Thursday Post-CPI Rally & State of the Market

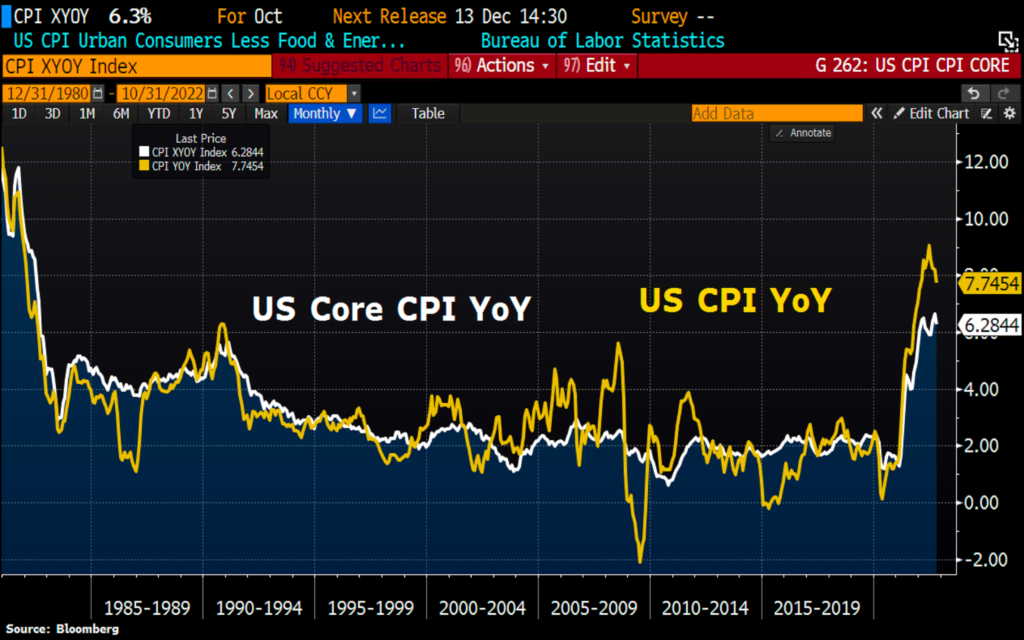

The lower-than-expected US inflation data sparked a massive rally in global stock and bond markets Thursday. Optimistic investors saw this as a sign that the Federal Reserve’s (the Fed’s) interest rate hikes were already having the desired effect of slowing down inflation.

They figured that the next step would be for the Fed to cool its jets on those future rate hike plans. Never mind that the October inflation pace of 7.7% – while still a slowdown from September’s print of 8.2% – is still significantly higher than the Fed’s 2% long-term target rate.

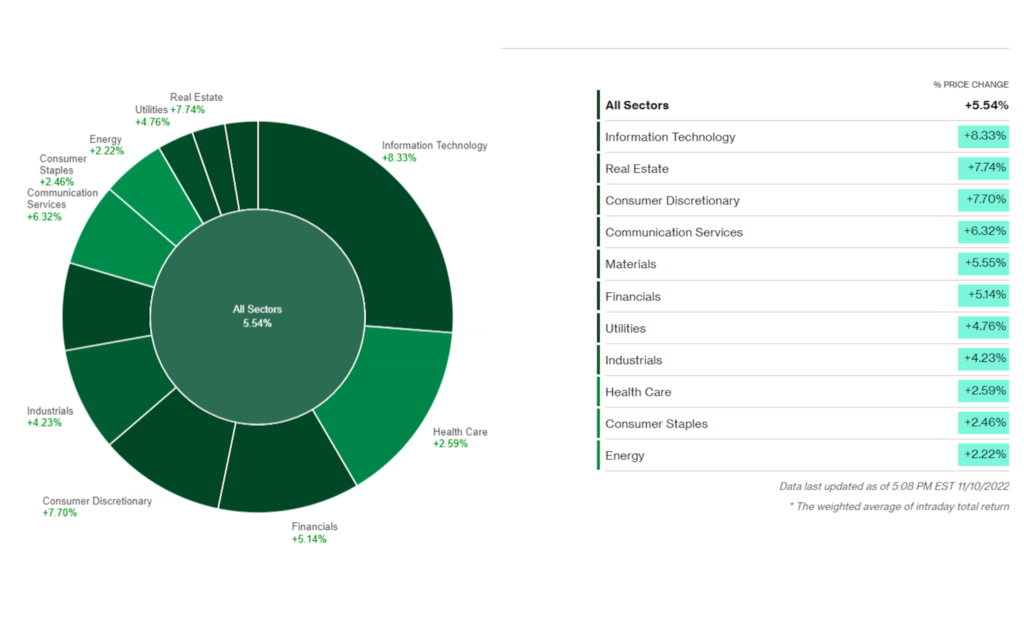

The US and European indexes rose sharply, with the S&P 500 rising 5.5%, the Nasdaq 100 rising 7.5%, and the Stoxx 600 rising 2.8%.

An interesting price reaction on Thursday showed how negatively positioned investors were and the potential risks to the upside. A little positive news is all it takes to drive an outsized price reaction.

It’s hard to understand the market, much less try to time it. But Thursday’s price rally just goes to show that the old adage is true: it’s not about timing the market, but about time in the market.

We made a bet on this outcome in the account attached to Portfolio ECS with Yamarkets and Exness and bought SP500 & US10 prior to the report release.

The result was a bit higher than we expected, but we could not complain, and not putting a Take Profit too conservatively in Yamarkets allowed us to collect a whopping 920% (more in this here) in one day of trading, the best one up to date.

Don’t get us wrong, days like this are very rare, but time in the market and grinding eventually pays off if you have a strategy, last night, ours aligned with the rest of the market.

Safe Trading

Team of Elite CurrenSea 🇺🇦❤️

Leave a Reply