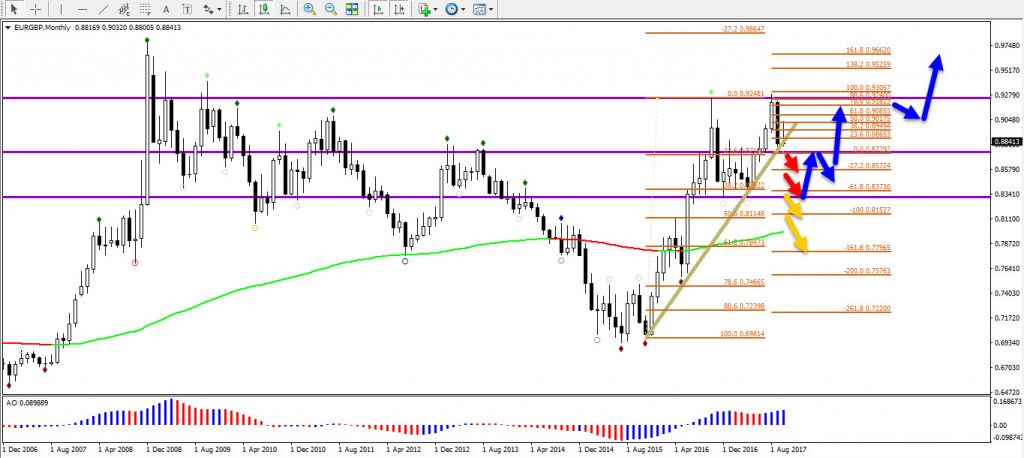

In the meantime, we wanted to focus today on the EUR/GBP as the bearish momentum is currently testing a key support area 0.8750-0.88.

To enable screen reader support, press Ctrl+Alt+Z To learn about keyboard shortcuts, press Ctrl+slash

.

EUR/GBP Strong Bearish Candlestick Pattern

The EUR/GBP is in a sturdy and long-term uptrend. However, last month’s bearish candlestick pattern on the monthly charts does make a bearish retracement likely. This month price has not been able to break below the support trend line and support zone at 0.8750-0.88 yet. This could happen next month. Especially if this month’s candle (October) has a large wick on the top of the candle.

Ultimately if price does manage to break below the support zone, then a bearish breakout should be able to take price down to -27.2% Fibonacci target at 0.8572 and later on even to the -61.8% Fib target at 0.8373. The latter target is equal to the 38.2% Fibonacci support level of the major bullish swing and also the bottom of the sideways range (purple) lines.

A bullish boiunce is expected at either of the Fib targets but especially at the -61.8% Fib target (see blue bullish arrows). A bullish continuation is then likely to continue and reach the previous highs again and perhaps even break above that for a move towards the -27.2% target at 0.9860.

EUR/GBP Daily Triangle Pattern

This chart is showing multiple bearish (red) and bullish (blue) arrows. The goal is to show where the main decision zones are located. At the moment price is in between support (green) and resistance (orange) trend lines and a bullish or break breakout above or below the chart pattern is needed before a larger price movement is tradeable.

A bullish breakout of the triangle will probably find an initial resistance or reversal point at 0.91 aor 0.92 for a bearish bounce.

a bearish breakout of the triangle will probably see price test the horizontal support (purple) at 0.8750. The next break could take price to the targets metioned on the monthly chart.

Many green pips,

Chris

To enable screen reader support, press Ctrl+Alt+Z To learn about keyboard shortcuts, press Ctrl+slash

.

Leave a Reply