MT4 vs TradingView – platform comparison

Learning how to trade is related to many challenges. There’s so much to learn. Including how to use a trading platform, how to read and analyze charts, how to make a sense of market news, which strategies to use, how to manage your emotions and much more.

Choosing the right platform can save you from a lot of unnecessary headaches, shorten your market research time and increase your profits. There are various trading platforms in the market to choose from. And each software comes with certain benefits and shortcomings. In today’s comparison, we are talking about MetaTrader 4 and TradingView in detail to make choosing easier for you.

MetaTrader 4

MetaTrader 4 (MT4) was released in 2005 by a Russian software company MetaQuotes Corp. From 2007 to 2010 many brokerage firms started offering the platform to their clients. The software has quickly become very popular and you can hardly find a boker that doesn’t offer access to MT4 today. The platform is generally used to trade Forex pairs. In order to use the software, you need to be registered with a broker. Most brokers offer free MetaTrader 4 Demo accounts.

The platform has successfully withstood the test of time. In order to find out the reasons behind the amazing performance of the software, let’s take a look at its strengths and weaknesses that are still relative today.

| Pros | Cons |

| Free to use | Generally traders have access to trading less asset classes than MT5, TradingView, cTrader, etc. |

| Very stable, fast and able to work with high volumes | Not much has changed in terms of interface since its creation |

| Rarely occurs technical errors when live trading | Offers less time frames than most modern platforms. Including TradingView |

| Offers automated trading tools and there are vast amounts of algorithms accessible in the market. | Offers less indicators than most modern platforms. Including TradingView |

| Provides good analytical tools and indicators. In addition, traders can develop their own technical indicators. | |

| Simple and intuitive design |

MetaTrader 4 is very powerful and reliable. For this very reason it’s still relevant in modern trading. The design is simplistic, but outdated. Not much has changed in terms of looks since 2005. Most novice traders love the platform as it’s so easy to use.

The platform was created a long time ago and has gained popularity very quickly. As a result, you can find a lot of algorithms developed by traders on the market. Some of the algorithms are free to use, and some developers sell their creations. The MetaTrader algorithms are called Expert Advisors and are widely used to automate trading. Be noted that not all of the EAs that you can buy are working properly. There are many scammers in the market and you should always do research before investing in EAs. What’s more, you can learn to code and develop EAs yourself based on your own ideas.

Traders can download the mobile version of the trading platform, both for iPhones/iPods and Android phones. The mobile app comes with the full set of trading orders and various analytical and technical indicators.

Recommended MT4 Forex Brokers

Now let’s check some of the best Forex and CFD brokers that support MetaTrader 4.We picked AvaTrade and XM. Both brokers offer a vast number of tradable assets, are well regulated and highly reputable.

AvaTrade

AvaTrade is a Forex and CFD broker founded in 2006. The broker provides financial services around the globe. The company is based in Dublin, Ireland, but has global offices in various countries.

AvaTrade offers access to trading various asset classes, including currency pairs, CFDs on Stocks, commodities, and cryptocurrencies. The broker currently provides financial services to more than 400 thousand registered clients globally. Trading accounts are tailored to both professional and retail traders. Trading fees are low and account currencies are USD, GBP, EUR, and ZAR.

Minimum initial deposit required to open a live trading account with AvaTrade is 100 USD. Maximum available leverage is 400:1. AvaTrade is well regulated in multiple countries, including: Australia, BVI, Ireland, Israel, Japan, South Africa, and UAE.

In addition to MetaTrader 4, AvaTrade offers the following popular platforms to its clients: MetaTrader 5, DupliTrade, and ZuluTrade. It should be mentioned that mobile trading platforms and a web trading terminal are also available.

Get started wit AvaTrade

XM

XM is a multi asset broker operating globally. The broker provides financial services to one of the largest customer bases in the world. The broker has more than 10 million registered users from 190 countries. The broker was established in 2009 and is based in Cyprus. The broker offers not only CFDs on shares, indices, commodities and currency pairs, but also stocks for long term investing.

XM offers outstanding customer service available 24/7. There are multiple account types to choose from. As a result, all trader types will find the most suitable account type with this broker. XM is a well regulated broker in various jurisdictions including: in Australia, Belize, Cyprus, UAE, and UK.

Minimum initial deposit required to start trading with XM is as little as 5 USD. Available leverage for global traders is up to 1000:1.

In addition to MetaTrader 4 (MT4), the broker also offers MetaTrader 5 (MT5). The MT4 is made for trading currency pairs, while the MT5 is a multi-asset platform.

Get started with XM

TradingView

TradingView was founded in 2011 and mostly is a charting platform. The company has created a large social network of traders that use the platform to spot investing opportunities. The platform offers access to charts of various assets. Including: Currencies, Crypto currencies, Stocks, Bonds, Indices and Futures.

TradingView makes money in various ways. The main source of income comes from its monthly subscriptions, ads running on its platform and licensing fees.

| Pros | Cons |

| Free to use, unless you need more tools to enhance your trading | No direct access to the financial markets |

| Large social network | Less stable than MetaTrader 4 |

| No need to register | |

| Large variety of assets are accessible | |

| Modern and intuitive interface. | |

| Large number of indicators and timeframes | |

| Is under constant development |

If you have ever imagined yourself trading from your yacht, parting with your friends and making millions at the same time, you’re not alone. Most of us start trading with unrealistic expectations. In reality, trading can get pretty lonely. Especially when you are a retail trader placing orders from your bedroom. Access to a large network of like minded people is essential for many traders. TradingView social network is used by more than 30 million people globally. Traders can share their trades, financial analysis and develop trading communities.

The well established social trading network gives traders the ability to broadcast their trading, grow their following and make more money by selling trading signals.

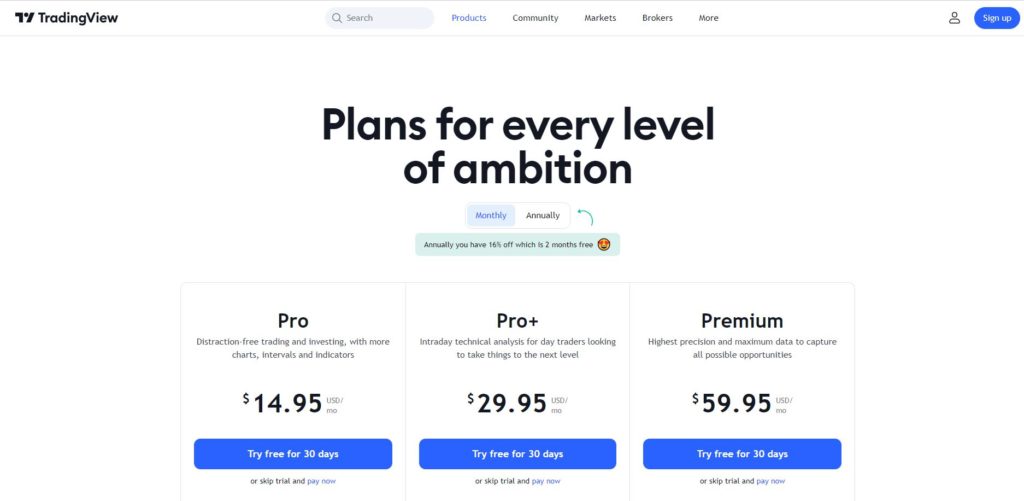

There’s no need to register in order to install and run the TradingView software on your computer. In addition, you can get the mobile version of the platform on Google Play and App Store. What’s more, TradingView is completely free of charge to use. However, in case you need an ad-free experience, more charts for a single layout and more indicators per chart, you can go for Pro, Pro+ or Premium account. But for most traders, the Basic software version will work fine.

TradingView has a much better looking interface than MetaTrader 4. There should be nothing surprising about this fact as the platform is much younger, created in 2011 and is under constant development. Whereas, MT4 looks frozen in time.

Recommended TradingView Forex Broker

TradingView is much less popular than MetaTrader 4. However, there are many great brokers that also support the TradingView platform.

Pepperstone

Pepperstone is an Australian broker founded in 2010. The broker provides financial services to 300,000 traders worldwide. Available trading instruments are currency pairs, Cryptocurrencies, shares, ETFs, Indices, Commodities, and Currency Indices. The broker has low trading fees and both commission free and spread (markup) free accounts are available to meet the needs of different traders. There are no minimum initial deposit requirements and maximum available leverage is 500:1. The broker offers more than 1000 tradable instruments out of which 62 are currency pairs.

Pepperstone is a tightly regulated broker globally. Regulator countries include: Australia, Bahamas, Cyprus, Germany, Kenya, UAE, and UK. In addition to TradingView, the broker also offers access to MetaTrader 4, MetaTrader 5, and cTrader.

Get started with Pepperstone

Comparing mobile apps

Mobile apps can be very handy when it comes to keeping track of your positions from anywhere in the world. Great mobile apps can help you in various ways. Such as, open and close trades in emergency situations like power outages, computer breakdowns, etc.

Both platforms offer mobile trading apps available for Android and Apple devices. While both offer various indicators and features, TradingView is superior in terms of number of indicators and functionality. With the TradingView app, traders can fund and withdraw money from their accounts. Whereas, MT4 doesn’t have that option. One more amazing feature provided by TradingView mobile app is that the watchlist data is synced and you don’t have to search for your favorite assets for long.

In the mobile category, TradingView wins due to higher functionality and better design. However, It’s worth mentioning that mobile trading is not that important for professionals. The apps are super useful for closing orders in emergency situations and that’s about it. It’s recommended to conduct any kind of analysis whether it’s technical or fundamental using a larger screen to digest the information better.

MetaTrader 4 or TradingView

MetaTrader 4 is very famous and offered by most forex brokers, which is a clear upside. TradingView has connections with very few brokers such as: OANDA, Alpaca, Gemini, AMC Global, etc.

In addition, TradingView offers superior watchlists and screeners. Moreover, TradingView watchlists are synchronized with mobile apps. For MetaTrader users, lack of screener functions might not be a dealbreaker since the assets offered are much limited in numbers compared to the assets offered by TradingView.

It’s obvious that both software have their strengths and weaknesses. There are various kinds of traders in the world of investing and each has own priorities. For many traders simplicity and order execution is more important than looks. Others are looking for user-friendly and eye candy software for conducting a better technical analysis. Let’s take a look at the comparison chart to get a clearer view.

| Platform | MetaTrader 4 | TradingView |

| Number of assets | Wins | |

| Charts and indicators | Wins | |

| Design | Wins | |

| Timeframes | Wins | |

| Order execution | Wins | |

| Social trading | Wins | |

| Algorithmic trading | Wins | |

| Registration | Wins | |

| Support | Wins | |

| Free to use | Wins | |

| Connection with brokers | Wins | |

| Watchlists and screeners | Wins |

Summary

TradingView wins in terms of modern design and available asset classes. But MetaTrader 4 is more reliable when it comes to trading. It’s difficult to choose, isn’t it? But who says you need to pick one over the other? Did you forget? For the most part, both platforms are free to use. You can get the best from both worlds by conducting a technical analysis using the TradingView and placing orders using MetaTrader 4. In fact, traders are doing the exact same thing.

FAQs on MetaTrader 4 and TradingView platforms

Which trading platform is better to use MT4 or TradingView?

It depends on who you ask. Traders that prioritize modern design, analytical tools, social trading and access to various assets, will pick TradingView. As for the traders that are mostly investing in Forex markets and prefer stable platforms, will choose MetaTrader 4.

Are MetaTrader 4 and TradingView free to use?

Both platforms are free to use. As most brokers offer free of charge MT4 demo versions and TradingView Basic version is easily accessible completely free of charge. However, in case you want an ad-free experience, more charts per layout and more indicators per chart, you can go for Pro ($14.95/m), Pro+ ($29.95/m) or Premium ($59.95/m).

Can I use both platforms at the same time?

Yes. Of course you can. Actually it’s recommended to do so and check how it works for you. Many traders are using TradingView for charting and technical analysis and place orders using MT4.

Leave a Reply