Wizz-pro tool is now available for all ECS clients

Hi traders,

Elite CurrenSea has developed a newly improved and updated Wizz expert advisor (EA) called “Wizz-Pro”. The Wizz tool explains how traders can find the best targets and when traders can expect price to behave correctively (choppy) or impulsively (quickly)… all of that is done via our Wizz tool.

This article will explain the main differences between the new Wizz-Pro (EA) and the free Wizz version. Don’t forget to download the ecs.START package here to try out the free Wizz version (script).

Main Differences Between Wizz-Pro and free Wizz version

The new Wizz-Pro expert advisor (EA) has multiple advantages when compared to our free Wizz version, which can be downloaded via our free ecs.START package.

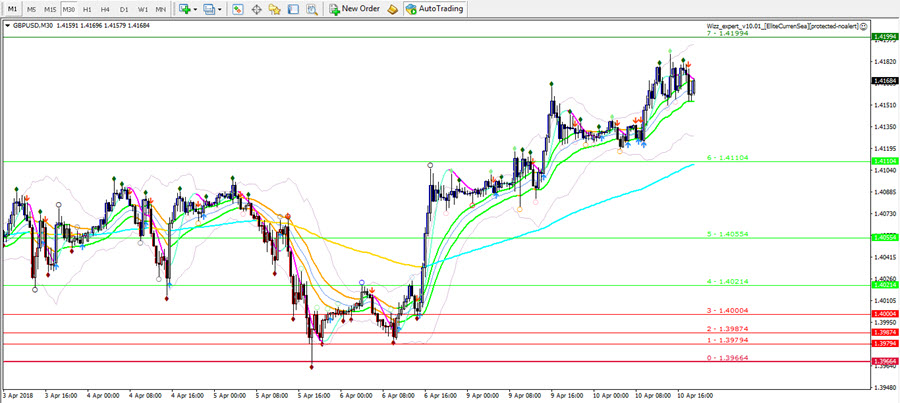

The first main benefit is the simple fact that each horizontal line now shows the Wizz levels. It’s a simple upgrade but a well needed one. The Wizz EA will now show all of the Wizz levels automatically. Plus it will also show the exact price for each of the Wizz levels.

The next benefit is based on multiple time frame analysis. The Wizz levels now change automatically when changing time frames so no need to add the Wizz tool again for a lower or higher time frame. The Wizz levels are placed into 3 groups:

- 30 minute charts and lower

- 1 and 4 hour charts

- Daily charts and higher

The third advantage is the simplicity in spotting the current Wizz levels. The old version used 2 different colors, one for the base and one for all of the other Wizz levels. The Wizz-Pro however provides a wider range of color codes, which helps analyse the charts:

- Level 0: red color

- Level 1 to 3 when unbroken: purple color

- Level 0 to 3 when broken: bright red color

- Level 4 to 9 when unbroken: dark green color

- Level 4 to 9 when broken: bright green color

- As a bonus, all of the colors can be changed to the colors of your choice.

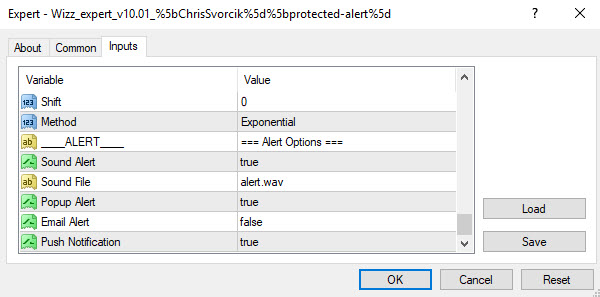

The fourth advantage is the fact that Wizz-Pro also offers alerts when price is bouncing at or breaking through Wizz levels and the key moving averages, which are 21 ema and 144 ema for SWAT trading (the EMAs can be changed as well). Your will never miss an opportunity for a break or bounce.

The alerts are available on MT4 via sound and pop-up or via email. Of course, you can also decide not to use the alerts or decide to use the alerts on the specific Wizz levels or MAs of your choice.

The fifth difference is that the EA and all of the Wizz levels can easily be removed by 1 click, rather than deleting all of the levels one by one. You just need to click on the EA and remove, its as simple as that.

What is the Wizz Tool?

The Wizz tool is based on Fibonacci sequence levels, which we use for understanding the phase of price movement.

Everyone knows the Fibonacci levels, ratios, extensions, and targets. However, we apply the sequence levels themselves, rather than the ratios… We use them for counting pips.

The Wizz tool is a great concept for identifying the wide open spaces, for finding targets and know when to expect corrective or impulsive price action.

Tip 1: let’s start with impulse and correction.

We figured out that price action tends to move correctively or impulsively based on the distance that price has moved. The following is valid for 1 (and 4) charts, measured from current price to top or bottom:

a) Anything between 0 and 144 pips: corrective phase.

b) Between 144 and 377 pips: impulsive phase.

c) Between 377 and 610 pips: could be both impulsive and corrective (depends on pair).

d) More then 610 pips: corrective phase.

Tip 2: wide open spaces.

So where is the wide open space on the chart? Where could you expect price to move fast and quickly to target?

The key zone (for 1&4 hour charts) is when price is in between 144 and 377 pips (for some pairs like GBP/JPY till 610 pips)…

When price is in this area, It is beneficial to keep the trade open and aim for higher targets or use a loose trail stop loss on average… Why? Simply because there is a high chance that price will move far and quick.

Basically, this is where traders can expect quick price action, which is why we call it “wide open space”. Then again, we are more careful in other price areas or phases… here we will aim for closer targets because price is either in a corrective mode or is overstretching itself within the trend.

Tip 3: finding the best targets.

Wizz helps us find better targets and places for stop losses. The idea is key for any trader who wants to understand the chart in more depth.

The Fib sequence levels help us find the best targets because the next Wizz level or the 2nd next Wizz level is often key target. We can also use the Wizz levels for additional information when adding a stop loss or using a trail stop loss.

Effectively it will help us let winners run and cut losses short… this is a key concept in trading but very few explain how to really do this on actual charts.

How to Get a Copy?

To try the free version of Wizz, please download the ecs.START package.

To get a copy of Wizz-Pro, you need to become a member of ecs.SWAT course or ecs.LIVE subscription.

If you already a member of ecs.LIVE or ecs.SWAT – send us an email.

Many green pips,

Mislav and Chris

Leave a Reply