Money Management In Forex

In the Forex, while some people prefer to rely on their own trading, some prefer experienced forex traders to take the shots, thus the invention of Forex PAMM/MAM and copy trading solutions. Today we are going to focus on Forex Money Management through PAMM & MAM technology, analyzing popular pitfalls and providing suggestions on how to evaluate the money managers you are looking to invest in.

Difference between PAMM and MAM accounts

Although to you as a final consumer of money management services, it is of little importance to understanding the nitty-gritty of the underlying technology, the industry is still guilty of using “technical jargon” when communicating with clients, therefore, it’s best you understand the basics of PAMM & MAM technology, as well as where it’s different.

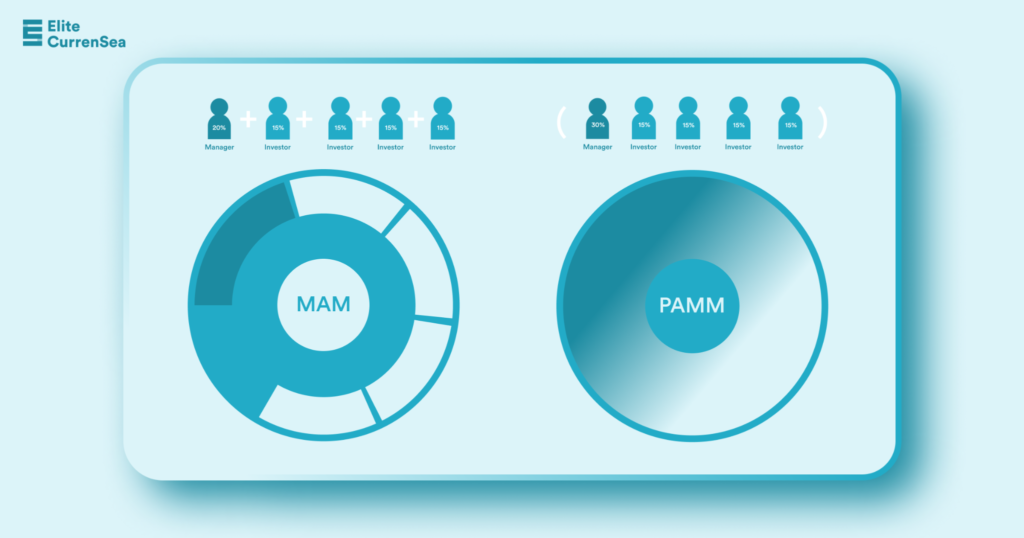

While PAMM stands for Percentage Allocation Management Module and MAM is a Multi-Account Manager. Both of the accounts are for fund management, managed by an external party. The biggest advantage of these types of accounts is that there is no necessity of creating an investment fund to manage other people’s accounts. In terms of Profit distribution, they are spread across all the managed accounts within the PAMM/MAM account but in different ways. This way the clients under those accounts are directly tied to the account manager.

PAMM Account

To simply explain what a PAMM account entails, when a client finds a suitable account manager, whether it is through a broker or a platform, then they decide the amount of money they are willing to put in the shared pool of assets. This gives them a certain percentage that they hold in the PAMM account, the more you invest the bigger is your share of profits and the bigger loss you might encounter as well, some might say this egalitarian approach is the finest lure behind PAMM accounts. This is why it is crucial to choose the PAMM account managers carefully.

The overall profit of the PAMM manager is dependent on the other accounts within the PAMM. Trades executed by the manager are copied to all of the clients’ accounts as well (respective to the amount of percentage each sub-account has), this process is also known as copy trading and has other variations as well.

Most PAMM accounts are free to join but have a profit share system that secures the trust between the client and the account manager because if the account manager is not producing good trades their profit is also going down.

MAM Account

Mam accounts follow the same logic as PAMM where the Manager uses the master account to perform trades and the sub-accounts are following their actions automatically and are referred to as slave accounts.

MAM offers more flexibility for both aspiring traders, for they can follow the trading, and also offer an extra edge to professional traders who also invest in money managers and therefore might have their own interventions to make, i.e. a client with experience might want to limit exposure during important global events, and visa versa.

In the case of the MAM accounts, the performance fee is paid to the master trader according to his profit and unlike PAMM, the percentage of profit share can vary throughout the different sub-accounts.

Best MAM/PAMM Forex Brokers and Platforms

Keytomarkets.com

Key To Markets also known as KTM is a brokerage company offering PAMM services to different Account managers. Through their innovative Social PAMM technology, many leading financial firms have created a successful platform. One of the prime examples of being Portfolio ECS produced by Elite CurrenSea. The platform is a combination of technical analysis and market structure research that allow Portfolio ECS to utilize both manual and automated trading in a sole unified Multi-Asset, Multi-Approach Money Management Service.

eToro

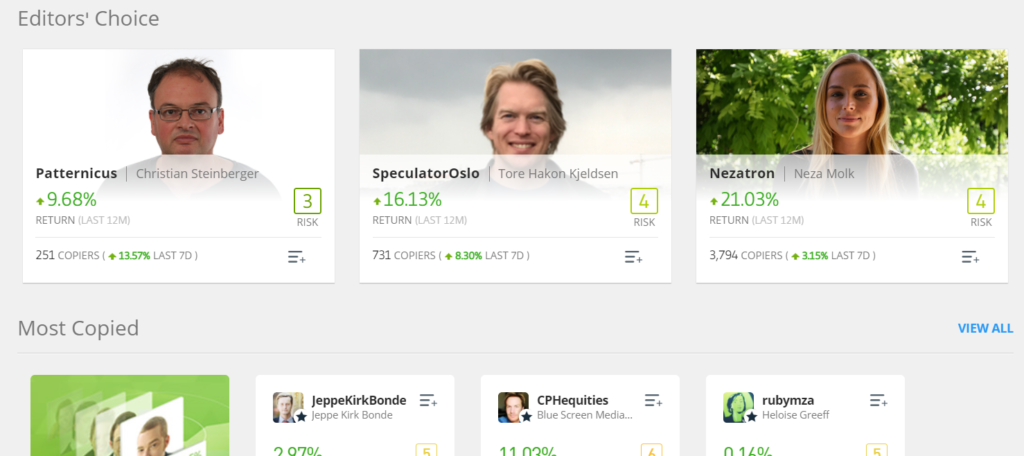

eToro is a multi-asset investment platform that values the power of Social Investing, the company operates in different markets such as stocks, crypto, etc. In terms of Forex, eToro offers a CopyTrader™. The platform made sure to simplify the process of copy trading. Choose the top trader that you’d like to copy, indicate the amount of money you are willing to invest, and start duplicating their positions automatically in real-time and direct proportion.

Darwinex

Another famous copy trading brokerage, Darwinex has a unique community of social copy traders where traders get to buy and sell pre-developed strategies. The whole process of copy trading is very easy due to the technology that Darwinex takes pride in. Even though the platform offers a secure way of copy trading, there is not much else to it. But on the contrary, Darwinex is a broker that gives money managers money through different competitions if their strategies perform well, by the way, one of our strategies, Rush EA (ex Ultima EA) has been running with Darwinex invested capital since 2020. This is an example of how the best money managers can also provide trading ideas for brokerages and institutional clients. The main focus of the brokerage is set on social trading so if you are looking for some additional features, this might not be the best choice for you. On top of that, keep in mind the company has considerably high-performance fees of 20% (without any hidden fees).

Pelican

The only application on our list, Pelican is a platform built for mobile users where traders are able to share their FX strategies, chat and copy all in one place.

How to start copy trading on Pelican:

- Download the application

- Connect to your MetaTrader 4 account

- Select a trader to copy from

- Complete Suitability questions

- Required by FCA

- Enter funds to risk

- And start copying

Having this powerful platform in your pocket, receiving notifications and being able to communicate with the traders in the wide community might be a game-changer for a lot of traders.

Myfxbook

Myfxbook is known to be one of the best live trading performance websites, but what many do not know is that the website also offers different tools specifically designed to enhance traders’ ability to copy trades. MyFxbook is an amazing platform to oversee different trading strategies, some manual and most automated and see how they perform with more financial data available on the website as well.

How to evaluate PAMM and MAM accounts

To better understand which PAMM or MAM account to join, consider evaluating them with the following criteria:

- Growth Rate

- Shows how the particular strategy has been doing since the launch date, this is stat puts into perspective the whole historical trading data of the given strategy.

- Drawdowns

- Helps an investor grasp the idea of how risky the trading strategy is when it performs the worst. Strategies with higher drawdown tend to also be the most profitable, but as an investor, you need to be wary that drawdown above 35% can entail 1/3 a temporary (or permanent) loss on account. Therefore, it is not advised for beginners to invest in strategies above 40% DD unless they understand such risk.

- Community reviews

- If you are looking for more specific details that might not be mentioned in the criteria above, it’s a good idea to check the comment section and see how other traders are liking the strategy or what they don’t. The common mistake is to skip this step but be sure this in some cases checking the community reviews might be more detrimental.

- Strategy Type

- Grid, Momentum, Discretionary

- Asset Category

- Equities, Forex, Crypto, Multi-Asset (all of them mixed together)

- Instruments

- EUR/USD, Bitcoin, Apple stock, S&P500 etc

ZuluTrade

ZuluTrade is an online copy trading platform that allows traders to copy the trades of experienced traders in the forex to achieve a level of automated trading. On top of that, the social aspect of the platform ables trades to leave comments and engage in discussions.

We suggest you take the advantage of ZuluRank calculation which is going to help you with choosing the right signal provider on the platform. This proprietary algorithm rates traders by a number of different factors such as low drawdowns, high profits, age of signal provider, amount of trade activity, etc.

How to avoid scams in Forex Money Management

Like any other financial service, there are numerous scamming PAMM and MAM accounts on the market. To avoid any interaction with those kinds of services we suggest checking different attributes such as backtesting, live trading record, transparency and reviews on third-party websites.

Backtesting

Backtesting is a good method to analyze a Forex trading strategy by using historical data and seeing how it is going to perform in the future. This retrospective approach might work for the majority of the strategies but follow others’ steps and does not make a decision based solely on backtesting results. Take a note, the key to having accurate backtesting results is to use appropriate historical data.

Live Trading Record

To make sure the trading strategy or the broker you are entrusting your funds are legitimate, check the live performance on myfxbook and overview the historic data and see how it performed over the period of time.

Transparency

Make sure to do deep research and find out the names behind the brokerages offering the PAMM or MAM account services. Most of the time the offers and deals might lure you into trusting a scamming broker. But when you look deep into it and detect the red flags, you might save yourself from deep trouble. Keep in mind when you find the people behind the platforms, check their overall experience in the field.

Reviews on third-party websites

Another good way to check the performance of a particular brokerage is to check if any of the popular third-party websites have a review on them. We recommend checking the information on forexpeacearmy.com. The website offers both educational content, reviews and forums where you can observe what the large community of traders are saying about the particular brokerage.

Is Forex Money Management Legal?

Managed accounts are a highly transparent and safe form of investment in the Forex industry. Professional traders with different degrees of expertise are offering different types of account options to investors to suit their needs. The high flexibility of this financial service makes it one of the top choices for beginner traders. Investors can select the trading conditions and adjust the risk according to their trading preferences.

Licensed and Unlicensed Money Managers

Although licensing is a bit of a grey area, it often depends on the platform/broker that either accepts or doesn’t accept a non-licensed money manager. Although an important indication of expertise and trustworthiness, it often requires a higher initial capital and may not always over-perform the benchmark set by S&P500 or Cryptocurrencies and even sometimes non-regulated money managers. Among the most popular money manager license granting bodies are, CySEC (EU), FCA (UK), ASIC (Australia). You should always ask if your money manager is regulated if you find this part of the investment concerning.

Leave a Reply