The Best Target in the Forex Market: the -61.8% Fibonacci Level

Hi Trader,

I realize that not every trader is a fan of using Fibonacci levels. But after reading this blog article, I think that you might join us in saying this:

The best target for Forex and financial trading is the -61.8% Fib.

These levels are literally worth gold and I absolutely love using these targets. I believe that you will see their value after reading this article and especially once you apply it to real live charts.

Make sure to check out the bottom of this article where we dedicated a special series on the Fibonacci tool.

WHAT ARE FIBONACCI TARGETS & HOW TO ADD THEM ON CHART?

The Fibonacci tool (also called “Fib”) is fantastic because it offers both precise entry and exit levels. First, traders need to place the Fib on a swing high and swing low. Second, traders can establish where the discount levels are (Fibonacci retracement) and the corresponding Fibonacci targets.

The most used targets are these 2 levels:

- -0.272

- -0.618

After there are some lesser used targets like:

- -1.000

- -1.272

- -1.618

- -2.618

Check out this video about adding the Fibonacci tool to your chart.

WHY ARE FIBONACCI LEVELS SO VALUABLE?

These Fibonacci levels and targets are priceless for 1 very simple reason:

The market RESPECTS these levels very precisely and accurately!

This is NOT a pattern that has only occurred this month or year… this is something that is TIMELESS and is a pattern that is repeated over decades.

Fibonacci levels are true ‘signals’ and have nothing to do with ‘noise’.

The quality of my trades and analysis has seriously improved ever since I started using negative Fibonacci levels (both retracement and targets).

You can achieve the same improvement in YOUR trading skills by using Fibonacci.

TIP: Check out our special video series on Fibonacci.

WHY ARE FIBONACCI TARGETS ‘RESPECTED’?

There is nothing magical or mystical about the fact that Fibonacci targets work so well, unless you see it for the very first time.

Price naturally makes ups and downs. These trend continuation spots are at Fibonacci levels because of the trader’s and the market’s psychology.

1) Nobody wants to buy or sell when price has moved into 1 direction for a decent while without a retracement.

That is why Fibonacci retracement levels will always work. Discounts never fail to create interest.

2) Obviously when the trade starts to go our way, then we are looking for good target spots…

Here too Fibonacci targets help optimize the profits.

All patterns are vulnerable to change and so are the Fibonacci levels. But as long as traders seek discounts within trends, I see no reason why this pattern will not be valid. It makes sense to benefit from the advantage it provides. By trading with one of our supported brokers you can get a hold of benefiting from Fibonacci trading in telegram channel for free.

WHICH FIB TARGETS TO CHOOSE?

Generally speaking I am the biggest fan of the -61.8% target as it most often used in the market. There are exceptions when using other Fib targets makes more sense.

1) USE -27.2% TARGET –> When price retraces back to the 78.6% or the 88.6% Fibonacci level

In this case price has made a DEEP retracement and it therefore has less momentum than when it retraces to a shallower Fib. The lack of momentum could be a warning sign that price might be unable to hit a bigger target like the -61.8. In these cases I rather take profit at the -27.2% target.

2) USE -61.8% TARGET –> In case of the 23.6%, 38.2%, 50%, and the 61.8% Fibonacci levels

In these scenarios price has not retraced deeply and has sufficient momentum remaining to expect price to go to the normal target.

3) VARIABLE TARGET –> In case price is at the beginning of a turnaround OR correction

a) In these scenarios I like to mix up my targets. If a higher time frame is showing a big trend then I will like to aim for the -161.8% or even -261.8%.

b) If the turnaround is only expected to be a correction then I prefer to aim for a lower target like -27.2% or the -61.8%.

4) USE -161.8% TARGET –> In case price is in the middle of the trend

When I think that price has just started to trend relatively recently and a big trend is pushing price on the daily chart, then I aim for a better target and more pips by taking profit at the -161.8% Fib for some bonus profit.

5) USE -27.2% TARGET –> In case price is in the end of the trend

When the trend is about to end, then price typically runs out of momentum and energy and divergence becomes clearly visible as well.

Keeping the targets flexible and adjusting them for every situation is essential to let winners run when possible and take profits at reasonable distances when a big run is not likely.

HOW TO TRADE WITH THESE TARGETS

Obviously we can optimize the target depending on circumstances (as mentioned above). But as a rule of thumb, the -61.8% Fibonacci level is a sturdy and reliable target. You can use the Fibonacci targets for 2 things:

1) Exit at the Fibonacci target(s)

Here you have the luxury of finding one of the best spots to exit a trade and thereby optimize the profit as much as you can. Optimizing profits is essential for booking sufficient reward.

2) Enter counter trend trade at the Fibonacci target(s)

Although riskier it is occasionally profitable to look for big bounces at these targets because many traders exit at this spot, which creates opportunity for a counter trend trade.

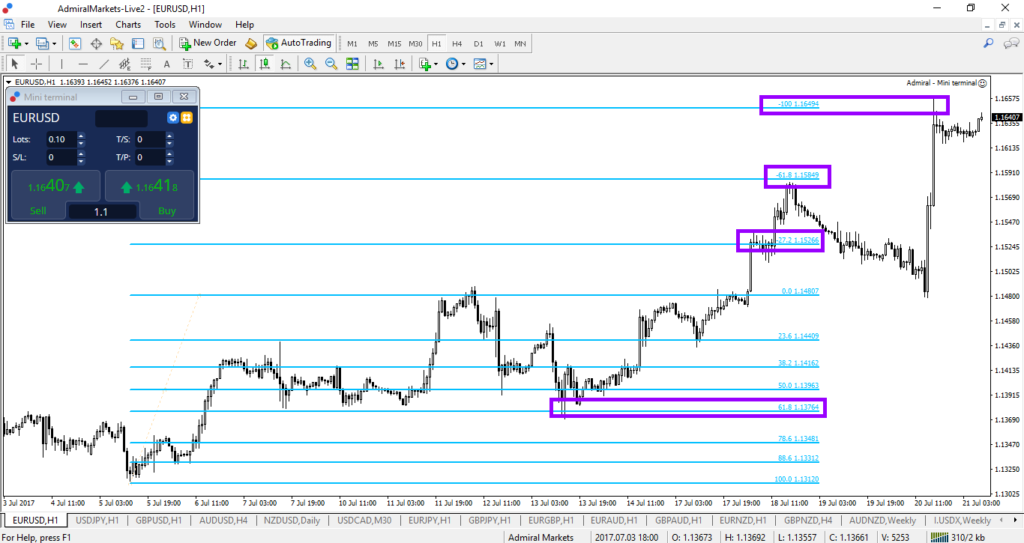

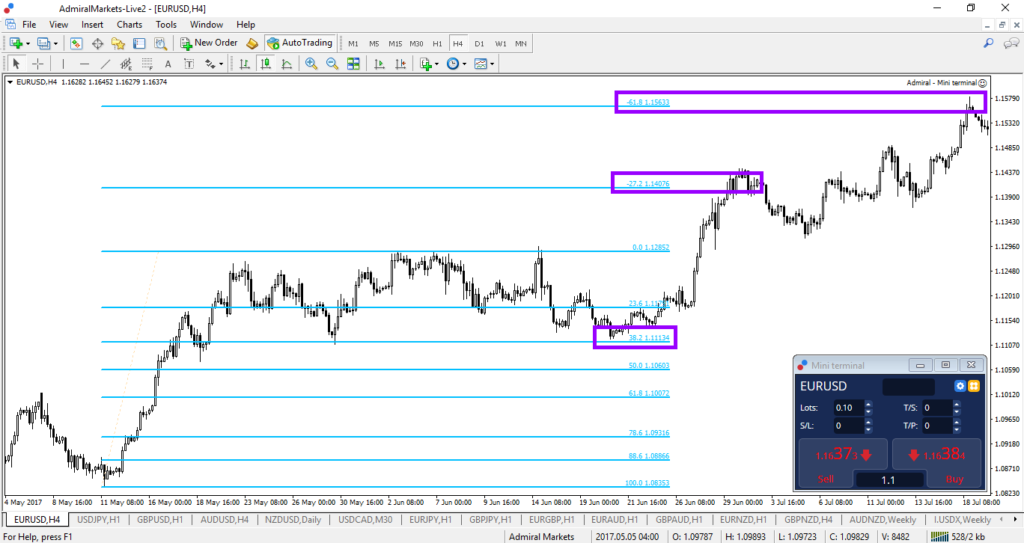

The Fibonacci levels work on all time frames, ranging from a weekly chart to daily to 4 hour to 1 hour. Here below is an example of how price fell to targets, first stopping at the -27.2% target before ultimately making a massive bounce at the -61.8% to the pip.

Make sure to check ecs.LIVE to see the Fibonacci trading in action.

Obviously, we can give example after example but it is more important that you try out the Fibonacci tool and targets yourself with a demo account.

HOW DO I CONTINUE WITH FIBS?

Our dedication to Fibs knows no border 🙂 The Fibonacci indicator manages to impress us (Nenad & Chris) on a daily basis even after using it 2+ decades. There are a couple of ways you can continue to learn about applying Fibonacci to your trading.

- Check out our dedicated series of articles (see below)

- Download our eBooks & tools

Here is the full list of Fibonacci articles we have written:

- Part 1 Series on Trading Fibonacci in Forex: Learn the Basics. Read now.

- Part 2 Series on Trading Fibonacci in Forex: Fibonacci Retracements, the World of Discounts. Read now.

- Part 3 Series on Trading Fibonacci in Forex: Fibonacci Targets, Unique and Amazing Levels. Read now.

- Part 4 Series on Trading Fibonacci in Forex: Why and When do Fibonacci Levels Work? Read now.

- Part 5 Series on Trading Fibonacci in Forex: Multi Dynamic Roles of Fibonacci. Read now.

- Part 6 Series on Trading Fibonacci in Forex: Fibonacci Tool as a Trigger and Entry. Read now.

- Part 7 Series on Trading Fibonacci in Forex: Fibonacci Trading Using a Fixed Method. Read now.

- Part 8 Series on Trading Fibonacci in Forex: Fibonacci and AO. Read now.

- Part 9 Series on Trading Fibonacci in Forex: Fibonacci Swings with the Fractal Indicator. Read now.

- Part 10 Series on Trading Fibonacci in Forex: Fibonacci Market Structure and Candles. Read now.

- Part 11 Series on Trading Fibonacci in Forex: Fibonacci Invalidation and Stop Losses. Read now.

- Part 12 Series on Trading Fibonacci in Forex: Chart Confluence Boosts Fibonacci Trading. Read now.

- Part 13 Series on Trading Fibonacci in Forex: Fibonacci Sequence Levels in Pip Value. Read now.

- Part 14 Series on Trading Fibonacci in Forex: The Mental Bounce or Break Game with Fibonacci. Read now.

- Part 15 Series on Trading Fibonacci in Forex: Fibonacci and Waves, a Wonderful Duo. Read now.

- Part 16 Series on Trading Fibonacci in Forex: Fibonacci and Multi Time Frames. Read now.

Thanks, Chris – Orca FX

@elitecurrensea