Investing in Cannabis Market: Top Worldwide Stocks & ETF Report

Hi Trader,

You are in for an enlightening treat today.

Throughout this thoroughly compiled report, you will learn the following:

- US & Canada Cannabis Market Comparison

- Growth Estimates & Legislation

- Pros & Cons of each market

- A Vertical Perspective for Cannabis Investing

- Risk Assessment & Legal Oversight

- Type of Cannabis Investment Methods

- Best 2020 – 2021 Cannabis Stocks & ETF’s to Invest

Enriching our readers by breaking down the highlights of this industry report procured for high net-worth individuals, we will share the invaluable tidbits of knowledge required to strike it big with the cannabis markets.

We are starting with the major players.

The United States and Canada.

The United States Cannabis Market

Let’s start with what the numbers are saying.

One in six adult Americans consumes cannabis each year.

Up to 263 million people worldwide consume cannabis.

This buying power equates to a $344 billion market value.

Compared to alcohol, approximately four times the value of the $344 billion cannabis market ($1.326 trillion), cannabis slowly emerges from the wake of delayed legalization on both a state and federal scope.

Data projections from Arcview Market Research and BDS Analytics in 2019 reveal how the cannabis market featured a bullish outlook with an estimated market value of $40.6 billion in sales by 2024.

Well-known is how the U.S. dominates the cannabis sector.

Research shows that the U.S. may output as much as $30.1 billion in revenue by 2024.

Remember, this data was collected before a global pandemic took root.

States are likely considering legalizing more than ever to amass revenue.

Many states are out of much revenue as a result of the coronavirus pandemic.

Some states reopened, but overall, the virus has extreme financial ramifications.

What is more surprising is the resiliency of cannabis.

Consumption has skyrocketed with recreational use, accounting for 75% of licensing revenue in the United States.

That is roughly $21.1 billion in recreational sales, while medical accounted for approximately $9 billion.

As more states legalize cannabis during these post-pandemic times, the cannabis sector will only continue to grow in the United States.

Marijuana Business Daily foresees an annual 24% growth rate up to $30 billion by 2023.

In the U.S., cannabis will continue to marginalize the black market as it becomes legalized by more states and federal levels.

North America amasses the vast majority of cannabis sales.

Canada’s Cannabis Market Outlook

Therefore, it comes to no surprise that Canada is the second-largest cannabis market.

Canada is estimated to generate $5.8 billion in revenue by 2024.

$4.8 billion of that estimation may stem from recreational sales.

Unlike the U.S. cannabis markets, the Canadian cannabis market may continue to stay stable or slowly stagnant over time and decline.

Lack of innovation is one reason why Canada’s cannabis market is stale.

The shortage of retail locations also causes a hindrance to Canada’s market.

Following COVID-19, Canada’s market got hit hard like many significant economies.

The U.S. cannabis catalysts include the following three U.S. legislations:

- The SAFE Banking Act

- The STATES Act

- The MORE Act

Collectively, these bills seek to cannabis mainstream, benefitting from the taxation and regulation of the cannabis sector.

By taxing the cannabis sector with other “sin” sectors like tobacco, alcohol, and gambling, authorities gain more financial compensation and power.

The SAFE Banking Act, the STATES Act, and the MORE Act are not constitutional bills, but they are gaining momentum.

|

SAFE Banking Act Banking & Payment Focus |

STATES Act Defers to State Law |

MORE Act Nationwide Descheduling |

|

| Bipartisan Sponsors | YES | YES | NO |

| Contains Social Justice Initiatives | NO | NO | YES |

| Places a Special Tax on Cannabis | NO | NO | YES |

| Encourages Interstate Market Development | NO | YES | YES |

| Permits Bank Accounts for Cannabis-Related Businesses | YES | YES | YES |

| Permits Payments and Money Transmission | YES | YES | NO |

| Permits Capital Markets Activity | NO | YES | YES |

| Contains Directions to Regulators | YES | YES | |

| Protects Insurers | YES | YES | YES |

| Table recreated by Tim from Davis Polk, September 2019. | |||

A trip through history will remind us that the Controlled Substance Act of 1971 made the vast majority of cannabis trade illegal.

The Controlled Substance Act has five different “schedules.”

The most strict schedule of the Controlled Substance Act is Schedule I.

Schedule I includes the most strictly banned substances.

No accepted for medical uses and came with a high degree of risk.

These include drugs such as:

- fentanyl

- heroin

- LSD

- ecstasy

- psilocybin mushrooms

Only 16% of Americans had believed that cannabis should be legal in 1990.

Remember, public opinion shifting from two decades of the War on Drugs.

Nowadays, legalization is favored.

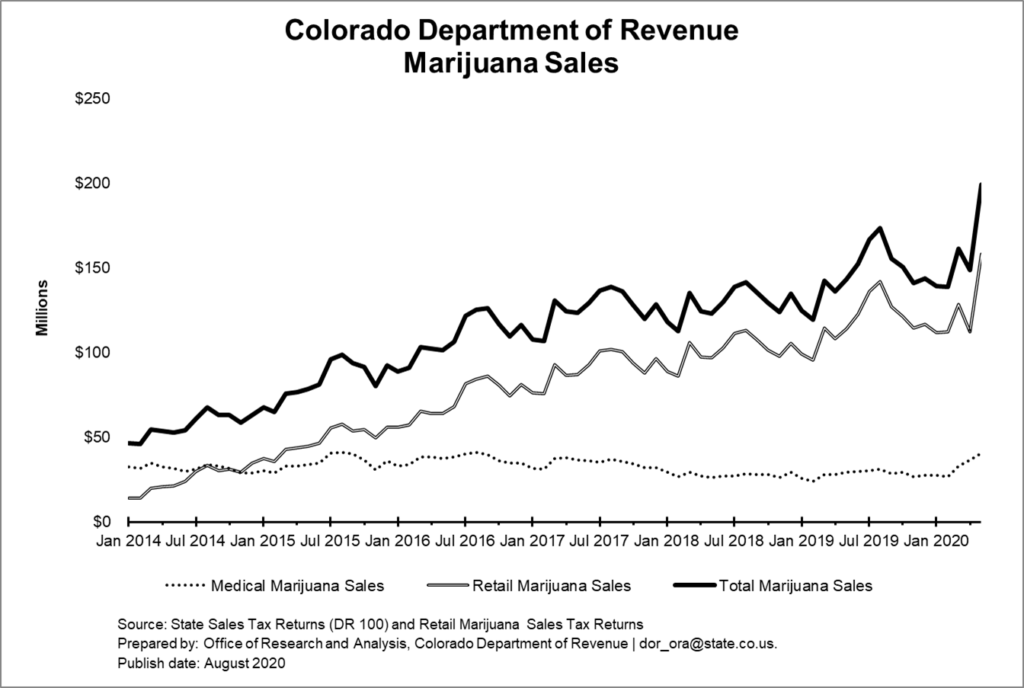

Colorado’s Cannabis Market Growth

Colorado is flourishing from cannabis legalization.

Considered the most mature recreational cannabis market, Colorado’s recreational market domination started only shortly ago in January 2014.

Colorado is the per capita leader in recreational cannabis sales.

Colorado’s market is less regulated than in Canada.

There is no cultivation cap or dispensary licenses, while fewer regulations mean increased product offerings, such as the robust and mature edible sub-sector.

Colorado’s explosive cannabis market is an ideal model for the U.S. to follow.

Both medical and recreational sales are cap free on store licenses in Colorado.

Colorado’s cannabis market has known over five years of bullish growth.

In 2018, Colorado’s cannabis market resumed its bullish characteristics in 2019.

While medical cannabis consumption is falling, recreational sales pick up the offset, while more states continue to lean towards cannabis legalization.

Pros & Cons

The U.S. Cannabis Catalysts

The U.S. cannabis sector’s primary catalysts stem from the taxation and regulation of the cannabis sector at a state and federal level.

As cannabis legalization continues to increase, investors of all calibers can take advantage of bullish cannabis companies.

Illinois legalized recreational cannabis on January 1, 2020, and more states are likely to follow suit.

| Pros | Cons |

| Bullish market. | Slow state regulation acceptance. |

| Lucrative investment opportunities. | |

| Mature markets spark innovation. |

Canada Cannabis Catalysts

Canada had the potential to create a market turnaround by adding more retail stores.

However, these efforts are not viable because of the Coronavirus.

Canada legalized edibles and vaporize oils in December 2019, which helped sway black market buyers to the legal market.

Canada may have a 34 percent gain in recreational sales as black market sales decline.

| Pros | Cons |

| Annual demand has been bullish. | They have limited recreational stores. |

| Recreational cannabis offers are increasing. | The market lacks variety and innovation. |

|

Black market buyers become new clients. |

A Vertical Perspective for Cannabis Investing

Recreational

Cannabis companies that are vertical control the whole supply chain.

Why is this so?

It is not yet legal to transport cannabis across state borders.

The U.S. multi-state operators, or MSOs, are companies that amass state cannabis licenses in states that have legalized medical or recreational cannabis.

Those companies must obtain licenses to operate in each state legally.

MSOs tend to be more efficient, although there are concerns regarding the costs associated with growth strategies.

Metrics to Measures MSOs

Some cannabis companies are generating free cash flow.

Sometimes these companies reflect future potential value rather than current.

Their revenue stream and profitability are high while their brand name builds momentum.

Investors looking beyond those metrics seek out EBITDA for profitability, dispensary count, and dispensary licenses count to estimate the potential size of a U.S. MSO.

Investors should always be aware of how much cash companies have and their operating cash flow – as capital can be expensive for U.S. cannabis companies.

Therefore, it is advantageous to invest in companies that are better at growing their business while maintaining relatively robust operating and free cash flows.

By using EBITDA, investors can see a cannabis company’s profitability.

Generally, the norm is using net income.

Most large cannabis companies report adjusted EBITDA, which usually excludes share-based compensation and excludes one-time costs such as acquisition costs.

Net income is not a metric used to measure profitability in the cannabis sector.

By following Canadian IFRS accounting standards, traders trade publicly-traded MSOs.

Under these standards, net income may be mostly non-cash fair value adjustments (the fair value of cannabis inventory compared to its production cost) and changes in the number of outstanding stock warrants.

Frequently these non-cash items must be reported and are seen in net income.

These reported non-cash items can skew net income statements.

For example, Trulieve earned $58 million in net income on $58 million in the June 2019 Quarter.

This enormous high net income was a byproduct of $66 million of non-cash fair value adjustments related to Trulieve increasing cannabis production.

Net income figures are misleading due to reporting non-cash items.

If Trulieve did not have fair value adjustments, it would have lost $9 million in the quarter.

That’s not to say that EBITDA does not have disadvantages.

Adjusted EBITDA is the least difficult metric for cannabis companies to improve.

Since it is not GAAP (Generally Accepted Accounting Principles), or IFRS, cannabis companies can exclude the following:

- One-time costs

- Share-based compensation

- Interest expenses

- Taxes

The exclusion options of EBITDA make it much easier for cannabis companies to be profitable.

Share-based compensation and tax income account for the two most significant exclusions.

A main driving force behind this reality is that it is challenging to raise capital in the U.S. cannabis sector, and it can be beneficial to pay using shares rather than cash.

Share-based compensation dilutes the shareholder pool and frees cash flow.

Federal law forbids the deduction or ordinary business expenses from the income associated with trafficking Schedule 1 substances in the cannabis sector.

Typical businesses deduct both gross costs and operating costs from their revenue to calculate taxable income.

However, in the cannabis sector, cannabis businesses cannot deduct operating costs when calculating their taxable income.

Their gross profit is their taxable income.

These unfair practices lead to profitable cannabis companies paying astronomically high taxes.

For example, Trulieve generated $58 million in net income in June 2019 quarter.

Trulieve had a gross profit of $38 million and 65 percent gross margins (excluding non-cash fair value adjustments).

Trulieve provisioned $28 million for income taxes, including $12 million in current taxes and $15 million in deferred taxes.

These high taxes make it very difficult for U.S. cannabis businesses to generate meaningful cash flow even if they report adjusted EBITDA profits.

To Sum Up

It is challenging for MSOs to trailblaze a path to profitability with the unfair and enormous cannabis taxation.

Many MSOs are similar to that of Canadian growers a year ago, where scalability and excellent financing are needed to go the distance.

Should cannabis continue to legalize at the state and eventually federal level, then the potential cannabis market’s growth potential in the U.S. will bullishly explode.

The growth of the cannabis sector in the U.S. will help fuel hurting economies post COVID-19.

Medical

Depending upon the region of jurisdiction will determine medical cannabis profitability.

Canada’s medical cannabis market is not as explosive as the U.S. recreational cannabis market is now becoming famous.

As the coronavirus’s financial ramifications continue to hurt state and federal economies, legalization of cannabis can significantly boost income in the U.S.

The marginalization of the cannabis black market will also occur in the U.S.

While medical has been around longer, culture and popularity make cannabis consumption part of the movement these days and not seen as a problem.

Medical sales are likely to continue growing, although recreational sales are where the immense profit potential is in the cannabis sector.

Ancillaries

The ancillary market has large players.

Such as Industrial Properties (IIPR), KuskCo Holdings KSHB), and Scotts Miracle-Gro (SMG).

Since they ‘don’t touch the plant’ themselves, they are more stable than other cannabis stocks affected by ever-changing legislation.

Investors may choose some ancillary players when reluctantly entering the cannabis sector.

ETFs are ideal for new or conservative investors, while they are safer to trade.

Cannabis ETFs are a good investment option for those who believe in a bullish cannabis sector.

Actively managed funds eschew the use of an index and instead utilize management teams that are doing well.

Pure play funds consist of strict cannabis stock holdings.

No trade is alcohol or tobacco stocks, but solely cannabis is an example of pure-play funds.

Cannabis Investments by Market

The cannabis sector has explosive growth potential.

Consider full-scale distribution, which may shrink the alcohol sector.

Many cannabis investors hope to ride out the cash burn to become the big cash winners in the end.

Showing a clear path to profitability and having patience are two distinctions for general cannabis investments.

Therefore, we’ve broken down cannabis investments geographically by market.

The United State’s Cannabis Markets

Legalization continues to pave the way forward to a bullish U.S. cannabis market future.

States are legalizing marijuana, which has driven revenue and served as a critical financial crutch for post Coronavirus sector activity.

With demand high, innovation and market variety has enriched consumers’ appetite for cannabis consumption while the profit margins pouring in from the increased taxation and industry prices have driven some U.S. cannabis companies market revenue to the billions.

The cannabis sector has a strongly bullish outlook.

Projections

Revenue by 2024: $30.1 billion

Black Market: Marginalization towards recreational markets

Sales Through July 2019: C$1.5 billion

| Pros | Cons |

| High demand with many products. | High taxation. |

| Aids Coronavirus market recovery. | Relatively new, unknown risks. |

| Stong bullish outlook. | |

| Versatile cannabis investment options. | |

| The black market becomes marginalized. |

Canada’s Cannabis Markets

Canada reaps the benefit of experience.

Legalization and medical marijuana have long been available in Canada.

In 2018, the recreational use of cannabis became legal.

Their market is not as strong as the U.S. cannabis markets.

Limited retail store and licensing caps make it difficult for Canadian cannabis companies to generate significant revenue.

The Coronavirus pandemic also hindered retail store opening while production has been challenging to meet given post COVID-19 employment situations.

While their markets are relatively stable, room for improvement is sought after selling edibles, concentrates, infused drinks, and vapes became legal at the end of 2019.

Projections

Revenue by 2024: $5.18 billion

Black Market Percentage: Approximately two-thirds

Sales Through July 2019: C$1.5 billion

| Pros | Cons |

| Experience may help Canada’s cannabis market. | The market lacks innovation and market choices. |

| Cannabis consumption is widespread among adults in Canada. | The Coronavirus has made opening retail stores challenging. |

| Canada’s cannabis sector has been annually bullish on average. | |

| Canada has industry-leading cannabis companies. |

Germany’s Cannabis Market

Health insurances cover medical cannabis in Germany.

Weaker sales in Germany stem from a lack of complaints.

Aurora allowed licensed grants to produce 200 kilograms annually over four years.

German sales have been placed on hold because the company is waiting on local regulators to grant additional authorization related to its sterilization process.

Projections

Revenue by 2024: $1.35 billion (all medical)

Black Market: Unconflicted with only medical cannabis available

Sales Through July 2019: Unknown for 2019, it is estimated that 2,600 kilograms will be available by the final quarter of 2020.

| Pros | Cons |

| Health insurance covers medical cannabis costs. | Authorities are resisting open access to companies ready to distribute cannabis. |

| Additional authorization steps hinder profitability. | |

| They limit production volume. |

Mexic’s Cannabis Market

Mexico may legalize cannabis soon.

Their population is three times that of Canada, while one in six adults are likely to consume cannabis in Mexico.

With a population of roughly 132 million, which is more significant than California, it could result in tremendous growth potential for Mexico’s cannabis market.

How Mexico will handle competition directly with the black market is unknown.

Projections

Revenue by 2024: $1.02 billion

Black Market: Uncertain whether they will make as much headway into the illegal market as developed nations

Market Value in 2019: Between $1.8 billion to $2.0 billion

| Pros | Cons |

| Mexico has a massive cannabis market potential. | The black market features new competition and threats. |

| Mexico is densely populated. | |

| Mexico may legalize cannabis. |

The United Kingdom’s Cannabis Market

GW Pharmaceuticals delivers much of the U.K.’s cannabis success.

Its highly successful Epidiolex and Sativex are used to treat symptoms related to spasticity in multiple sclerosis patients.

Sativex is only available in the EU.

Projections

Revenue by 2024: $546.9 million

Consumption Rating: Canada could experience a CAGR of over 95% while GW Pharmaceuticals continues to pave the way forward.

Sales in 2018: $9.9 million

| Pros | Cons |

| The U.K. has tasted success in the cannabis sector. | They limit Sativex’s availability. |

| Multiple sclerosis patients have effective treatments. | |

| The demand for Sativex is high. |

Asia’s Cannabis Market

Should Khiron continue to be an export powerhouse, Asia and European cannabis markets could experience a bullish momentum swing.

THCX, the cannabis ETF, became available in June 2019 and has also helped increase U.S. exposure.

As more information about Asia’s cannabis market becomes mainstream, we will update our review to provide relevant insights.

Projections

Revenue by 2024: $5.8 billion

Consumption Rating: 3.2% in India, the most considerable consumption in Europe that continues to rise

Outlook: Asian countries are opening up to cannabis, although it remains illegal in most of Asia.

| Pros | Cons |

| Strong bullish potential with Khiron. | Speculative markets. |

| Unknown market players. | |

| The regulatory practice is unknown. |

Australia’s Cannabis Market

The Australian Capital Territory (ACT) becomes the first jurisdiction in Australia to legalization recreational cannabis use.

Medicinal consumption became available in 2016.

Roughly 35% of Australians aged over 14 have tried cannabis in their lifetime.

Should commercial sales of cannabis become open, then Australia’s economy could benefit significantly from taxation and accrued revenue.

| Pros | Cons |

| Experience-rich consumer demographics. | No commercial sales. |

| Medical consumption is approved. | Not enough regulatory laws are active. |

|

ACT allows recreational cannabis use. |

Risk Assessment & Legal Status

Vaping Health Crisis

The majority of growth in the cannabis sector will stem from legal cannabis competing with the black market rather than attracting new cannabis users.

While until recently, the history of legal cannabis has been grim, changes in cultural, political, and medical outlooks have enabled increased cannabis consumption.

The following cannabis sectors are to-watch and will serve as a useful measure for gauging the future outlook on cannabis markets.

Risks associated with cannabis primarily revolved around the widespread vaping crisis.

In the U.S., there have been over 2,000 confirmed cases and lung injury cases.

Fifty-four cases have confirmed deaths.

All of the above cases are associated with illicit THC products.

The FDA and CDC warn consumers against these products.

Cannabis edibles have surged in demand as a result.

Damaging health is not the only risk involved in the cannabis sector.

Legal Risks (US & Canada)

Cannabis is still federally illegal in the United States.

Meaning the cannabis industry faces tremendous legal and regulatory obstacles.

Should cannabis never become nationally legalized, then profitability within the sector will be challenging to maintain.

Some cannabis businesses will find it impossible to stay afloat with decreased cash flow on an after-tax basis.

Canadian Risks

In Canada, companies are deviating from Health Canada and international regulations, which have affected their margins.

Another challenge surrounding Canadian growers is the slow pace that their government is permitting retail licenses.

Back in the United States, should the SAFE Banking Act go into legislation, then the cannabis sector would likely see a bullish uproar as banks would be more willing to lend money to what the government considers an “illegal enterprise.”

Sub-Sector Uncertainty

The question of which value chain roles may prove most profitable is unknown.

The long-term profitability of the cannabis sector is unclear.

Perhaps this is best depicted through the two real-world examples below:

Before its CEO and co-Found resignation, MedMen was an industry leader who believed that retail is best positioned in the value chain, specifically the Whole Foods sector.

While this theory may be correct, it isn’t a guarantee that operating within the retail confines will prove valuable.

Should cannabis become commercially accessible at grocery and convenience stores, then retail chains may become worthless.

Our other example includes Aurora, who focuses on cultivation capacity.

Before stumbling earlier this year, Aurora was able to grow over 600,000 kilograms of cannabis per year.

Some observers believe that cannabis will be a scalable crop that will be like a commodity where consumers cannot differentiate between cannabis strains.

In situations like those, the companies with the best marking and growing cannabis may become outsourced to farmers instead of creating value within major cannabis companies.

Both Aurora and MedMen were industry leaders with riveting stock prices, but the newly legalized cannabis sector’s challenges have proven unrelenting.

Before investing with a cannabis company, make sure you dive into their corporate finances and see how well they are managing before investing because they have good marketing.

Votality & Market Bubbles

Investor sentiment may cause dramatic fluctuations, bubbles, and declines in the financial markets.

The first publicized cannabis stock, Canopy Growth, IPOed at $17 per share and closed at $22 per share in July 2018.

An enormous market bubble occurred in a euphoria wave where shares reached an intra-day high of $300 per share on September 19th, 2018.

Shares have since lost more than 90% of their value from that intra-day peak.

Capital Risks

Banks are unwilling to risk lending money to cannabis companies due to fear of regulators.

Should the SAFE Banking Act pass, then this reality will change.

It will provide banks the ability to render services without fear of prosecution.

However, companies need to show proof of long-term profitability in a new sector.

Should federal legalization occur, it still may take years to implement effectively.

Cannabis companies may need to rely on their ability to raise money through debt or equity to meet capital requirements for expansion.

Companies may face insolvency if the legal cannabis sector does not become more corporate-friendly at a regulatory level.

Producer Risks

Growers worry about what will happen once domestic demand in Canada and the U.S. is full.

Companies will have to robustly handle production capacity, growth in demand, distribution, and generating more income than expenses to avoid cash burning.

Cannabis is grown cheaply in South America possesses another risk associated with production.

This factor will predominately be felt in the dried flower sub-category since some companies may decide to switch producers due to costs.

Over time, the EU medical cannabis market will continue to mature and become more accessible.

Bearish Cannabis Scenario

Several scenarios that may cause the crash of the cannabis sector include:

- SAFE Banking Act – If this U.S. legislation does not pass the Senate or if the President does not sign it into law, banks will be unable to render services safely to cannabis companies.

- Regulatory Intervenience – If the FDA, CDC, or Health Canada grill more industry-leaders, uncertainty may stem in investor sentiment.

- Overspending – Companies may financially overextend themselves.

- Edged Out – Big tobacco, pharma, and alcohol companies may edge out cannabis veterans, over-regulate, and commoditize while damaging the sector and deterring customers.

Cannabis Growth by Country

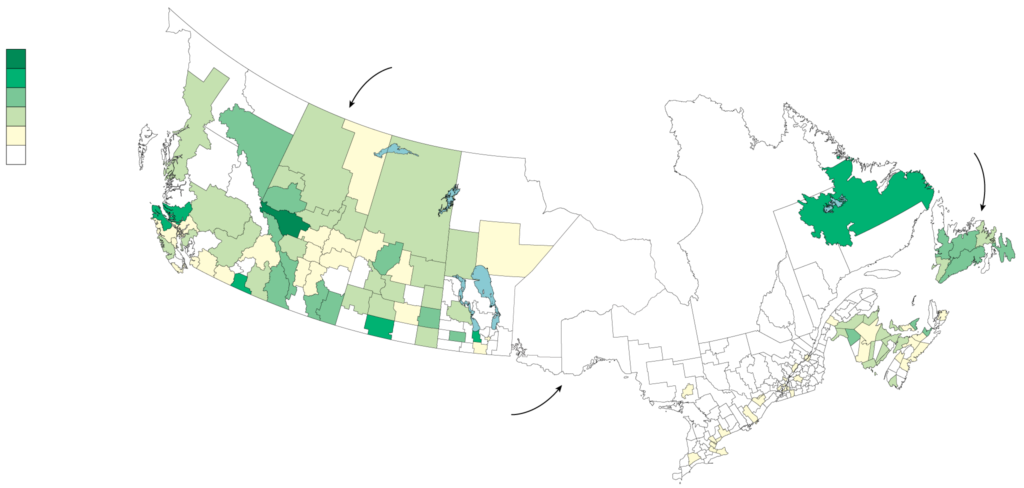

Canadian Cannabis Markets

Medical Cannabis Sector

Canada legalized medical cannabis in 2001 after Health Canada started a medical marijuana program.

The program was amended in 2013 to enable commercial growers to supply cannabis.

Top medical cannabis producers include Aphria, Tilray, Aurora Cannabis, and Canopy Growth.

Canada’s cannabis market is mature and stable nowadays.

Prescriptions are required to obtain medical cannabis while patients purchase cannabis directly from Canadian LPs (licensed producer).

Recreational Cannabis Sector

Dry flower, cannabis oils, cannibal soft gels, and more became legalized in Canada in October of 2018.

The Cannabis Act enabled national retail outlets and online stores per providence.

Provincial liquor authorities oversee cannabis sales and regulations.

Cannabis is federally legal in Canada, while increase store density is a desire for a bullish outlook for Canada’s cannabis market.

Colorado (U.S.)

Colorado Medical Cannabis

This state has the most mature legal recreational cannabis market in the world.

Per capita, cannabis sales are higher than in any other state.

Recreational cannabis was launched in Colorado in January 2014 and is much less heavily regulated than Canada.

No cultivation or dispensary licensure caps in Colorado, while fewer regulations enabled a more robust and mature edible sub-sector and increased product offerings.

Colorado Recreational Cannabis

In 2018, Colorado sold $1.2 billion of recreational cannabis and $332 million of medical cannabis.

Coloradans purchased $64/year of medical cannabis and $286/year of recreational cannabis.

Recreational cannabis sales in Colorado have been steadily bullish since legalization.

Medical cannabis sales have seen a decrease as much as 26%.

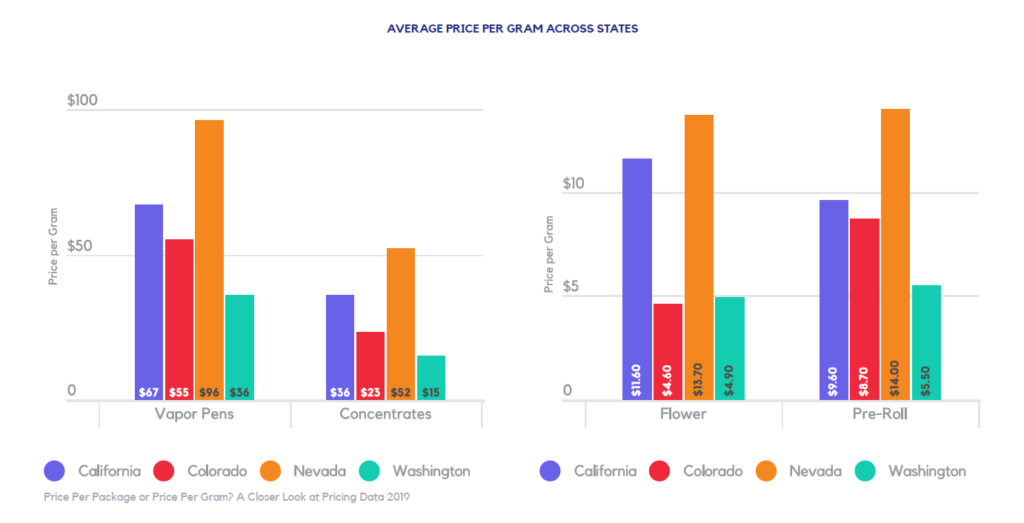

Colorado is home to some of the lowest cannabis prices in the country.

Illinois and Nevada are nearly double to triple the cost per gram of Colorado.

Colorado’s recreational cannabis market is bullish.

Illinois (U.S.)

Illinois Cannabis Market Outlook

Illinois is a high potential state that just recently legalized cannabis on January 1st, 2020.

Up to 110 dispensaries are allowed, while licensees also enable existing dispensaries to convert to adult-use cannabis stores after approval from the municipal government.

Key market candidates include Cresco Labs, Green Thumb Industries, Curaleaf (through Grassroots), and Harvest Health (Verano Holdings).

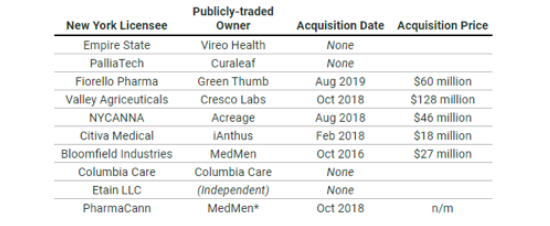

New York (U.S.)

New York Cannabis Market Outlook

Medical cannabis is highly competitive in New York.

High population and minimum cannabis license grants make New York a high-potential demographic, but legally, the state is more liberal is hesitant to legalize recreational use.

Attempts to legalize cannabis in New York have proven challenging.

Publicly-traded multi-state operators own nine out of 10 New York licenses.

These licenses cost between $18 million to $128 million to be acquired.

Green Thumb Industries purchased Fiorello Pharmaceuticals for $60 million in August 2019, which supplied one out of ten licenses.

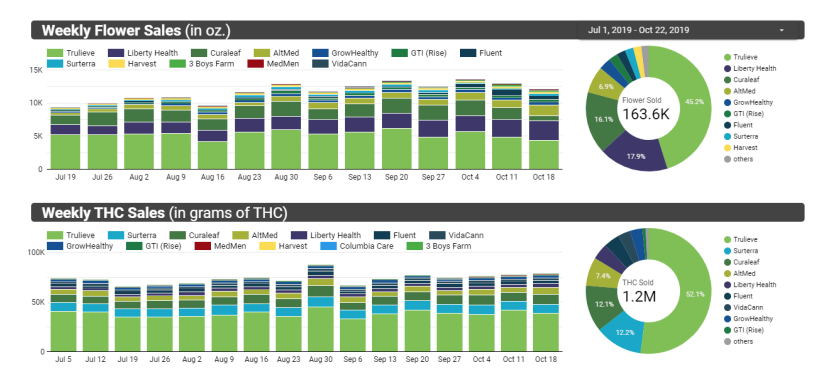

Florida (U.S.)

Florida Cannabis Market Outlook

Florida has one of the most competitive recreational cannabis markets.

The state has 174 dispensaries serving nearly 270,000 active patients.

Florida has a cap on the number of medical licenses it will grant.

Trulieve, Surterra Wellness, Curaleaf, and Liberty Health Sciences (LHSIF) are high dispensary cannabis operators to watch out for in Florida.

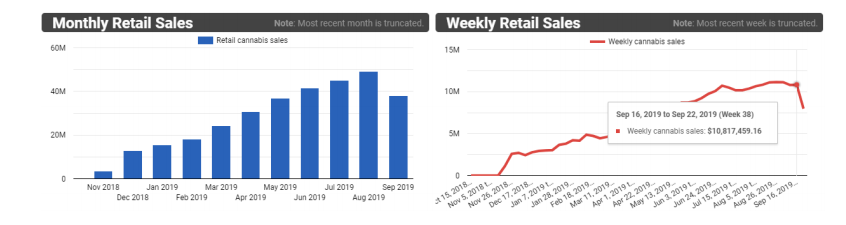

Florida publishes weekly cannabis sales broken down by the company.

Since legalized in March 2019, the dry flower represents about one-third of the Florida cannabis market, while THC concentrates account for nearly two-thirds of the market.

Curaleaf is currently the Florida market leader with 26 dispensaries and a market cap of $3.6 billion.

To Watch: Massachusetts, Ohio, and Pennsylvania

Massachusetts is enjoying a bullish cannabis market since legalization in 2018.

Recreational sales grew from $12.8 million in December 2018 to $49.2 million in August 2019.

Top companies to keep an eye out for include:

- Cresco Labs

- Acreage Holdings

- Columbia Care

- Curaleaf

- Green Thumb Industries

- MedMen

- Trulieve

- Harvest Health

- iAnthus

Medical cannabis is legal in Pennsylvania, while recreational cannabis is under consideration.

Top companies to watch include Cresco Labs, Colombia Care, Harvest Health, Acreage Holdings, Curaleaf, and MedMen.

In January 2019, Ohio legalized medical cannabis and gave licenses through a points-based system.

Notable industry leaders with companies in Ohio include MedMen, Harvest Health, Green Thumb, Cuareleaf, Columbia Care, Acreage Holdings, and Cresco Labs.

Types of Cannabis Investments

There are a couple of available metrics cannabis investors patiently seek out.

These include a visible path to profitability and differentiation.

Most cannabis companies are in the development stage.

As a result, considerable cash-burning occurs early on with the hopes of obtaining a significant return later down the road.

Therefore, the ability of cannabis companies to differentiate themselves from competitors will be paramount to their success.

One such example includes Charlotte’s Web strain, one of the most recognizable hemp strains.

Charlotte’s Web was awarded the first patent or a hemp strain by the U.S. Patent and Trademark Office, which creates a natural moat against competitors for distinguishment.

Cannabis companies have to create memorable brand experiences to stand out from the pack; otherwise, a commodity business model will take shape where competition is solely price-driven.

This section would not be complete without differentiating the active types of cannabis companies, which are as followed:

Cultivator – Companies that cultivate marijuana and cannabis-related goods.

Distributor – Companies that supply goods to stores and other cannabis businesses.

Consultant – Companies that provide research and expert advice.

Marketing – Entities that perform marketing and provide marketing strategies.

Medical – Companies concerned with the medical application of cannabis.

Investment – Are companies looking to accrue capital gains from company investing.

Technology – Are entities primarily involved in research and development.

Mixed – A cannabis company involved in growing, medical, and technology applications.

Best Cannabis ETFs to Invest in 2020

Cannabis ETFs follow that same ground rules as standard ETFs.

Meaning that they are funds that track a basket of different companies competing in the cannabis sector; some are regular index ETFs and others actively managed.

The question remains then whether to invest in an assortment of companies or take positions in individual cannabis companies, such as stocks.

Traders who understand how cannabis ETFs work and how to manage are at an advantage.

Trade volume may become an issue with low-liquid cannabis ETFs.

Cannabis ETF Advantages

Cannabis ETFs are considered safer for investors who don’t possess much trade knowledge or experience.

If you are bullish with the cannabis sector, then you may consider cannabis ETFs.

ETFs can be used to margin from potential declines in particular companies while reaping from the cannabis sector’s collective growth.

Traders should be mindful of cannabis stock fees and compare commissions when trading ETFs.

Cannabis ETF Disadvantages

ETFs tend to have an increased cost of expense ratio.

The lowest-priced cannabis ETF is five times as high as a broader market fund like the SPDR S&P500 Trust ETF (SPY) or the Vanguard Total Stock Market ETF (VTI).

ETFs tend to sway in correlation to cannabis market movements.

The U.S. & Canadian Exposure

Trading Cannabis ETFs happen in the U.S. and Canadian stock exchanges.

A diversifying figure is whether cannabis ETFs have exposure to the U.S. cannabis market, the Canadian cannabis market, or both markets.

Some of the largest cannabis ETFs only support Canadian cannabis markets due to legal restrictions, while few ETFs off exposure to the U.S. cannabis sector.

Most notably, YOLO uses complex derivative swaps, which allow investors to get exposure to some U.S. facing assets.

Index Funds, Active Management & Pure Plays

Index Funds: There is no industry-standard similar to the Dow Jones Industrial Index or S&P 500 for the cannabis sector. Some cannabis index funds use proprietary cannabis indexes that vary in breadth and coverage, while some cannabis ETFs are cannabis sector index specific or actively managed.

Actively Managed Funds: Actively managed ETFs use a management team that actively selects companies to do well. Actively managed cannabis ETFs cost more than index funds, but fees tend to be equal between two classes of funds.

Pure Play Funds: Pure play ETFs don’t associate with related companies in the alcohol or tobacco sectors. Pure play ETFs are more advantageous than the previous year when they were less developed. If you are bullish on the cannabis industry, naturally, it makes sense to gravitate towards pure-play ETFs.

Cannabis ETF investors should pay attention to the management of companies.

Co-founder, Debra Borchardt of Green Market Report, said:

“There are some ETFs that are actively managed monthly. There are some that are done quarterly. There is a bit of overlapping because [while] there are quite a few publicly traded companies… there are quite a few that are fairly small and for these ETFs to work efficiently the stocks have to have some amount of liquidity so there has to be a lot of volume to work with. So it kind of starts to make the pool of potential names a little tighter. I think you want to look for the portfolio managers that have been around cannabis for awhile not the ones that have just decided to jump in.”

Top ETF Players

MJ ETF

The two largest cannabis ETFs are the Horizons Marijuana Life Sciences Index ETF (HMLSF) and the ETFMG Alternative Harvest ETF (MJ).

Both funds have indexed exposure and liquidity to the Canadian cannabis market.

MJ is the largest and oldest cannabis ETF on the market.

MJ is not considered a pure-play ETF for cannabis since over 17 percent of its holdings are in tobacco stocks.

| ETF: | MJ |

| Net expense ratio: | 0.75% |

| AUM: | $720 million |

| Management type: | Passive |

| # | Top Holdings | Weight | Type |

| 1 | GW Pharmaceuticals | 7.6% | Cannabinoid medicine |

| 2 | Canopy Growth | 7.6% | CAN cannabis |

| 3 | Cronos | 7.4% | CAN cannabis |

| 4 | Aurora Cannabis | 7.2% | CAN cannabis |

| 5 | Tilray | 7.1% | CAN cannabis |

| 6 | Aphria | 4.6% | CAN cannabis |

| 7 | Organigram | 3.8% | CAN cannabis |

| 8 | Corbus Pharmaceuticals | 3.8% | Cannabinoid medicine |

| 9 | Hexo | 3.6% | CAN cannabis |

| 10 | Medipharm Labs | 3.2% | CAN cannabis |

| Top 10 Holdings | 56.2% |

MJ is a U.S. traded funded listed on the NYSE ARCA exchange, while HMMJ is a Canadian-traded fund listed on the Toronto Stock Exchange.

HMMJ ETF

HMMJ is also traded over-the-counter under the ticker HMLSF in the U.S.

| ETF: | HMMJ/HMLSF |

| Net expense ratio: | 0.75% |

| AUM: | C$518 million |

| Management type: | Passive |

| # | Top Holdings | Weight | Type |

| 1 | Canopy Growth | 10.8% | CAN cannabis |

| 2 | Cronos | 10.5% | CAN cannabis |

| 3 | Aurora Cannabis | 9.5% | CAN cannabis |

| 4 | Tilray | 8.2% | CAN cannabis |

| 5 | GW Pharmaceuticals | 8.2% | CAN cannabis |

| 6 | Aphria | 7.7% | CAN cannabis |

| 7 | Scotts Miracle-Gro | 6.9% | Fertilizer |

| 8 | Charlotte’s Web | 5.6% | U.S. CBD |

| 9 | Hexo | 3.2% | CAN cannabis |

| 10 | Organigram | 2.9% | CAN cannabis |

| Top 10 Holdings | 73.6% |

The MJ and HMMJ cannabis funds contain only Canadian cannabis holdings since Canada is medical and recreational cannabis legal for business.

YOLO ETF

The AdvisorShares Pure Cannabis ETF (YOLO) is the largest actively-managed cannabis ETF.

YOLO has the most significant fund with holdings in the U.S. cannabis sector.

Market exposure includes U.S. and Canadian markets, while the fund became tradable in April 2019.

Dan Ahrens and Robert Parker of AdvisorShares manage YOLO.

Around 17 percent of YOLO’s exposure to cannabis is from swaps and derivatives, making the bid-ask spread more challenging to compute.

YOLO trades on the NYSE Arca exchange and provides an alternative to U.S. cannabis investors.

| ETF: | YOLO |

| Net expense ratio: | 0.74% |

| AUM: | $46 million |

| Management type: | Active |

| # | Top Holdings | Weight | Type |

| 1 | Village Farms | 7.1% | CAN cannabis/U.S. CBD |

| 2 | Innovative Industrial Properties | 5.9% | U.S. cannabis REIT |

| 3 | Trulieve (swap) | 5.8% | U.S. cannabis |

| 4 | Organigram | 5.4% | CAN cannabis |

| 5 | GW Pharmaceuticals | 5.0% | Cannabinoid medicine |

| 6 | Valens GroWorks | 4.4% | CAN cannabis |

| 7 | Green Thumb (swap) | 4.2% | U.S. cannabis |

| 8 | Curaleaf (swap) | 4.1% | U.S. cannabis |

| 9 | Aphria | 3.9% | CAN cannabis |

| 10 | Corbus Pharmaceuticals | 3.4% | Cannabinoid medicine |

| Top 10 Holdings | 49.20% |

YOLO has more diversification than MJ or HMLSF.

Approximately 20% of YOLO’s exposure comes from U.S. multi-state operators, including Curaleaf, Green Thumb, Harvest Health, Cresco Labs, iAntuhs, and Trulieve.

POTX ETF

Launched in 2019, the Global X Cannabis ETF (POTX) tracks the Cannabis index.

A unique aspect of POTX is its low cost and fee waivers.

The net expense ratio sits around 0.5%, two-thirds the size of its larger ETF competitors.

| ETF: | POTX |

| Net expense ratio: | 0.50% |

| AUM: | $4 million |

| Management type: | Passive |

POTX features eight Canadian cannabis companies and features smaller fees than the portfolio Horizons Marijuana Life Sciences Index ETF.

| # | Top Holdings | Weight | Type |

| 1 | Hexo | 9.4% | CAN cannabis |

| 2 | Canopy Growth | 9.0% | CAN cannabis |

| 3 | Aphria | 7.9% | CAN cannabis |

| 4 | GW Pharmaceuticals | 7.7% | Cannabinoid medicine |

| 5 | Aurora Cannabis | 7.7% | CAN cannabis |

| 6 | Cronos | 7.6% | CAN cannabis |

| 7 | MediPharm Labs | 4.7% | CAN cannabis |

| 8 | Tilray | 4.6% | CAN cannabis |

| 9 | Organigram | 4.5% | CAN cannabis |

| 10 | Charlotte’s Web | 4.4% | U.S. CBD |

| Top 10 Holdings | 67.5% |

TOKE ETF

In July 2019, The Cambria ETF Trust – Cambria Cannabis ETF (TOKE), is an actively managed ETF and is Cambria’s first trial with cannabis ETFs. Cambria is head by Mebane Faber, a well-known ETF industry titan.

| ETF: | TOKE |

| Net expense ratio: | 0.43% |

| AUM: | $10 million |

| Management type: | Active |

TOKE is ideal for cost-conscious investors.

TOKE trades the cannabis, alcohol, and tobacco sectors.

| # | Top Holdings | Weight | Type |

| 1 | Medipharm Labs | 6.9% | CAN cannabis |

| 2 | Aphria | 5.8% | CAN cannabis |

| 3 | Aurora Cannabis | 5.7% | CAN cannabis |

| 4 | Constellation Brands | 5.2% | Alcohol |

| 5 | GW Pharmaceuticals | 4.8% | Cannabinoid medicine |

| 6 | Canopy Growth | 4.3% | CAN cannabis |

| 7 | British American Tobacco | 4.1% | Tobacco |

| 8 | Village Farms | 3.5% | CAN cannabis/U.S. CBD |

| 9 | Organigram | 3.4% | CAN cannabis |

| 10 | Cronos | 3.1% | CAN cannabis |

| Top 10 Holdings | 46.8% |

THCX ETF

The Spinnaker ETF Series (THCX) ETF is a passive fund.

The THCX ETF tracks the Innovation Labs Cannabis Index and rebalances monthly as opposed to the quarterly occurrence.

| ETF: | THCX |

| Net expense ratio: | 0.70% |

| AUM: | $19 million |

| Management type: | Passive |

THCX offers quality exposure to legal cannabis, hemp, and CBD space.

| # | Top Holdings | Weight | Type |

| 1 | Canopy Growth | 7.5% | CAN cannabis |

| 2 | Aurora Cannabis | 7.4% | CAN cannabis |

| 3 | Aphria | 7.2% | CAN cannabis |

| 4 | Tilray | 7.1% | CAN cannabis |

| 5 | Cronos | 7.1% | CAN cannabis |

| 6 | Scotts Miracle-Gro | 6.7% | Fertilizer |

| 7 | Charlotte’s Web | 6.3% | U.S. CBD |

| 8 | GW Pharmaceuticals | 6.2% | Cannabinoid medicine |

| 9 | Arena Pharmaceuticals | 3.3% | Cannabinoid medicine |

| 10 | Sundial Gowers | 3.3% | CAN cannabis |

| Top 10 Holdings | 62.2% |

CNBS ETF

Analyst Tim Seymour runs the Alternative Plant Economy ETF (CNBS).

Tim Seymour is a veteran in the cannabis sector.

80% of the fund’s holdings get 50% or more of its revenues from the cannabis industry.

As a result, CNBS a high-powered pure-play ETF to consider.

| ETF: | CNBS |

| Net expense ratio: | 0.75% |

| AUM: | $6 million |

| Management type: | Active |

| # | Top Holdings | Weight | Type |

| 1 | Canopy Growth | 6.9% | CAN cannabis |

| 2 | GW Pharmaceuticals | 6.5% | Cannabinoid medicine |

| 3 | Medipharm Labs | 5.5% | CAN cannabis |

| 4 | Aurora Cannabis | 5.0% | CAN cannabis |

| 5 | Aphria | 4.9% | CAN cannabis |

| 6 | Organigram | 4.7% | CAN cannabis |

| 7 | Canaccord Genuity | 4.7% | CAN investment bank |

| 8 | Cara Therapeutics | 4.6% | Cannabinoid medicine |

| 9 | Canopy Rivers | 3.8% | CAN cannabis |

| 10 | Charlotte’s Web | 3.7% | U.S. CBD |

| Top 10 Holdings |

50.2% |

Best Cannabis Stocks to Invest in 2020 (Mid-Term)

Three standout cannabis stocks include Aphia, Khiron, and Trulieve.

We broke down their management, risks, and catalysts below.

Aphria

Aphria (APHA) is a large Canadian cannabis company with operations spanned out through five continents.

The bulk of their revenues comes from Germany and Canada.

Last winter, Aphria acquired CC Pharma (a German pharmaceutical distributor) for $48 million ($70 million).

An estimated three-quarter of Aphria’s revenue comes from CC Pharma, while the remaining quarter stems from Canadian cannabis sales.

While Canada’s cannabis sector has taken a hit this year, Aphria has experienced leadership and could be due for all-out performance.

Management

Aphria suffered a rocky started early on.

Former CEO Vic Neufeld was quickly ousted while Irwin Simon took over as interim CEO.

Simon became the official CEO of Aphria after the Q2 earnings report.

Since Simon’s appointment, Aphria has experienced a bullish development.

Simon’s accolades land his strengths in the consumer packaged goods arena, specifically the natural food and personal care sectors.

His takeover of Aphria has proven prosperous thus far.

Catalysts

Aphria has the second largest-largest capacity in Canada that captures significant market share.

They have a positive EBITDA, which shows that they are an efficient and massive scale operation.

Aphria will feature one of the most mature cannabis company profiles in Canada.

Early investments in automation have moved Aphria to one of the lowest cost structures in the sector.

In contrast, the launch of Cannabis 2.0 products has created a revenue surge, with vapes estimated to account for 30% of future sales by FY2021.

Risks

If Canada does not peel back its extensive regulatory practices, its medical and legal cannabis sectors could take a massive nosedive.

Licensing delays while prohibiting products such as vapes in some demographics have only caused financial complications for companies, producers, and growers.

Khiron

Khiron Life Sciences (KHRNF) is a well-known cultivator, producer, domestic distributor, and international export of THC and CBD medical cannabis.

Khiron reaps the benefits of being a first-mover in the Latin American cannabis market.

Columbian licensed and based, Khiron Life Sciences is listed on the TSX Venture Exchange and became the first Colombian medical cannabis company to trade globally on an exchange.

Management

Former President of Mexico and Khiron board member Vicente Fox is one of the earliest and most influential cannabis legalization advocates.

Their VP of Compliance is a former Chief of Pharmaceutical Investigations for the DEA and has a background in legal and regulatory aspects of cannabis companies.

Their President, Chris Naprawa, brings 20 years of institutional capital market experience while also features a team of well-accomplished workhorses.

Catalysts

Khiron is well suited to take over the Mexican cannabis markets should legalization and medical use comes into effect.

Advantageously, Mexico could provide a market 3.5 times the size of Canada.

They have people and facilities in Chile, Peru, and Mexico ready for production and distribution when legalization comes into effect.

In a recent joint venture with Dixie Brands (DXBRF), Khiron now has access to the U.S. markets.

Khiron is well-structured to be a cannabis exporting powerhouse in EU, Asian, Mexican, Canadian, and U.S. markets.

Risks

Khiron may be a highly speculative play due to how much depends on regulation going their way.

Debt only accounts for 5.3% of its equity, and equity capital has accounted for most of its funding.

Shocking to some investors would be the silent and quick resignation of Khiron’s CEO.

Trulieve

Trulieve is one of the few profitable players in the MSO space despite ending 2019 with a short seller.

They have competitors like Cresco Labs (CRLBF) and Green Thumb Industries (GTBIF), but Trulieve still edges them out to be an industry MSO leader.

Management

Khiron has moved past the alarming management issues early on and is proving through their results that they are in it for the industry’s long haul and leaders.

Catalysts

This company was founded and leads Florida is dry flower sales.

Over 51% of dry flower and 47% of THC-based extract products in Florida are Trulieves.

20% of Florida’s dispensaries are Trulieve.

Should recreational adult-use cannabis become legal in Florida this year, then Trulieve will become bullish.

Risks

Trulieve has had a volatile year, like many MSOs.

If legalization continues to pose a problem to operational profitability, Trulieve will undoubtedly have to find solutions to offset those losses.

Additionally, if Trulieve loses its product or cannot harvest because of contamination, infestation, or disease, they will suffer.

Despite these new hurdles to clear later down the road, Trulieve may weather the storm and prove a great long-term play.

Brokers

How to Trade Cannabis Stocks

Access to an internet-enabled device is a requirement of trading.

Desktop, tablets, and mobile phones are an investor’s go-to devices.

Many trading platforms have mobile trading apps, which encourages trading on the go.

The next step is to register with a licensed and regulated broker for your jurisdiction.

A brokerage that supports stocks, ETFs, options, and cryptos is a good starting point.

Make sure to do your due diligence, read at least a dozen investor reviews, and have a game plan before trading.

A few high-caliber platforms that support cannabis stock trading includes:

- Robinhood

- Degiro

- Interactive Brokers

- Webull

- M1 Finance

Next, let’s learn how to buy cannabis stocks for long-term portfolio enrichment.

How to Buy Cannabis Stocks

Buying cannabis stocks online can be done with a trusted brokerage.

When looking for a brokerage that supports cannabis stocks, you must check out investor reviews before signing up while making sure they are legal for your jurisdiction.

If you are new to trading or investing in cannabis, try to find a brokerage that offers a free demo account to test out before going live.

To diversify your portfolio, the three brokers below have high industry ratings:

Degiro

Degiro is an internationally awarded brokerage with over 600,000 investors.

Supporting cannabis stocks and cannabis ETFs, Degiro provides access to more than 50 exchanges across 30 countries.

In the order book, traders can see the bid/ask spread and place orders by investment size instead of the number of shares.

Several order types are available, while traders can create a favorite list featuring their go-to financial instruments.

For European and UK traders, Degiro is a one-in-all platform for online trading and cannabis investing.

Robinhood

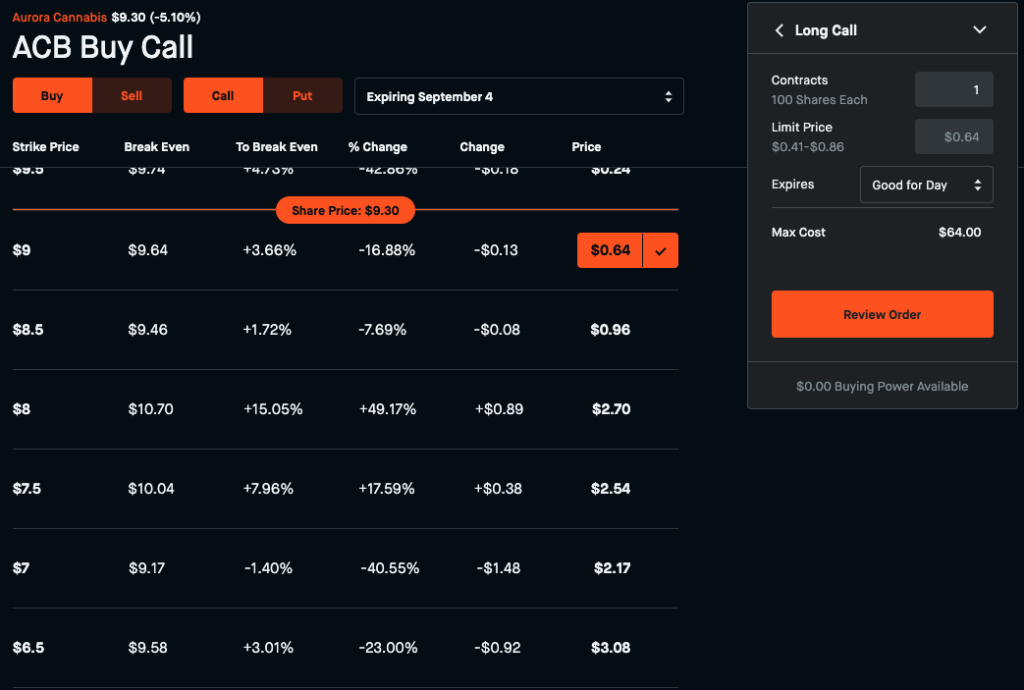

Robinhood offers people the ability to invest options, stocks, cryptos, and ETFs.

All trades are commission-free, while cannabis stocks can be purchased or invested through options trading.

If a trader owns a cannabis stock, they will have the option to exercise a sell-buy, where they can sell off pre-existing stock to fund an investment option.

Otherwise, traders can deposit into the platform upon registration or after queuing up their order.

Additionally, below the real-time chart of an asset is analyst ratings, where you can see how many investors are buying, holding, or selling.

Interactive Brokers

Interactive Brokers platform caters more towards experienced traders.

There are over 100 order types, access to global markets, and low commissions featured.

Investors can trade cannabis stocks, cannabis ETFs, and cannabis options.

If you are a more advanced trader that enjoys algorithmic trading and complex trading tools, then Interactive Brokers would be a good fit for you.

Individual Stocks Short Term

Sometimes buying individual cannabis stocks for short-term trading is exercised through marijuana stocks, cannabis ETF, and CFDs.

When you are using contracts-for-difference with leverage, you mustn’t overextend yourself as margin trading can amplify your profits or losses.

By trading responsibly, traders can short cannabis assets.

With responsible trading, traders can short cannabis assets while using leverage to amass more immediate profits than they would achieve without leverage.

When considering shorting cannabis stocks, it is ideal that you keep your targeted asset list confined to the top-performing marijuana stocks and ETFs.

Here are some big hitters to consider in the cannabis sector:

| Type | Company | Market Cap |

| Grower/Retailer | Cresco Labs (OTC: CRLB.F) | $1.315 B |

| Aurora Cannabis (NYSE: ACB) | $1.05 B | |

| Canopy Growth Corporation (NYSE: CGC) | $6.11 B | |

| Green Thumb Industries (OTC: GTBI.F) | $3.082 B | |

| Cronos Group (NASDAQ: CRON) | $1.892 B | |

| Aphria (NASDAQ: APHA) | $2.295 T | |

| Tilray (NASDAQ: TLRY) | $60.918 B | |

| Charlotte’s Web (OTC: CWBH.F) | $456.018 M | |

| OrganiGram (NASDAQ: OGI) | $240.167 M | |

| HEXO (NYSE: HEXO) (TSX: HEXO) | $399.668 M | |

| ETFs | Horizons Marijuana Life Sciences ETF (OTC: HMLS.F) | N/A |

| ETFMG Alternative Harvest ETF (NYSEMKT: MJ) | $551.230 M | |

| Ancillary Providers | Valens (OTC: VLNCF) | $212.771 M |

| Scotts Miracle-Gro (NYSE: SMG) | $9.485 B | |

| Biotechs | GW Pharmaceuticals (NASDAQ: GWPH) | $2.878 B |

| Cara Therapeutics (NASDAQ: CARA) | $707.053 M | |

| Corbus Pharmaceuticals (NASDAQ: CRBP) | $728.055 M | |

| * These values were gathered 09/02/2020. | ||

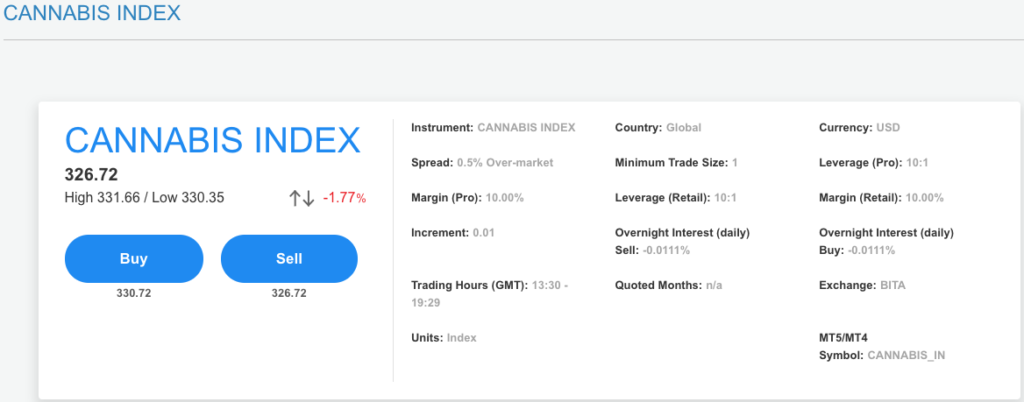

AvaTrade

Regulated by multiple financial authorities, AvaTrade is an industry-leading CFD brokerage whose wide asset selection makes them ideal for cannabis investors.

Traders can invest in cannabis ETFs, stocks, indexes, and CFDs.

The platform is tailored to accustom both novice and professional traders and has over a decade of experience within the online investing arena.

PUT Options

| Pros | Cons |

| The less initial capital required. | The contract becomes worthless if the strike price is not hit. |

| Costs of trades are known. | It’s difficult to short a bullish sector. |

| The flexibility of trade options. | A margin call may occur with inadequate funds. |

| High risk. |

Going Short CFDs on Cannabis

Traders can more effectively short cannabis CFDs and ETFs than stocks.

Opposed to trading physical assets, CFDs allow for the trading of particular units.

By correctly predicting whether the price will rise or fall, you can generate profits.

Although there are advantages and disadvantages to shorting cannabis CFDs:

| Pros | Cons |

| There are no shorting rules with CFD instruments. | Poor money management may lead to losses. |

| Access multiple cannabis markets at once. | Short selling CFDs may have interest charges. |

| Less trading requirements. | You do not have ownership of underlying assets. |

| There is a lower capital outlay and higher ROI. | There are collateral requirements to avoid a margin call. |

The Bottom Line

The consensus surrounding the cannabis sector reveals a bullish euphoria.

Through equipping yourself with the information shared above, you should have a more thorough and educated background concerning the present and future workings related to the cannabis sector and cannabis trading.

Should you have questions about this publication or valuable insights to share, we invite you to share your feedback below.

Good Trading,

Tim Lanoue

Leave a Reply