What’s Under the Tree of Financial Managers This Year?

This month, Bank of America’s Global Fund Manager Survey revealed a noticeable uptick in optimism among the 281 professionals surveyed, whose collective portfolios are worth more than $725 billion. Let’s take a peek into their views on the global economy, inflation, and the assets they currently favor and those they anticipate favoring in 2023.

Global Economy Perception

Just one month made a world of difference to fund managers’ outlook on the Chinese economy – in the November survey, 77% of respondents anticipated a recession within the next 12 months, however this decreased to 68% in the December survey.

This change of heart is largely thanks to China’s efforts to reopen its economy, and now in the most recent survey, 77% of fund managers have projected a stronger Chinese economy in 2023 – a gigantic leap from the mere 13% from the month prior. It’s the most confident these investors have been about China since May 2021 and the biggest surge in optimism since January 2020.

Approximately 75% anticipate that by the close of 2023, China will have completely restored its economy to full working order.

What About Inflation in 2023?

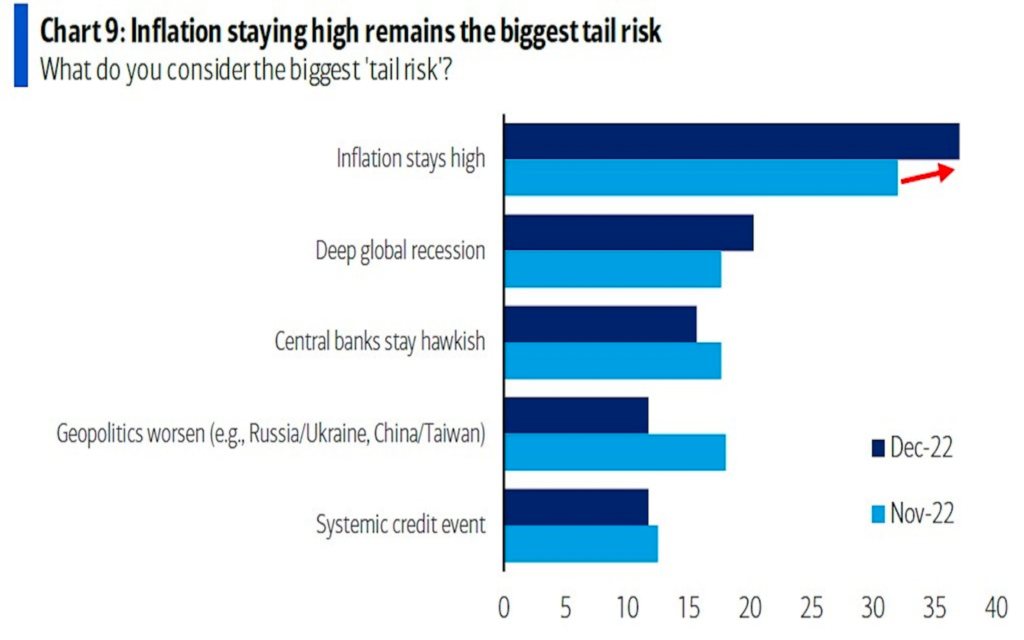

For six consecutive months, US fund managers have voiced their greatest concern. Now, however, a record 90% of them think that inflation has reached its peak, and the Federal Reserve’s predictions suggest US Treasury yields will reduce to 4.2% in the next year. Additionally, 42% of these fund managers forecast a drop in rates, the highest proportion since March 2020.

What Assets Do They Hype?

At the top of their list, they hold a fondness for government bonds, with a whopping 27% anticipating that these will be the top asset class by 2023 – far surpassing the 25% that choose stocks, and a mere 4% that select crypto.

As the US Federal Reserve hikes interest rates, a recession looms on the horizon, prompting investors to seek refuge in safe-haven assets such as government bonds. With 2023 approaching, US bonds are viewed as an attractive option and this drab outlook has only increased their allure.

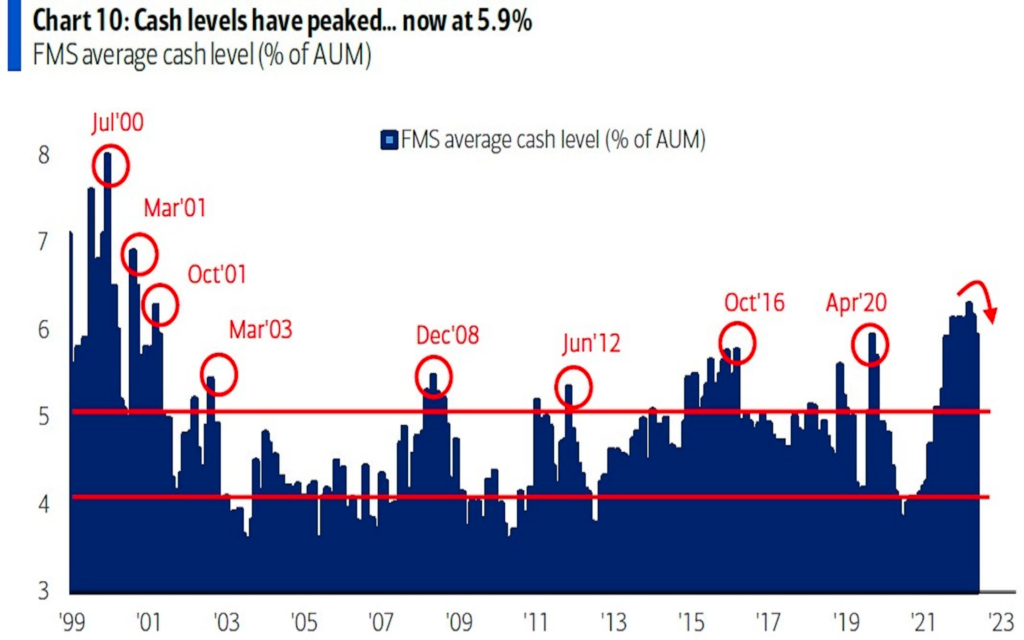

Fund managers weren’t totally pessimistic in December – in fact, they had a slightly brighter outlook about the markets, reducing their cash holdings from 6.2% in November to 5.9%, suggesting an appetite for risk and a readiness to seize potential opportunities.

Cash levels can be used strategically as a way to signal when to purchase or sell global stocks. When they are above 5%, it could be a good moment to buy, and when they are below 4%, it may be a good idea to sell. Still, like with all market indicators, it is best to take into account the broader context – never just rely solely on this signal.

Fund managers, at present, appear to have a preference for stocks – or at least some stocks. They are being careful not to commit too heavily to equities in established markets like the UK, where they maintain an average underweight of 18%. But they appear to be more open to the notion of investing in riskier emerging economies, as indicated by their average overweight of 13%.

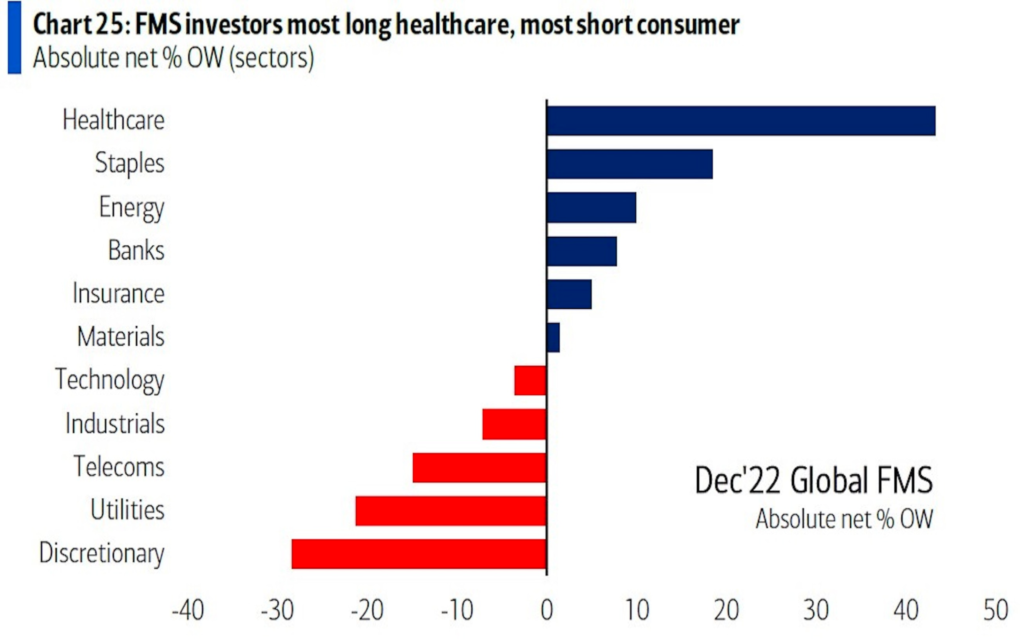

Avoiding consumer discretionary stocks and being conservative with utilities and telecommunications stocks, they have collectively piled into healthcare stocks, and to a lesser degree, consumer staples and energy firms.

They are bullish about gold’s potential: 21% consider it to be undervalued – the highest since 2008.

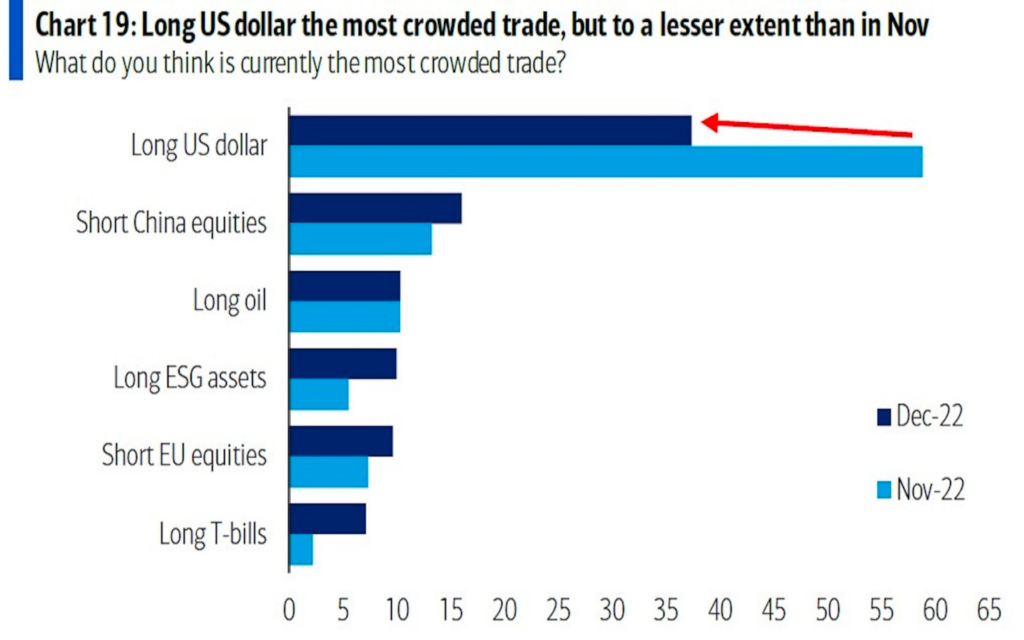

At the same time, however, they have a negative outlook on the US dollar; an unprecedented 51% anticipate that it will depreciate, and have been closely monitoring it as the most crowded trade of them all – hinting at a potential selloff.

What are the angles here?

Since the main purpose of these trading ideas is to show you our thinking about the global markets, it would be a crime not to invite you to invest in managed accounts under our manual and automated methods.

Passive moves:

For spikes, with Portfolio ECS, you will be betting on us catching the discrepancies between asset prices and the freshest news (we are nearly 1,000% up this year, it’s been crazy, we know). All at 20% expected drawdown (we use SL and Dynamic TP to maximize the results).

For ranging markets, ECS Live (Managed), offers major currencies, commodities (gold for now), and indices (DAX and DOW). You can also get a taste of this account by joining a telegram channel with signals for free now or getting one of the five EAs that run the game on that account here.

Active moves

Make sure your account has enough equity to enter some of a longer-term positions on popular Chinese stocks and get some longs on gold.

Since we might be after all approaching a global recession, consider holding actual stocks as opposed to trading CFDs. Dollar cost averaging may begin in that direction.

Safe Trading

Team of Elite CurrenSea 🇺🇦❤️

Leave a Reply