Forex Robots Performance: Reality & Myth Deconstructed

Trading is a great way to make money online, and especially during the last as of 2019, the market has seen more newcomers to trading than ever before. However, since the impact of Covid-19 is becoming less relevant now, many traders feel that they no longer can afford to spend hours watching the charts. Most likely you are one of them, a person who was somehow successful trading currencies or other assets online, but now you are looking to add a forex robot into your portfolio. trades.

The good news is you came to the right place. So buckle up and keep on reading. In this guide we are going to explain to you what Forex robots are, how to select a proper one, and how to not get scammed with all of the flashy ads promising your 1000% ROI.

What are Forex robots?

Introduced in the 1980s since then it has been used by numerous large trading firms. Forex robot is a method of trading utilizing computer programs, they are also referred to as Expert advisers(EAs) or algorithmic trading systems. Recently data has revealed that algorithmic trading holds approximately 20% of all institutional FX trading and 50% of all equity trading volume. Major benefits that traders all over the world seem to care about when it comes to FX robots are low capital requirements and how easy it is to set it up. Some say trading robots are one of the nicest ways to enter the market of Forex trading because of how user-friendly they are.

While Forex robots seem to have positive prospects, nonetheless it is crucial to also take into consideration some of the less pleasant aspects of it. There are numerous ways to avoid dysfunctional trading robots, but in this article, we are going to focus on the ones that work.

What defines a successful Forex robot?

There are multiple aspects that define if the trading robot is successful. One of the first ones, which should be pretty obvious is a well-built, strong algorithm. The main advantage of algorithmic trading is how automated the whole process is. A good algorithm should perform multiple transactions simultaneously. Some of the advanced Expert Advisors (EA) also make sure to take into consideration the world’s major events and automatically stop working to avoid any losses. In addition to that, it is a common fact that the Forex market moves fast and due to that traders can miss some of the upcoming opportunities. If done correctly, Forex robot trader has the advantage of curating those opportunities that otherwise would be overlooked.

With trading robots just like any other FX trading strategy, profitability is something that all traders should probe. Nobody wants to invest in a robot that will not make any money. To avoid choosing the wrong trading bot make sure to check out its verified trading history with back-testing and live trading results to back the statements up and see how it performed over the past year. We are going to further talk about our recommendations as to which trading robot to invest in later in the article.

Another key factor is the amount of involvement the trading robot needs from a trader. In most cases less means better. When trading robots were in the early stages of development, one of the goals was to make them as automated as possible. Trading robots with minimal involvement allow traders to manage trades remotely when they are not even sitting in front of the screen. It also allows traders to sit back while the algorithm is doing a deep market analysis before it proceeds to make any trade decisions. The idea is for the robots to be able to work autonomously with no human interjection and minuscule attention.

What to look for in a successful Forex robot?

We have pretty much covered what the successful FX robot should look like. On the other hand, there are more specific aspects traders need to take into account. Here’s the list of all of the aspects you should look for in a successful Forex robot.

Risk-reward ratio

One of the essential indicators of any trading bot is the risk-reward ratio. It marks a possible reward that an investor can earn for every $ they risk on an investment. To put it in simpler words Forex risk-reward ratio measures how much you are risking for how large of a return. Be sure to use preexisting trading history and strategy to measure an appropriate ratio. There is no right or wrong but make sure to do proper research to be more confident with your decision whilst investing.

Though there is not a perfect risk-reward ratio, most Forex traders consider 1:3 to be ideal for their investment.

Drawdown

Drawdown is a term that indicates how much a trading account/investment is down from the peak before it recovers back. To estimate a drawdown you should simply subtract the peak amount on your investment to the thorough, which is the lowest point until the accounts start growing back. The tricky part about calculating drawdowns is that you cannot estimate the trough until the account returns or exceeds the peak. Check out our diagram to help you better understand and visualize the concept of drawdowns.

Trading Style

There are a plethora of different trading styles, be sure to choose one whichever you understand better and seem to like the logic it operates with. One of the newer and more popular ones is Grid Trading, which, unlike most others, achieves its peak performance in a constantly-ranging market that has no clear direction whatsoever. If you wish to learn more about Grid-Trading and robots that utilize them. There is also Arbitrage Trading which is one of the low-risk trading styles. The whole idea of it is to use the inefficiencies of the price in the market across different FX brokers. When it comes to the most used trading styles on market, trend-based Trading takes the lead. Even though this particular style of trading is very popular, it’s much more difficult to execute by yourself due to the intense market research requirements that it has to properly operate.

Live trading performance

As mentioned previously in the article, the trading history is an extremely important aspect to assess how well the forex robot function. One of the best ways to monitor the performance is live trading performance websites such as MyFXbook.

Here is an example of what a well-operated performance monitoring system should look like. It gives you access to all of the important information such as the overall growth of the trading robot, drawdowns it has seen previously, the profit that it has generated, etc.

Third party verification

Even though scamming Forex robots are no rarity in the FX market, there are ways to make sure you are not jumping the bandwagon with a fake trading robot. Third-party verification is safe reassurance that the trading bot is not a fraud. Besides being one of the best platforms for live monitoring, MyFXbook is also a great way to double-check if the trading robot is verified by its system.

What software do I need to run a Forex robot?

All of the most popular Forex trading robots are Expert Advisors (EA) which have different platforms that EAs need to be compatible with. The list includes MetaTrader 4 (MT4), MetaTrader 5 (MT5), Ctrader, and others. These platforms help you to see your FX robots progress.

In the market of Forex trading Expert Advisors play crucial roles as the building foundation for any automated Forex robots, they can be programmed to execute actions such as trading according to preset criteria. The criteria are set by pre-developed algorithms that do most of the job and make traders live’s way easier.

Where Do I find Forex Robots that work?

One of the most commonly used questions surrounding Forex robots is where do we find the one that actually works? There are numerous companies that try to develop automated trading robots, some are more successful than others and to make it easier for you, we have curated a list of all of our top Forex robots that have all the necessary requirements to suit your needs. Here at Elite CurrenSea, an award-winning company in the Forex market, we can recommend to you our well tested Forex trading robots that have an extensive trading history and additional tools to help you set up Expert Advisor.

Athena EA

Athena EA is one of the most powerful and aggressive Forex trading bots. It has already been operating for two years and during that period of time, EA has not closed any months at loss. This trading bot is fully automated which means there’s no necessary involvement needed from the traders’ side. Athena EA also comes with a special guide that helps you set up the trading robot which makes it a very user-friendly option. This expert advisor has different versions; rental and managed. With a managed account you need €0 upfront fees.

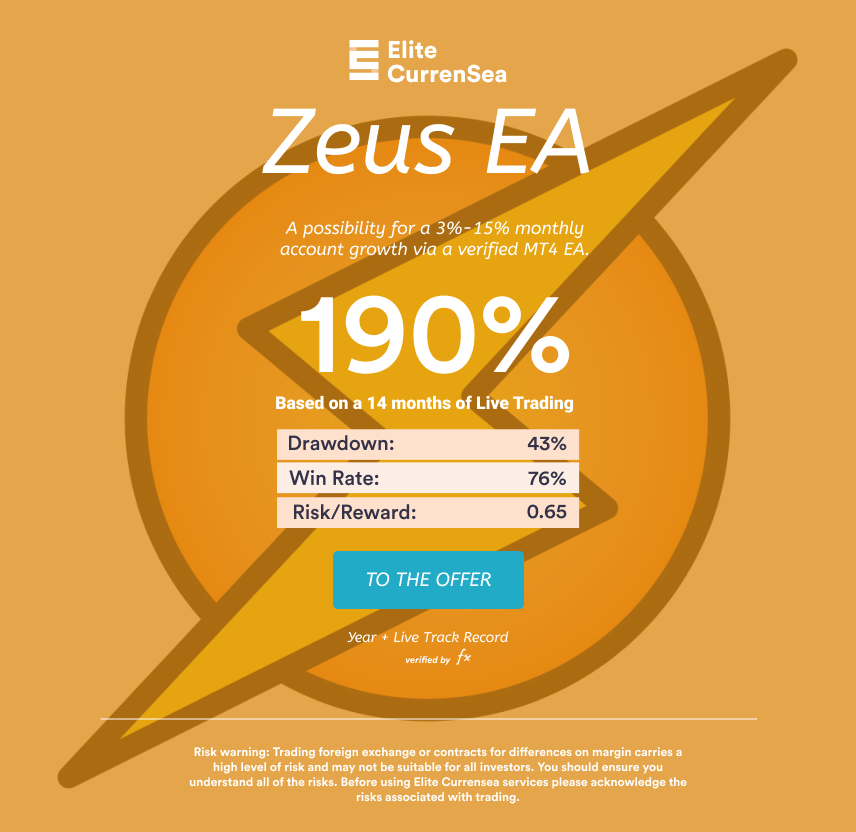

Zeus EA

One of the strongest automated Forex trading bots, Zeus EA, has been designed to generate a monthly passive Forex income for the clients without their involvement. Just like the previous trading bot, Zeus EA is also fully automated. On top of that this trading robot is very fast and manages to have complex monitoring which allows it to perform on a larger scale.

There are special websites where you can find additional information about different types of Forex trading robots. We suggest using these three websites for discovering the new Forex trading robots.

Forex Robot FAQ

Does the Forex robot work?

Even though most of the Forex robots do technically work, it is advised to invest in the one which has a good trading history. There are numerous scamming trading robots that promise unattainable profits and growth so it is always recommended to make sure it has third party verification.

Are there profitable Forex robots?

One of the most profitable Forex robots, Athena EA has an average of 200% yearly return. This Expert Advisor utilizes a Grid Trading strategy and for the past two years of its existence has not closed a single month on a loss.

What is the best Free Forex robot?

Elite CurrenSea, has introduced a managed version of Athena EA that requires €0 upfront, with a 25-35% profit share, depending on the net capital. This option gives the traders ability to better understand the power of automated trade robots and their maximal potential.

What are the best Forex robots of 2021-2022?

Here, at Elite CurrenSea, we can only be sure about the products that we develop in-house, hence we can recommend you take a glance at Zeus EA and Athena EA as so far, these two have been the best Forex robots in 2021-2022 within our product range.

Leave a Reply