EUR/CHF ? Bearish Correction ? Targeting 1.1400

Dear Trader,

the EUR/CHF left its long-term range in mid 2017, and has been in a bullish trend ever since. But the move appears to have run out of steam and now offers potentially lucrative short opportunities.

This analysis will take a closer look at the EUR/CHF price action and highlight potential trade setups.

Reversal Signs have Appeared

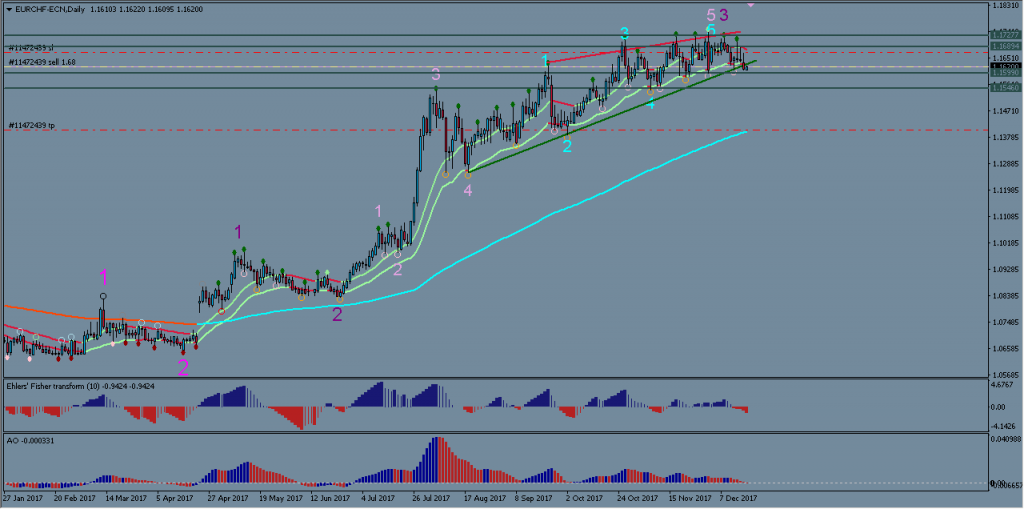

The daily chart below shows the EUR/CHF uptrend we have witnessed throughout 2017. Although the extended wave count suggests that there is room for further bullish trend continuation in the future, the chart right now reveals many signs that point towards a temporary, but substantial, bearish correction.

A classic Rising Wedge chart pattern has formed (green and red trend lines), which most commonly forms at the end of bullish momentum and just prior to a sharp bearish correction. In Elliot Wave theory, this bearish pattern is recognised as an ‘Ending Diagonal’, which appears in the Wave 5 of a large impulse. One way to verify whether the pattern is truly an Ending Diagonal, can be done by looking at the internal wave structure. Wave 5 of an ending diagonal should consist of 5 ABCs, and not the usual 5-3-5-3-5 structure. This is, indeed, the case in the EUR/CHF chart (see turqouise waves which make up pale pink Wave 5)

Divergence is confirmed

Additional signs of a pending bearish correction show up via the divergence between price levels and the momentum indicators at the bottom of the chart. This opens up space for a potential correction all the way down to the 144 long-term moving average (currently at 1.1400).

Bearish Price Action is confirmed

Furthermore, price broke the green support line yesterday with a strong bearish daily candle close at the low, which also meant that price closed below the 21 EMA of the daily chart for the first time in months.

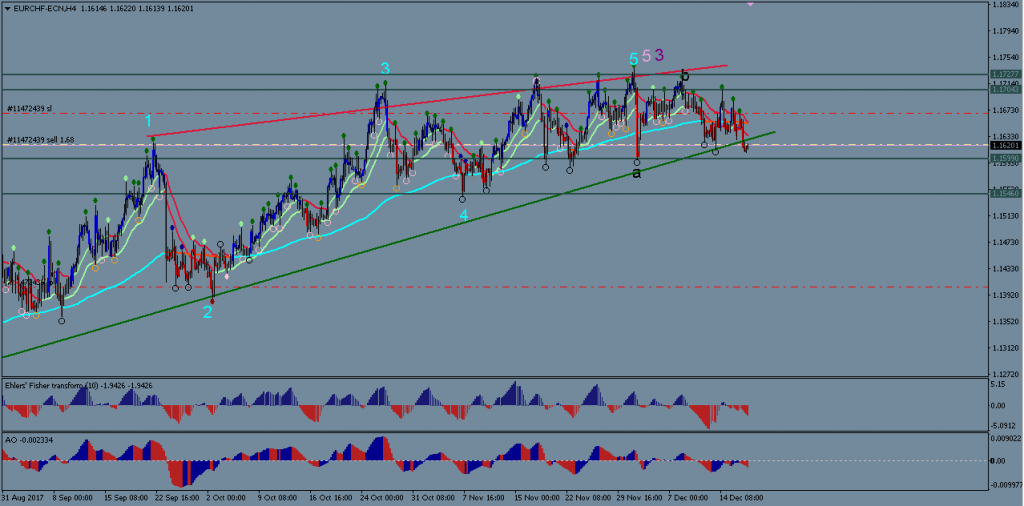

The 4 hour chart (below) equally shows a bearish double break of the 21 and 144 EMAs; another strong indication that price is planning a trip southwards.

Good Time for Potential Short Entries

Price has retraced slightly upwards from yesterday’s low, which provides a potentially good spot for new short entries.

Only if price breaks above 1.1670 does the bearish scenario become a lot less likely.

The ultimate target lies at the long-term moving average of the daily chart, at around 1.1400. But there are numerous interim support levels that could be used as partial targets too, such as 1.16, 1.1550, 1.15, and 1.1450.

Bear in mind that EUR/CHF is a slower moving pair and that this trade is based on a larger timeframe, which means that the trade could take around 2 weeks before it might hit the final target.

All the best along your trading journey…

Hubert

Follow Hubert on Twitter

.

Leave a Reply