Three Investment Maxims for the Recession Times

When times are uncertain, it can be difficult to maintain focus on your long-term investment goals. For some people, a mantra or some words of wisdom can help. If you’re not up for writing your own, borrow one of my favorites. Here are top three:

“Compound interest is the eighth wonder of the world. He who understands it, earns it. He who doesn’t, pays it.” – Albert Einstein Click To Tweet

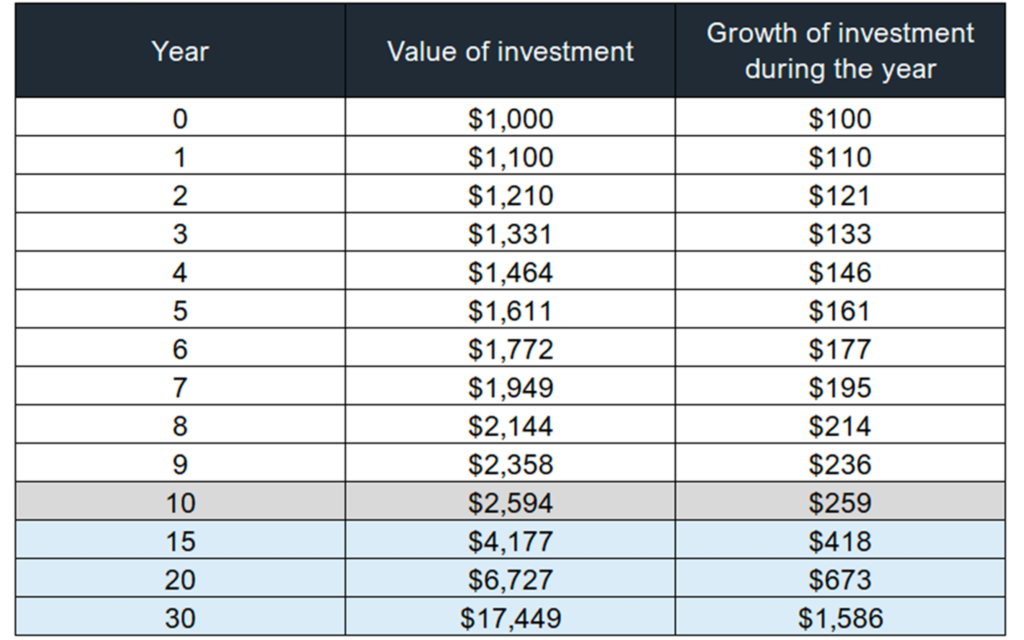

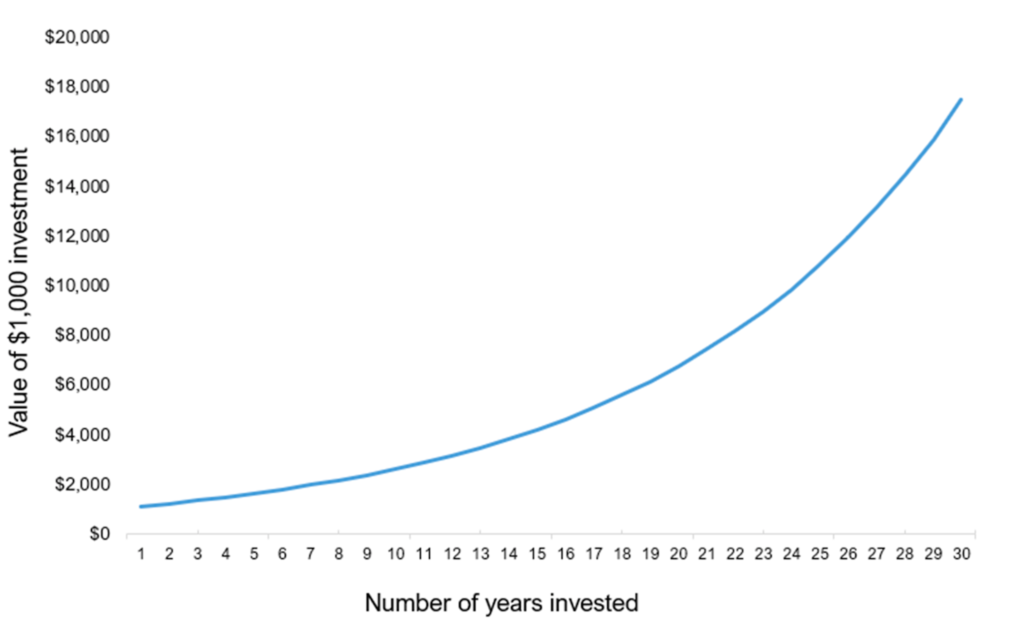

Your investment returns can give a big boost to your personal balance sheet over time if you steadily grow them year after year. For example, if you start with $1,000 and grow that by 10% in a year, you’ll have $1,100 – a $100 increase in the value of your investment.

But if you then earn 10% the next year on that $1,100, your investment grows by $110. That extra $10 might not seem like much of a change when you’re getting started, but as time goes on, you’ll see your portfolio growth really adds up.

You’re unlikely to earn the same percentage return on your investments every year. But as long as you’re earning a positive return on average, your overall gains will expand over time.

So it makes sense to take a long-term view on investing and build a core investment portfolio that you think will go up over time. Then, add as much money as you can to it each month. And if you’ve got debt, pay it off as fast as you can too.

“Far more money has been lost by investors preparing for corrections than has been lost in the corrections themselves.” – Peter Lynch Click To Tweet

Investing icon Peter Lynch’s Magellan Fund saw some serious growth, averaging 29.2% a year between 1977 and 1990. Not too shabby. And although the US stock market trended up over that time, it had its fair share of brutal corrections too – including a 35% drop in 1987.

But Lynch understood he couldn’t time the market by trying to predict what would happen to interest rates or the economy. He wrote in his book, Beat The Street, about only selling an investment if its “fundamentals deteriorate, not because the sky is falling”.

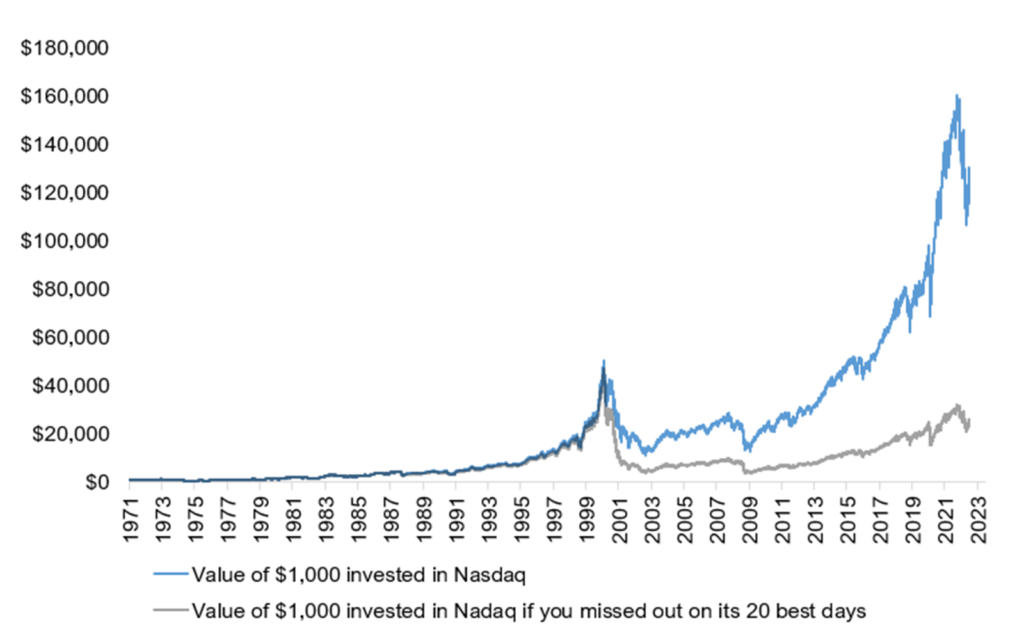

The data backs up Lynch’s thoughts on market timing – if you had invested $1,000 in the Nasdaq in 1971, that investment would have grown to $130,000 today. However, if you had missed the index’s 20 best-performing days, you would only have $26,000. What’s even more interesting is that most of the Nasdaq’s best-performing days happened during major bear markets, not bull markets.

If you sell your investment believing that the market is crashing, you could end up having to buy back in at a higher price. And, if the market crashes again, you would be caught two steps behind. If you have conviction in your investments, it is probably better to use market drops to add to those investments, rather than selling them.

“How many millionaires do you know who have become wealthy by investing in savings accounts? I rest my case.” – Robert G. Allen Click To Tweet

Although it is important to have money saved up for important future expenses, too much cash on hand can lead to what investment author Robert G. Allen calls “cash drag.”

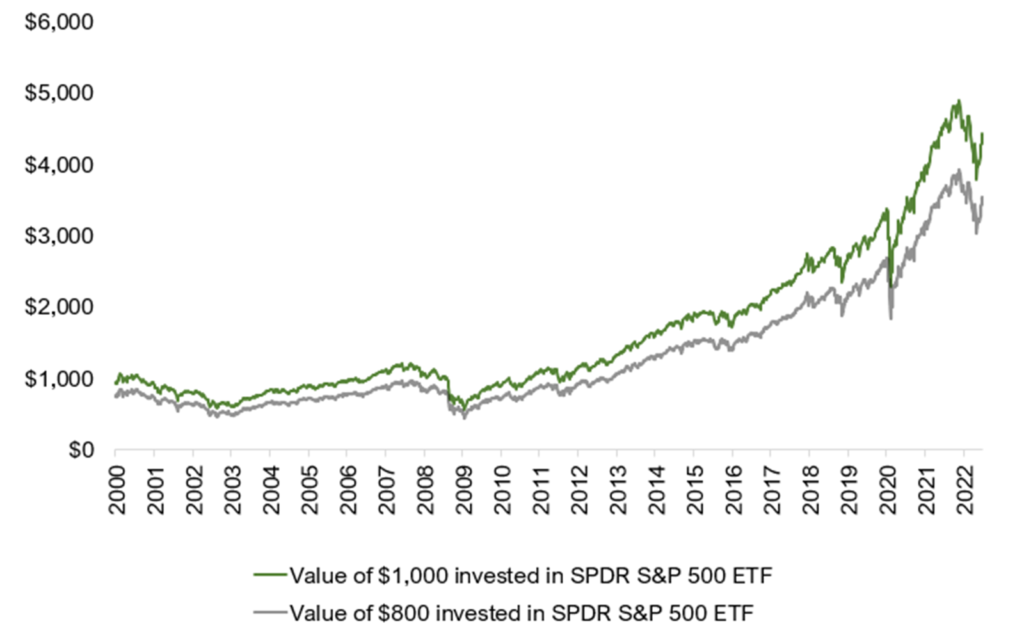

If you had invested $1,000 in the S&P 500 in the year 2000, it would be worth $4,432 today. However, if you had kept 20% of that money in your savings account and invested just $800 of it in the S&P, your $800 investment would be worth $3,546 – or 20% less.

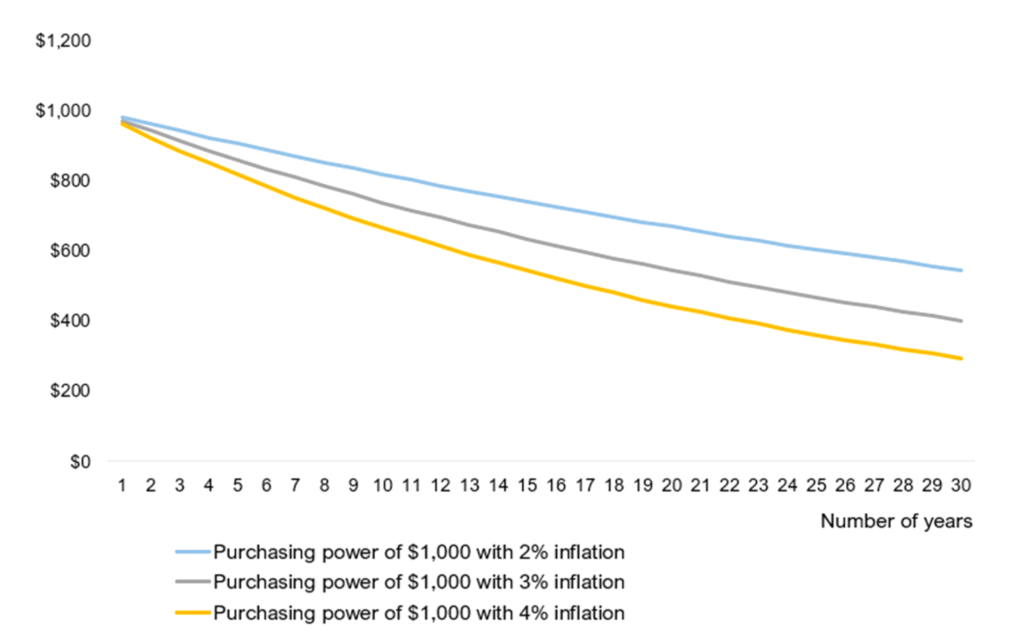

There’s another problem with holding too much cash in the long run: inflation. Even if the Fed gets back to its historical target of 2% inflation per year, that’s still a big knock on your purchasing power over the next 10, 20, or 30 years. So like it or not, you need to take investment risks to keep up with inflation, not just to outpace it in the long run.

So what is the unifying logic behind these distinct philosophies?

If you’re hoping to retire in style one day, keep these quotes about building wealth over the long term in mind.

The great thing about investing for the long term is that the recipe for success is relatively simple: pick a good mix of investments that you think will appreciate over time, and buy into those investments consistently – for example, once a month. Then tune out the short-term market noise, and you’re likely to do just fine.

Leave a Reply