Trade Journal: 6 Wins & 1 Loss For ecs.CAMMACD Method

Dear Traders,

Last week Nenad’s performance in ecs.LIVE with his well known ecs.CAMMACD method was truly excellent with 6 clear wins and one late loss on Friday. The GOLD trade was again the trade of the week with 80 pips win. A trade that is currently winning is also the EUR/USD which we kept open over the weekend.

A total of 15 closed setups were entered in just 5 trading days, where based on both the ecs.SWAT and ecs.CAMMACD trading methods.

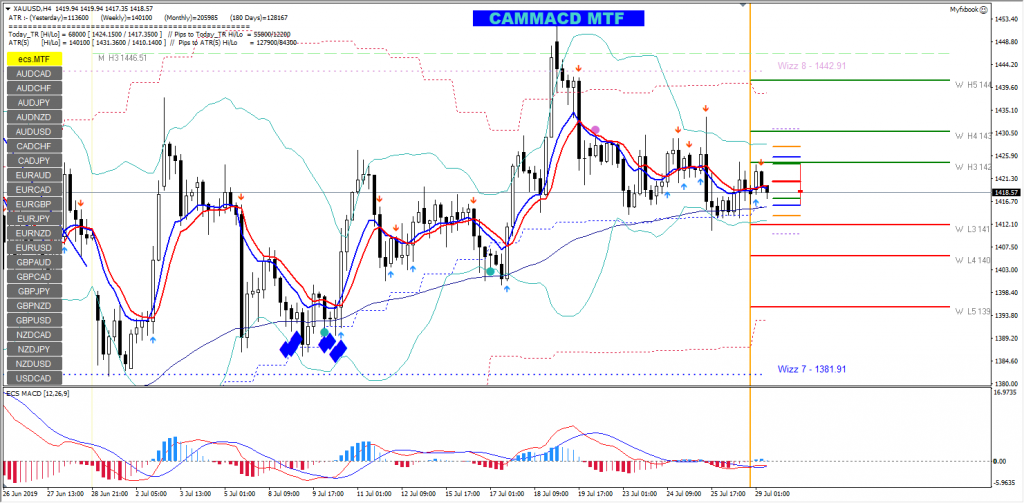

ecs.CAMMACD Gold Trade Made 80 pips

The Gold Trade was the winner of the week – although the GBP/USD also performed excellent with 42 pips from a single setup. However, the GOLD instrument has outperformed all Forex pairs due to its excellent Average True Range (ATR).

It gave us a nice win and boosted the performance of the entire week. The freshly created H4 MTF template scored 0 losses this week. We can see the power of the CAMMACD and Wizz combined in a single template.

Source: ecs.CAMMACD

Quick ecs.CAMARILLA Reminder

Let me remind you again how important the Camarilla levels are for my method. Simply put, the Camarilla indicator provides well respected, simple, and automated levels of support and resistance. Depending on the timeframe we use D- Daily, W- Weekly, M -Monthly and Q- Quarterly camarilla levels. We can easily identify levels of support and resistance and here’s how:

- W L3 – Weekly Camarilla Pivot (Weekly Interim Support)

- W H3 – Weekly Camarilla Pivot (Weekly Interim Resistance)

- W H4 – Weekly Camarilla Pivot (Strong Weekly Resistance)

- D H4 – Daily Camarilla Pivot (Very Strong Daily Resistance)

- D L3 – Daily Camarilla Pivot (Daily Support)

- D L4 – Daily H4 Camarilla (Very Strong Daily Support)

With the settings inside the indicator, yo can also see D L1, D Cm, and D H1 levels. Those are the very first levels of support and resistance, D Cm being the pivot point for the day.

The H3 and L3 are range levels. Price is in range or consolidation when it’s in between the H3 and L3 levels. Traders can use these levels as a break or bounce level. I always try to look at the ecs.MTF when deciding about taking an action.

ecs.SWAT Goes Through Small Draw-Down

After stunning results earlier in July with more than 10 units of reward to risk and wins of up to +300 pips, the small losing streak last week came out of the blue.

The trending markets suddenly caved and reversed, which caused two losses each on the EUR/CAD and GBP/AUD. Both currency pairs experienced larger retracements and consolidations.

The primary problem was the reversal of the Australian Dollar which caused small losses on EUR/AUD (-11 pips) and AUD/USD (-12 pips) and a full loss on the AUD/JPY.

The reality and bitter truth about trading, however, is that these ups and downs are normal and avoidable. As traders, we must count on the fact that both winning and losing streaks occur… the key aspects to keep in mind are these:

- Keep risk management under control

- Keep trading the plan as planned

Traders often get carried away and start to revenge trade in an attempt to win back their losses. Luckily, ecs.SWAT method was already sceptical about the market conditions and purposely lowered the risk on all the setups.

Even though we had a losing week, the total losses of all trades was just -1.11%, which is really one of the lowest draw-downs imaginable. The week before we book +3.5%. Win big, loss small is always the main motto. In the meantime, the GBP/USD short from loss week that we kept open during the weekend closed for +101 pips, nice!

Join ecsLIVE and see our analysis LIVE.

Cheers and safe trading,

Nenad and Chris

Leave a Reply