Three Reasons To Bet On European Growth

Although it may be difficult to find reasons to be optimistic about the current state of the markets, there are still reasons to be excited about investing in Europe. As value investor Howard Marks once said, you need to think differently and better than others in order to outperform. So here are three reasons why you can still be excited about investing in Europe…

Europe Still Boasts Heeps of Quality Firms

Investing in Europe doesn’t have to be a gamble. More than half of the revenue that flows into European companies comes from outside the continent, and Europe is home to many world-class companies with global sales. Multinational luxury brands like LVMH, Hermès, Kering, Richemont, Pernod Ricard, Ferrari, and Porsche are all based in Europe, and the recent market selloff could present a great opportunity to pick up their shares at a bargain.

Although the luxury sector is not entirely recession-proof, its connection to ultra-high-income consumers puts it in a good position: faced with high inflation and energy costs, these heritage brands can increase prices without a significant impact on demand from their affluent customer base. In addition, since many of these companies still have the stabilizing presence of their founding families, they tend to take the long view and see past any present turbulence.

Incentives to Cut Costs

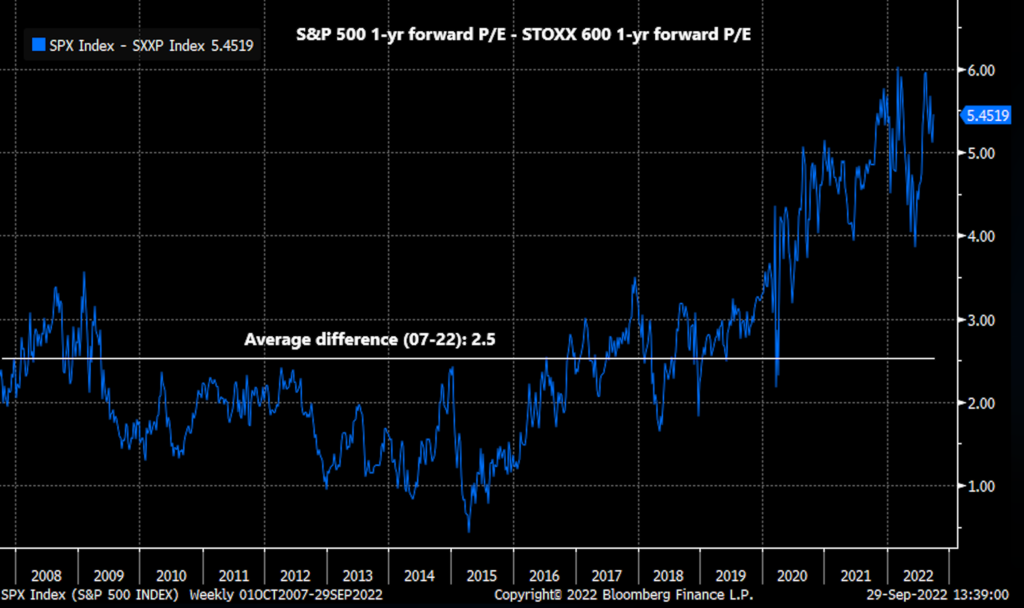

Although European companies have typically traded at a lower price-to-earnings (P/E) multiple than their US counterparts, there is good reason for this discount. On a like-for-like basis, European companies tend to have a more inflated cost structure than their US peers, due to higher tax rates, labor costs, and regulatory burdens.

As energy costs continue to rise, companies are under more pressure than ever to find ways to trim their costs and become globally competitive. This could lead to some much-needed changes in fiscal policy that would benefit the economy as a whole.

Companies that struggle with cost-cutting face a different risk: acquisition. The weakened euro makes them more attractive as acquisition targets, particularly to US companies. A strong dollar and lots of spare cash on balance sheets increase the odds of acquisition sprees.

And companies that operate in fragmented industries, have a higher cost structure versus their peers, have non-replicable brand value, or operate in complementary geographies to competitors are among the most interesting targets. For shareholders, this could be good news: acquirers typically pay more than the market price for the company.

EU’s Leading Stance in Green Technology

As the world struggles to grapple with high inflation, a recession, and energy worries, it is still also forced to focus on the climate crisis. As gas prices continue to rise and the need for energy security becomes more pressing, Europe will only hasten its transition to renewable energy. REPowerEU plan is to attest to this commitment.

Europe is a leading market for green technologies and offers excellent investment opportunities. It is home to leading wind turbine manufacturers like Vestas, Siemens Gamesa, and Nordex, as well as leaders in green energy production like Iberdrola, EDP, Enel, and Orsted. Rather than a one-off stimulus measure, many of the measures proposed by the European Green Deal will continue to drive growth over many years for companies exposed to the theme.

There are plenty of ETFs out there related to energy transition, but many of them include global companies that may not give you the clean exposure to discounted green European stocks that you’re looking for. In addition to investing directly in companies exposed to these trends, you could also invest in the Invesco MSCI Europe ESG Climate Paris Aligned UCITS ETF or the Amundi MSCI Europe Climate Transition CTB UCITS ETF to gain exposure to European companies that stand to benefit from the transition to a lower-carbon economy.

So How To Get Exposer to The Notion that Europe is not All “Doom and Gloom”?

This year has been tough for European stocks, with the Stoxx 600 down 21%. The euro has also fallen 17% against the US dollar. Despite all this, Europe may be a better investment than many people think.

The “buy US, sell Europe” trade has been popular, but that means that negative sentiment is already “priced in” to European assets. The difference between the one-year forward P/E multiple of the S&P 500 and the Stoxx 600 is bigger than it’s ever been in its 15-year history.

Although the winter months may be challenging for Europe, things are looking up beyond that. Warmer weather, improved access to energy, and progress on intra-European sharing are all positive areas of surprise that could move European markets.

To make money in the markets, you need to be ahead of the herd and sometimes bold enough to stand against consensus. And that’s something you might consider doing now, picking up some quality European bets for the longer term at a nice discount.

Safe Trading

Team of Elite CurrenSea ❤️🇺🇦

Leave a Reply