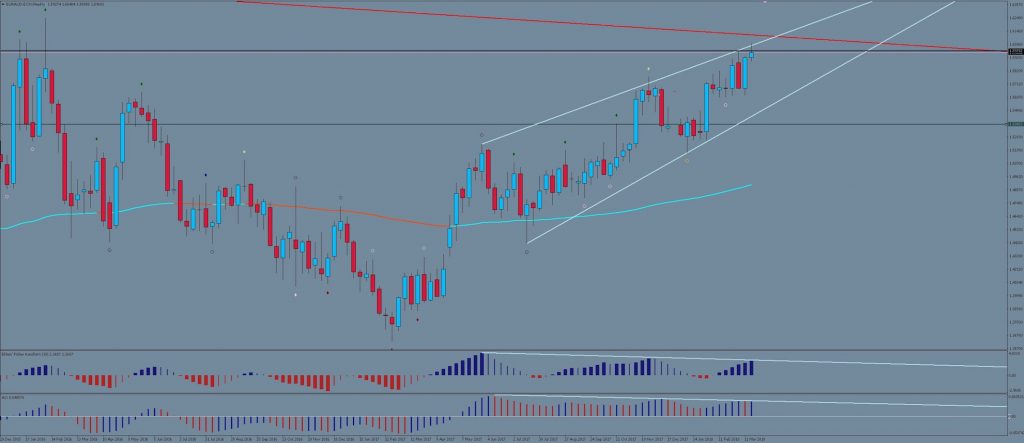

EUR/AUD – Bearish Correction Imminent

Dear Traders,

The EUR/AUD has been on a sturdy uptrend, but things are shaping up for a significant downward correction now.

This post will provide a technical analysis for the EUR/AUD including potential setups.

Wedge Pattern Suggest Culmination of Trend Waves

The EUR/AUD appears to be building a rising wedge pattern on a large scale (see weekly and daily chart above) as part of a large wave 5. The pattern is probably not complete yet, but an interim high/top is now being approached, as price is testing the upper trend line of the pattern.

It suggests that a sizeable downward correction is due again. In supportive of this scenarios is:

- Early momentum divergence on Weekly chart

- Confirmed momentum divergence on Daily chart

- Price has produced a bearish daily candle bounce of a long-term resistance trend line (red line in weekly chart) yesterday

- The smaller wave structure looks to be very complete in several degrees after a final attempt higher which could end in a double top/ truncated 5th (yellow count on 4 hour chart below)

- R1 pivot resistance at same level as last price high

Trade Setups

Very aggressive traders could consider taking sell entries at the resistance POC of around 1.603, but a more safe approach is to wait for a break of the 21 EMA of the 4-hour chart before entering.

Targets are the long-term moving average of the daily chart and a support zone around 1.55.

All the best along your trading journey

Hubert

.

Leave a Reply