Where to Place a Stop Loss

Dear Traders,

Forex trading is not just about winning trades… To stay on track, you need to accept losses too. This is main but also the most difficult lesson for traders to learn.

The biggest disservice you might do to yourself is that you let your emotions overwhelm you and you start losing all the profits you might have earned for the previous day or month.

This article will explain how trading psychology together with correct stop loss placement accounts for at least half of the success – if not more.

Learn how to Fish

Traders need to know one thing: I am teaching you how to fish, but ultimately, you need to catch yourself. Not all my accounts are in profits, but I manage to stay on track as I try to follow my trading plan religiously.

However, overall, as long as we can identify our mistakes, we should be able to rely on the trading plan and our knowledge that will make account growth steady even after some errors that we have made.

So what are we supposed to do if we want to maintain a consistent profitable track record in the Forex market?

Source: CAMMACD Myfxbook

Source: CAMMACD Myfxbook

Let’s discuss my 3 main tips how to implement the stop loss with consistency and precision before actually talking how to place the stop loss.

-

Capital Preservation/Risk Management

You always need to manage your risk on every single trade. The moment you lose your control over your trades, you allow emotion to creep in, and before you know it, you’re in a downward spiral of hope trading. Capital preservation should be a priority. What does that mean?

The money in your account, your capital, is your lifeblood as a trader. Without it, you obviously cannot trade, and the more of it you lose, the harder it is to recover.

Risk management and capital preservation are two sides of the same coin.

-

Steady Discipline

Trading is a discipline. You are effectively trading the risk. You need to understand it else your account might get depleted as soon as you start trading.

As long as you are a disciplined enough to stick to your trading strategy and not be emotionally attached (revenge video) to your losses, you tend to make more winning trades than losing trades and nett a profit.

-

Mastery

Master your trading method. Improve it, but stick to rules you devised. You have to place traps, which make money and pips for your account. Once the market conditions match your rules, you need to place your trade along with an SL, without fear holding you back.

Stop Loss Placement

Now it’s time to speak about the stops, which should be placed to limit your losses. There are a couple of ways how to place your stops. Before we delve into the subject of stop-loss placement, we need to understand everything we talked about in the paragraphs above.

The first is risk management. Risk is always fixed, while SL is a dynamic thing. Stop loss is usually placed below the last apparent swing low or pivot point. However, traders always need to add the spread plus a few pips below that most apparent level. Not each platform is the same and not each broker use the same time zone for their servers. That’s why we add a buffer.

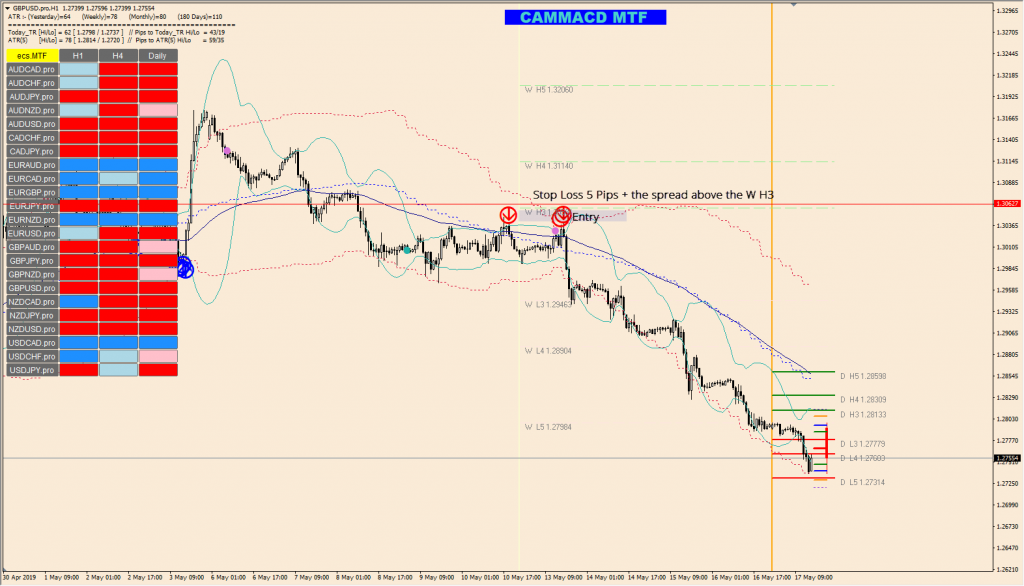

Source: CAMMACD GBP/USD

Source: CAMMACD GBP/USD

I already mentioned that Stop Loss is a dynamic thing. Moreover, the risk is fixed. It means that sometimes the stop loss is 20, 40, 50 pips depending on market conditions. Placing the stop loss based on market conditions is called a “technical stop”.

Technical Stop

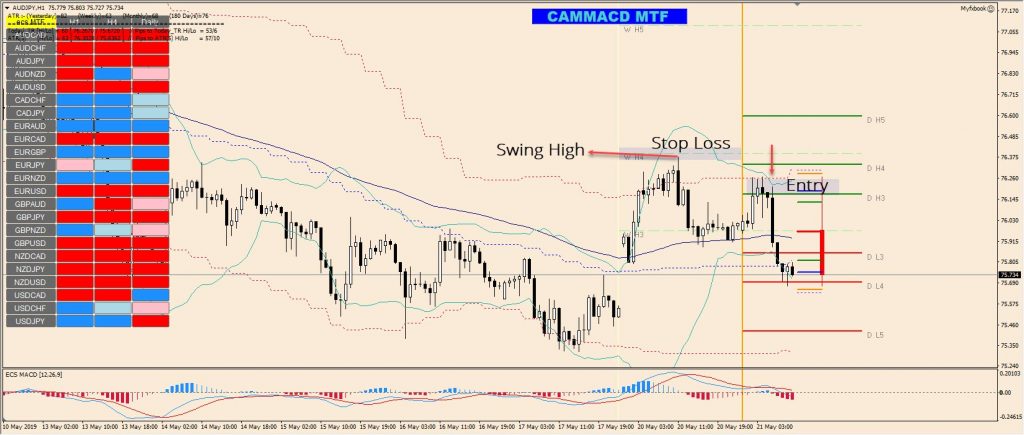

Technical stop is usually placed below the most recent swing low for long trades or below most recent swing high for short trades. If a pivot point is close by, then we use the confluence of a pivot point along with the most recent swing high/low depending on the direction of a trade. In the example below, I’d place a technical stop above the W H4 camarilla pivot as we see the confluence of a recent swing high and a pivot point.

Source: CAMMACD.MTF

Source: CAMMACD.MTF

ATR Stop

Another example is using the ATR stop. ATR stop is based on the ATR indicator. We usually use 70 % of the total ATR for last 5 days. For example, ATR(5) on the GBP/NZD is 120. The stop would be 120-30%=84.

Time Stop

The time stop is another technique traders use. Time stops are stops you set based on a predetermined time in a trade. It could be a predetermined set of time variables (h1 charts, h4 charts, hours, weeks etc) or trading during specific trading sessions or the market open. Anything that has to deal with the time limit.

Equity Risk

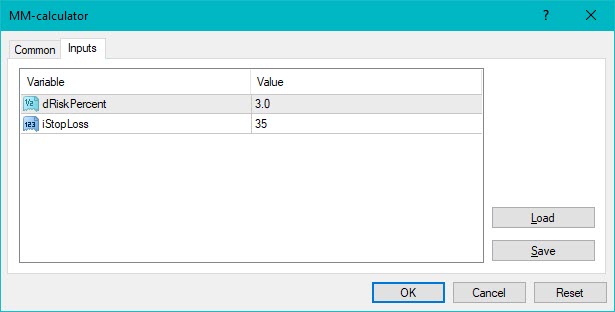

Usual risk for a trade goes from 0.5 % – 3 % per setup. That’s when we apply the following money management script.

Source: MM-Calculator

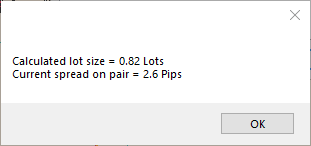

Let’s say that the SL for the above GBP/USD trade is 35 pips and we want to risk 3 %. Based on the size of the account ( 11082 USD), we can determine that the total risk is 0.82 lots for this particular trade.

Source: MM-Calculator

Another way to place stop loss is the so-called “equity risk”. For example, when establishing your position, place a stop order within a maximum of 3 % loss of the total equity in your account. A lower level of risk is always advised, especially for less experienced traders. However, I always advise placing “technical stop” due to market fluctuations.

As with every business, accepting a stop loss is a must. Placing stop losses is also a must. Not placing a stop is a huge trap, which happens because the trader does not want to accept his loss. Why? He’s so confident in his ability to predict the market that he feels there no need for a stop. That’s the biggest mistake you can make.

Simply said, always use either “technical”, “atr”, “time” and/or “equity” stop and avoid using a fixed pip size because these numbers are not in sync with the chart and market movement.

Cheers and safe trading,

Nenad

Good day Nenad, thank you for a great article and for all the knowledge you guys at ECS are willing to share with us! My trading has improved drastically with your help! I was wondering regarding sl’s, if the market should move against your position for whatever reason (not being a pullback) would you consider closing your trade earlier than price hitting your sl to save more? If so, do you make use of fib levels, ema/sma or trendlines and at what stage would you consider this move? Thanks again for all your help!