EUR/USD ? what to expect next for 2018? ?

The EUR/USD is one of the most highly traded currency pairs in the world.

What can we expect to happen to this pair in the foreseeable future? Will the Euro or the Dollar dominate?

This article will explore what factors have been governing the direction of this FX major, and analyze possible scenarios for its 2018 outlook.

A Brief Recap of the Past

Let us begin with a review of what happened to the EUR/USD over the past few years. 2014 was the year when the so called “Euro Crisis” came into full swing. The potential financial collapse of several EU member countries (especially Greece) was constantly present in the media and without any clear solution in sight, the EUR experienced one of its sharpest sell-offs that brought the currency pair within touching distance of parity.

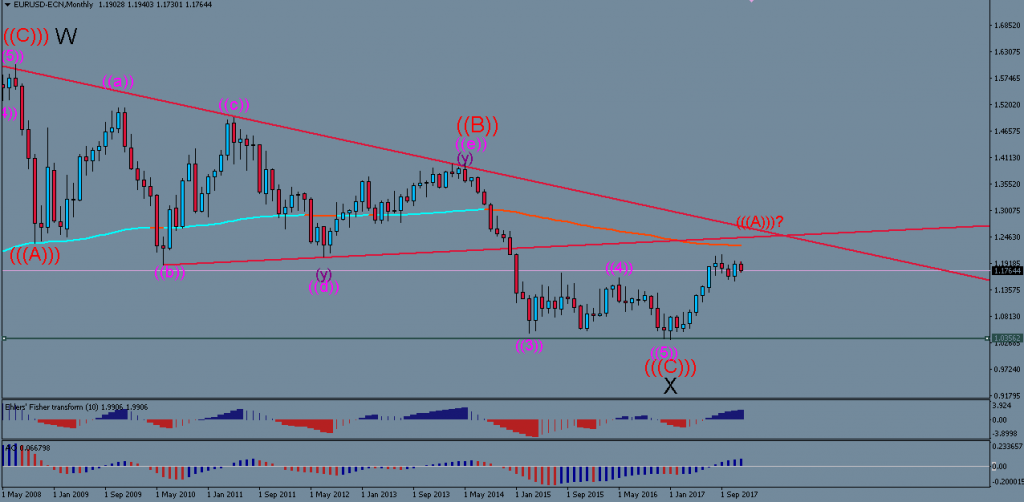

The monthly chart below shows the EUR sell-off reached its maximum momentum during 2014 and early 2015 and continued in a much slower fashion throughout mid 2015 and the whole of 2016.

2015 was also the beginning of the European Central Bank’s QE (Quantitative Easing) program, which was a sure sign that the economic system was in deep trouble. However the worries of over-indebted members states faded significantly into the background after new financial deals were reached with Greece. Even though the dangers of debt default still looms large in many EU countries to this date, the story dropped out of the media highlight and allowed the EUR to begin mild upwards correction attempts. But it was the year of 2017 that marked a significant change in the Euro’s dire outlook.

French Elections marks the turning point…

The socio-political problems that became highlighted during the Greek debt crisis sparked widespread discontent about the idea of the EU as a whole and saw the rise of many ‘Euro-sceptic’ political movements that were calling for a return to fully independent European nations and their original currencies.

A decisive factor in whether or not the anti-EU movements could gain significant momentum was centered around the outcome of the French election of April 2017. The Euro-sceptic candidate Marine Le Pen was neck-and-neck with pro-Euro candidate Emmanuel Macron. A win by Marine Le Pen could have signaled real challenges to the EU’s unity ideology and deepened the cracks between different members state.

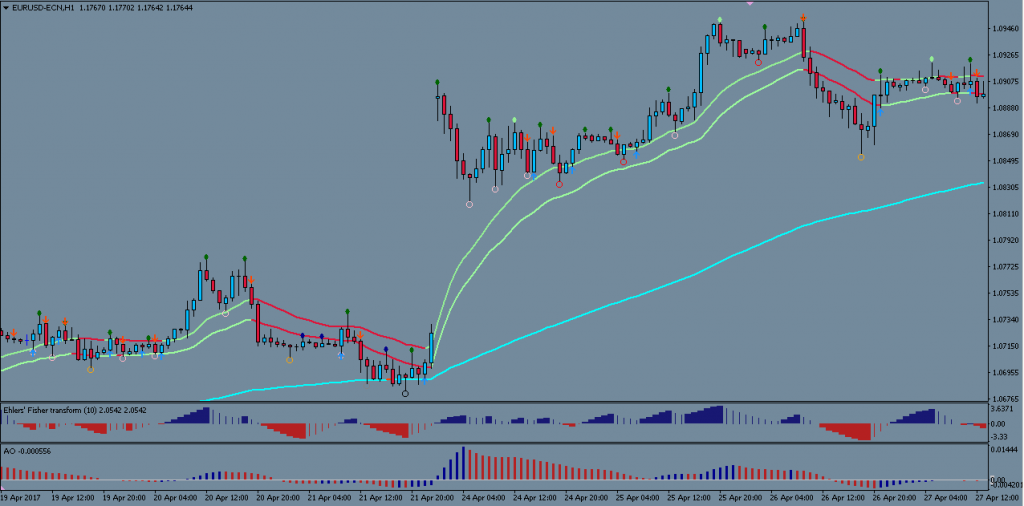

But in the end Macron won the election and committed his policies to European unity. This was nothing short of a liberation for the EUR-sentiment, which created the famous ‘Macron Gap’ in the EUR/USD chart (see image below), which has not been filled ever since and does not look like it is going to get filled in the foreseeable future.

Eurozone Data Establishes 2017 Trend

Macron’s win initiated the uptrend we have seen in the EUR/USD throughout the whole of 2017, but it was the consistently positive Eurozone economic data releases of this year that likely gave the EUR its sustained drive upwards, along side a rather weak USD.

However it is important to bear in mind that all these positive economic reports are happening during times of QE, i.e. the artificial creation of billions of new Euros every month, which one could view as a kind of financial ‘cheating’, which may distort the true picture of the EU’s longer-term economic viability significantly. For the moment though, the data is looking rosy and gives the market reason to be optimistic about the Euro.

2017: The Year of Monetary Policy Changes

2017 was no doubt the year of big changes in the policy of many central banks, which created major trends across many currency pairs.

It has also been an important driver in EUR/USD flows. Interestingly enough the ECB has been a lot more dovish in their stance compared to the US Fed. While the Fed has been hiking interest rates and taken steps to unwind some of the effects that QE has had on its balance sheet, the ECB has been consistently cautious about making any changes to their interest rate policy and decided only in October to reduce its QE program somewhat.

So although the Fed is no doubt the more hawkish central bank of the two, we have only very recently (October/November 2017) seen some hesitation in the pro-EUR sentiment and a stalling of its bullish trend.

Where will the EUR/USD head next? Will the uptrend continue or will we see a reversal? Let’s take a closer look.

EUR/USD Outlook: Combining Technicals and Fundamentals

I like to combine technical and fundamental analysis in my trading approach because I believe it provides a more complete and cross-verified picture. I liken it to the difference between one-eyed and two-eyed vision; two-eyed vision provides a lot more depth and perspective to an image and navigating is made tremendously easier.

Elliot Wave Structure Remains Bullish

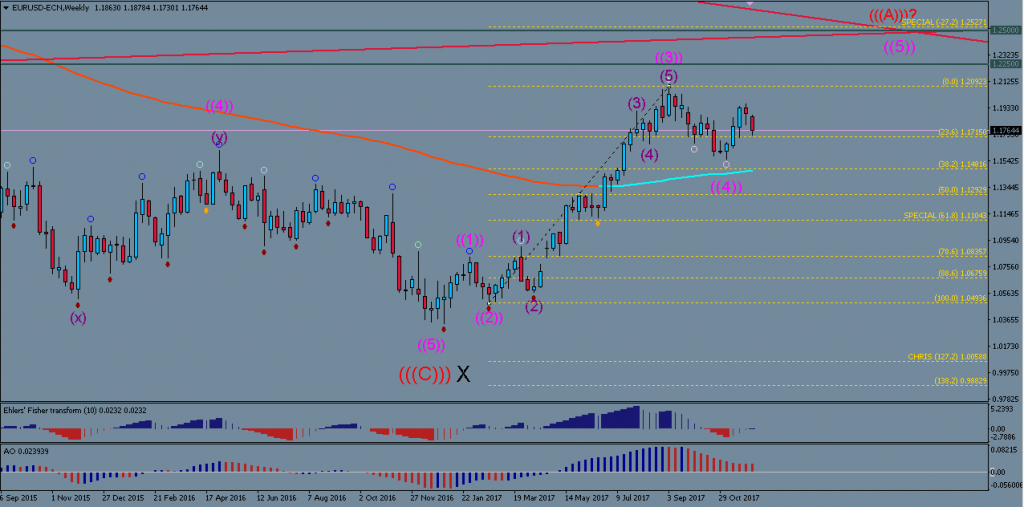

The EUR/USD weekly chart (below) shows us a very clear impulsive Elliot wave structure that forms the trend of 2017. Price looks to have completed 4 of the 5 waves that make up an impulsive price move. Accordingly, we should expect one further bullish push (i.e. pink Wave 5) before a more complex downward correction may occur.

I can see two key areas that could mark the culmination of Wave 5 of the EUR/USD uptrend.

The most significant point of confluence (POC) is around 1.25, which is a convergence point of two major resistance trend lines, the -27.2% Fibonacci target of Pink Wave 3, and the psychological resistance which the round number (1.25) creates. These combine to form a quite formidable barrier which is highly unlikely to be broken during the first approach.

The secondary POC lies at 1.2250, which is formed by the powerful long-term moving average of the monthly chart (see first image at the top), and the psychological round level of 1.2250.

So from a technical point of view, we should see a continuation upwards to these levels during the earlier part of 2018, albeit the bullish move is likely going to be less impulsive and more erratic compared to the price-action of 2017.

Fundamentals Reveal a Mixed Picture

From a fundamental point of view, the technical prognosis could correlate with monetary policy developments that are scheduled for the Fed and ECB. The ECB has made it clear that it will not raise interests until at least the end of 2018, and they are willing to continue with QE for as long as necessary. The Fed on the other hand is considering raising interest rates up to 3 times during 2018 (also bear in mind however that the Fed rate hike for December 2017 is already priced into the market. So this particular hike may not give a significant lift to the USD).

While this outlook on its own should indicate obvious USD bullishness and EUR bearishness, the USD could be weighed down by my more negative economic reports as the Fed begins to implement its tighter monetary policy, which is likely to put strain on the US economic recovery.

On the other hand, the ECB’s more accommodating stance could continue to produce more positive data releases throughout 2018, which may off-set the central bank’s dovishness relative to the Fed.

This mixed fundamental picture could therefore correlate well with the expected technical price-action I outlined earlier, i.e. that it might drive the EUR a bit higher yet but in a less clear and less dominant manner.

The first Fed rate hike of 2018 is expected to come in March and the second one in June – August, which could be important turning points in the EUR/USD trend.

After the EUR/USD will have peaked, a prolonged corrective phase should set in which may see price range between 1.25 – 1.15 for significant amounts of time.

All the best along your trading journey…

Hubert

Follow Hubert on Twitter

Leave a Reply