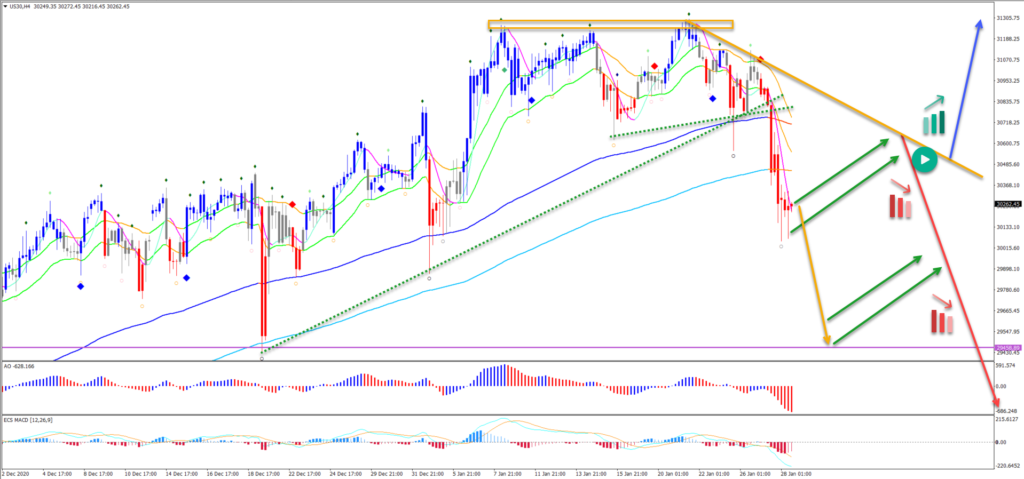

❗️ US30 Double Top Pattern Creates Bearish Daily Candle ❗️

Dear traders,

the Dow Jones Index (DJI or US30) broke below the daily 21 ema zone yesterday. This was the first bearish breakout since the end October 2020.

This article reviews the implications and expectations of the break. Is there a bearish reversal around the corner? Or just a simple retracement within the uptrend.

Price Charts and Technical Analysis

At the moment, the answer to the question could be both. There are a few strong arguments for a deeper pullback. But an uptrend continuation is certainly not ruled either.

The main reasons for a bearish retracement are summarized as follows:

- Divergence pattern between the tops on daily chart (purple line).

- Recent double top pattern (orange box in image below).

- Break below the 21 ema zone.

- Break of the rising wedge reversal chart pattern.

- Potential completion of 5 bullish waves up.

- Yesterday’s strong bearish daily candle.

Therefore, a bearish ABC pattern (purple) is certainly a valid expectation (red arrows). The retracement targets are the long-term moving averages, which could act as a support zone.

Alternatively, any mild pullback to the 144 ema (orange arrow) or bull flag pattern (grey arrows) could just indicate a mild pauze in the uptrend before price moves up higher (green arrow).

On the 4 hour chart, we can see the double top reversal pattern. Plus the steep decline since the appearance of the chart pattern.

Currently, price action is in bearish territory (price is below long-term moving averages). Any mild bullish retracement could start another bearish swing down (red arrows).

Only a bullish break above the long-term MAs and resistance line could change perspective back to a bullish zone (blue arrow).

The analysis has been done with the indicators and template from the SWAT method (simple wave analysis and trading). For more daily technical and wave analysis and updates, sign-up to our newsletter.

Leave a Reply