The Uncharted Waters of 2023: An Economic Perspective

The global financial market is akin to a ship in stormy waters, with all hands on deck anticipating the “next big wave”.

With the focus split between the debt ceiling and the promising AI revolution, other underlying data suggests a brewing storm. Yet, it’s crucial not to be swayed by the surface ripples and instead delve into the depth of the currents shaping the global economy.

An Economic Mosaic: Tracing Macroeconomic Currents

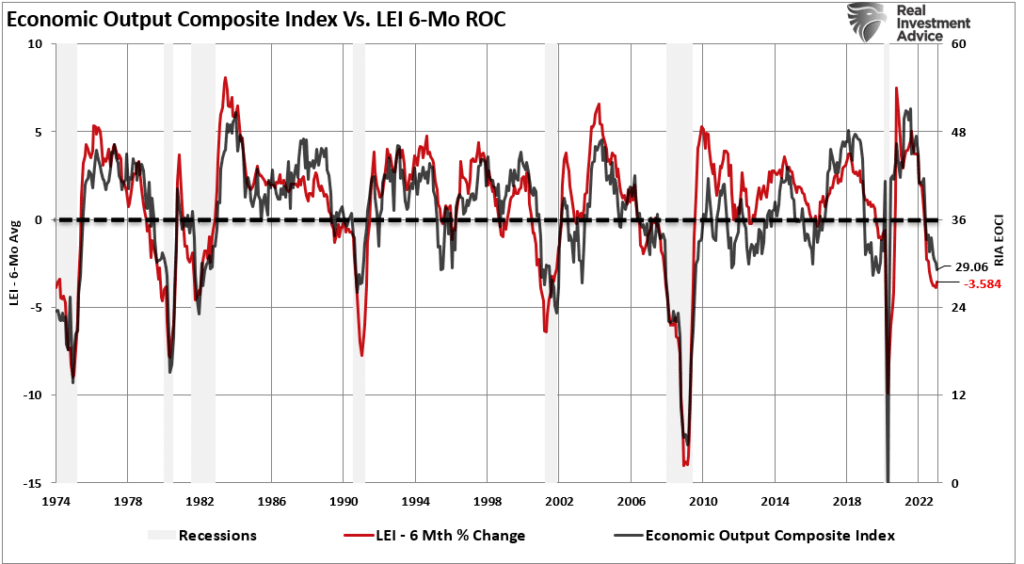

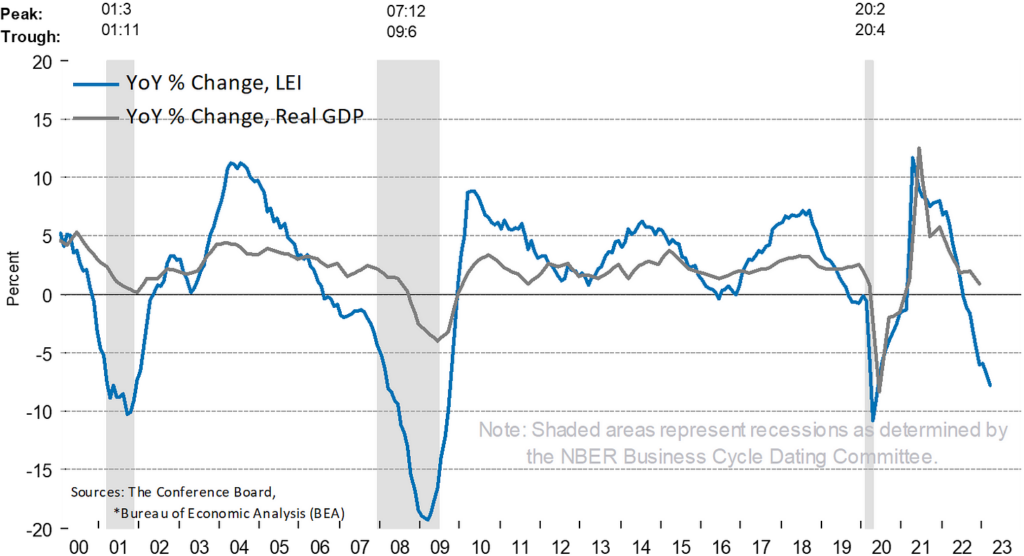

The general consensus among traders is that the market is stuck in a tumultuous stalemate. The Leading Economic Indicators (LEIs) are showing a decline, while equities jostle for their fair market value.

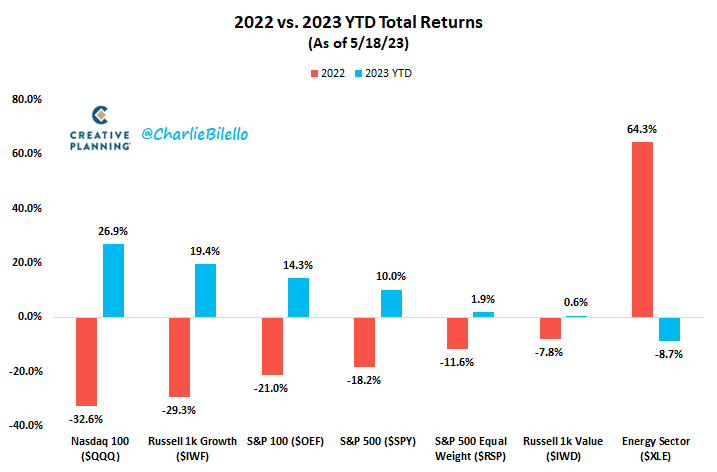

Although 2022 saw a significant contraction in growth stocks’ multiples, a confluence of operational leverage and the AI boom has given some a nudge back towards their peak.

However, 2023’s performance paints a starkly different picture, necessitating a deeper look into various economic indicators.

Chasing Inflation’s Shadow

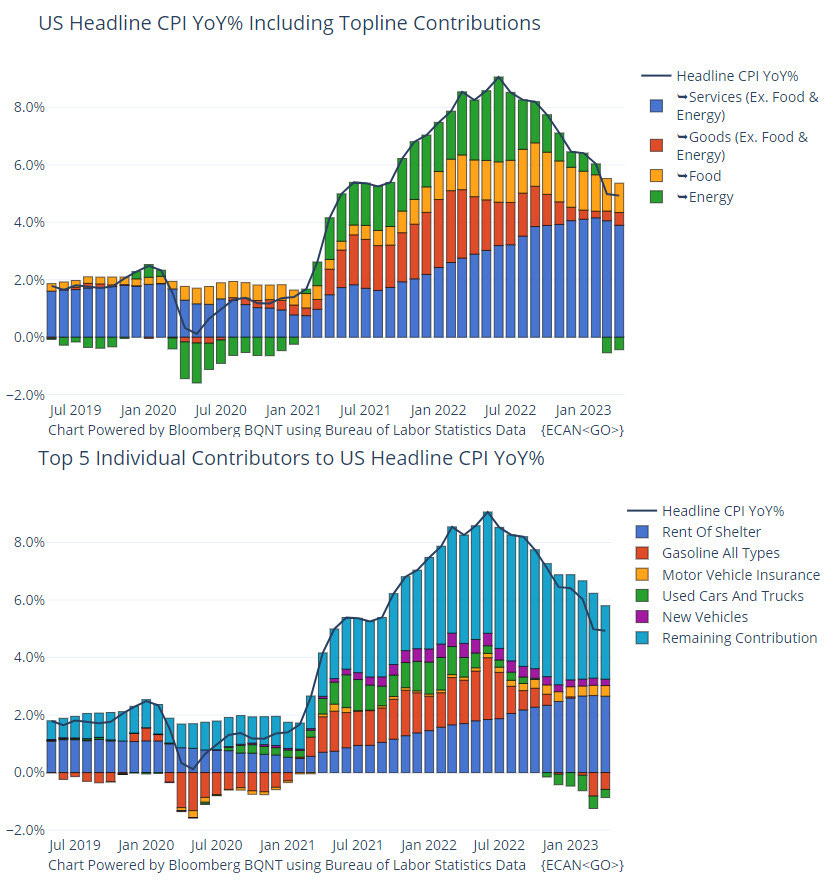

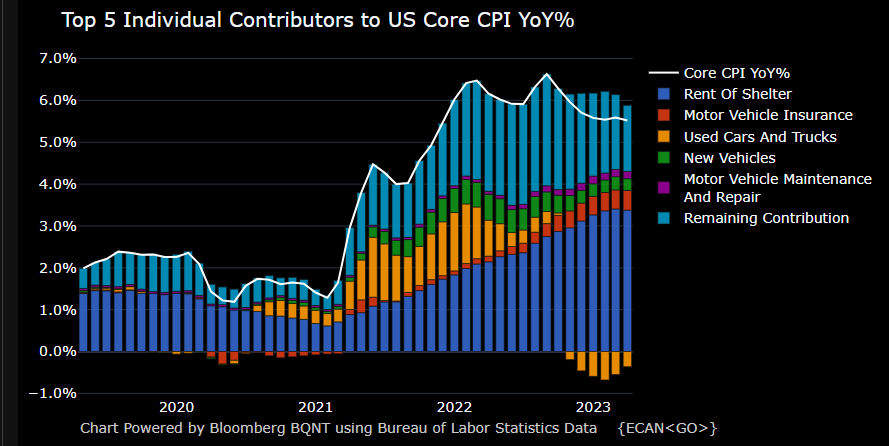

A series of rate hikes have seemingly had an impact with the Consumer Price Index (CPI) registering a downturn, offering a glimmer of hope that Federal Reserve Chairman Powell’s strategy may be working.

Meanwhile, the core components of inflation, often sidelined due to their volatility, also indicate a possible slowdown.

Simultaneously, the housing market’s subtle fluctuations, signified by a slump in US home sales and a significant drop in median home prices, add another layer of complexity.

In the tug of war against inflation, the Personal Consumption Expenditures (PCE) index, a favored measure of inflation for the Federal Reserve, reveals an interesting trend.

With the headline PCE surging to 4.4%, it’s clear that the battle against inflation might require more than traditional methods.

Unraveling the Manufacturing and GDP Conundrum

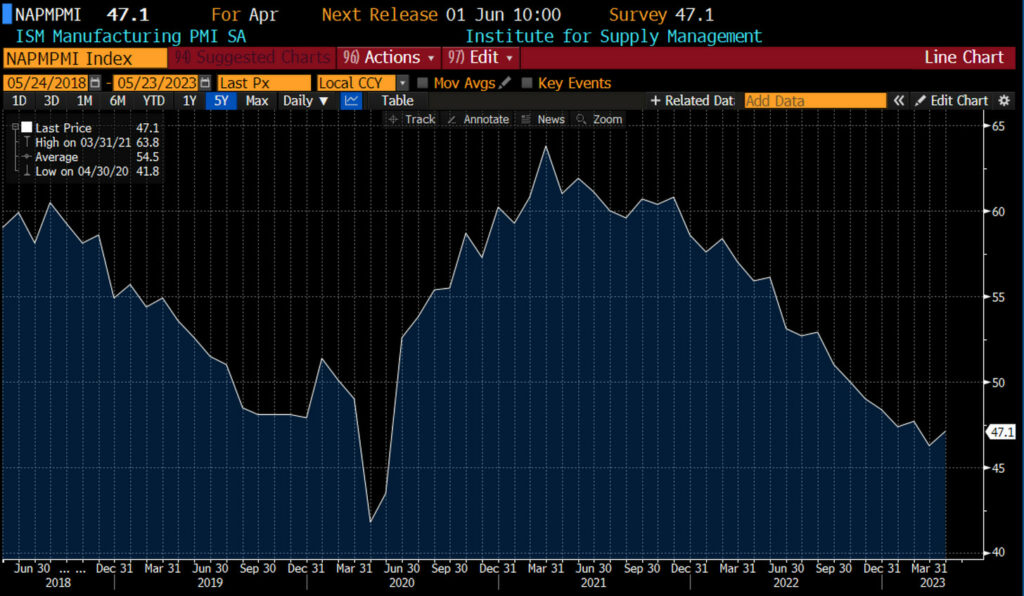

In the realm of manufacturing, the Purchasing Managers’ Index (PMI) suggests a contractionary trend. However, a slight uptick in factory activity might indicate a slower rate of shrinkage.

Debate rages around the definition of a recession, with some eyeing the National Bureau of Economic Research’s definition, while others point to GDP as the key growth gauge. The recent 1.3% growth in GDP, outperforming expectations, adds to this uncertainty.

Balancing Act: Monetary Policy and Bank Runs

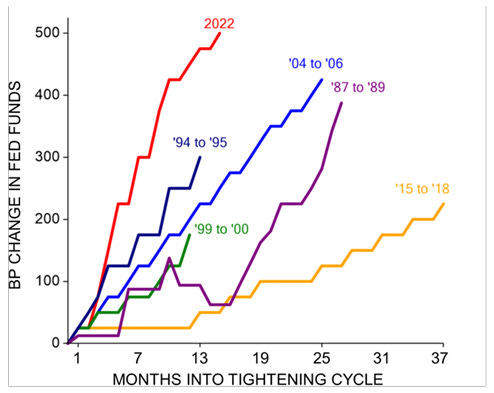

Amid the Federal Reserve’s aggressive interest rate hiking cycle, we’re witnessing a contraction in the M2 money supply, indicating tight monetary conditions.

Meanwhile, despite the 2023 headlines being dominated by regional bank collapses, the rate of decline in bank deposits remains relatively unchanged.

Foreseeing a Recession: The LEIs’ Tale

As Leading Economic Indicators (LEIs) display a rapid deceleration, whispers of an impending recession are gaining momentum. Yet, some financial institutions like Goldman Sachs maintain an optimistic view.

Equities in the Spotlight

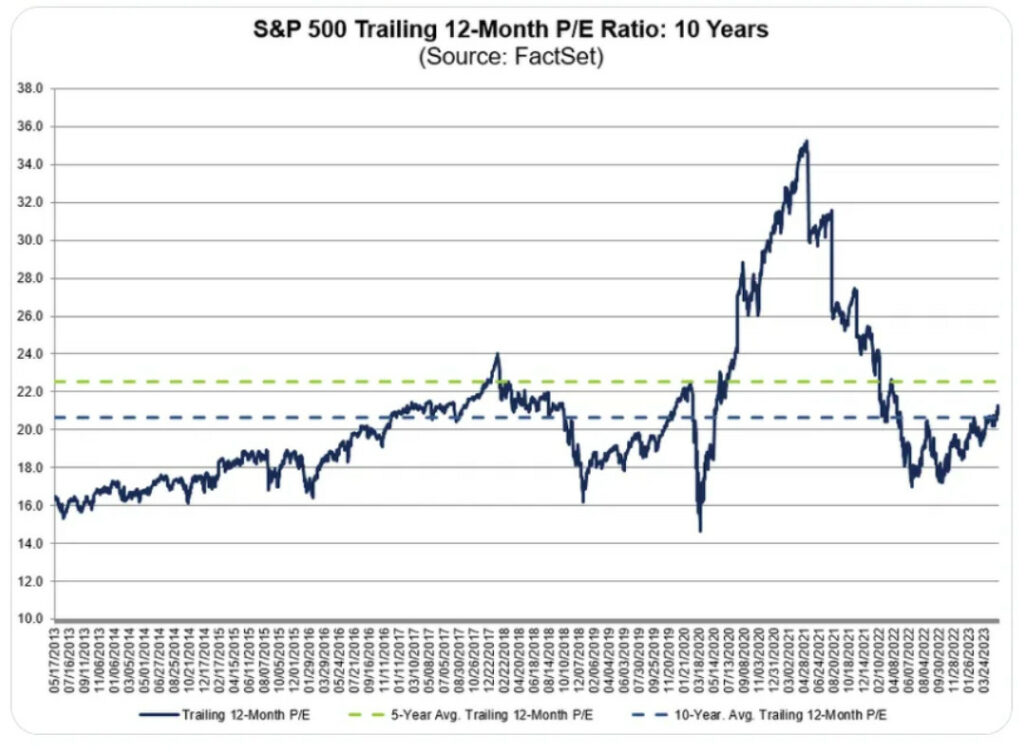

Despite the excitement around AI and concerns about valuation frothiness, the S&P 500’s trailing 12-month P/E ratio rests at 21.3x, slightly below the 5-year average.

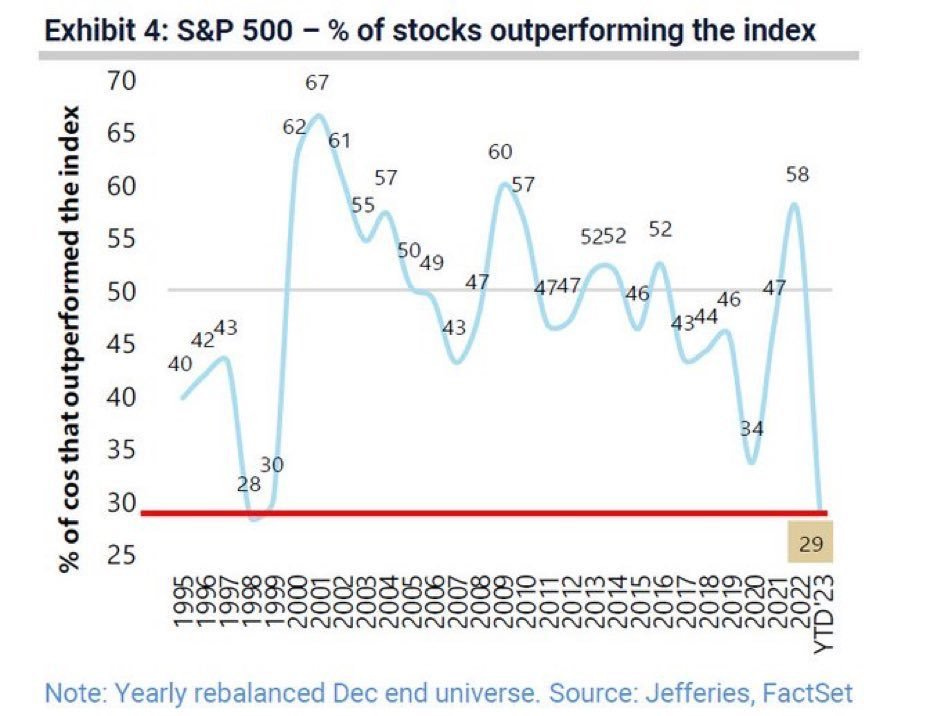

Market participants continue to congregate around specific sectors, resulting in a narrow leadership in the market.

Wrapping It All Up

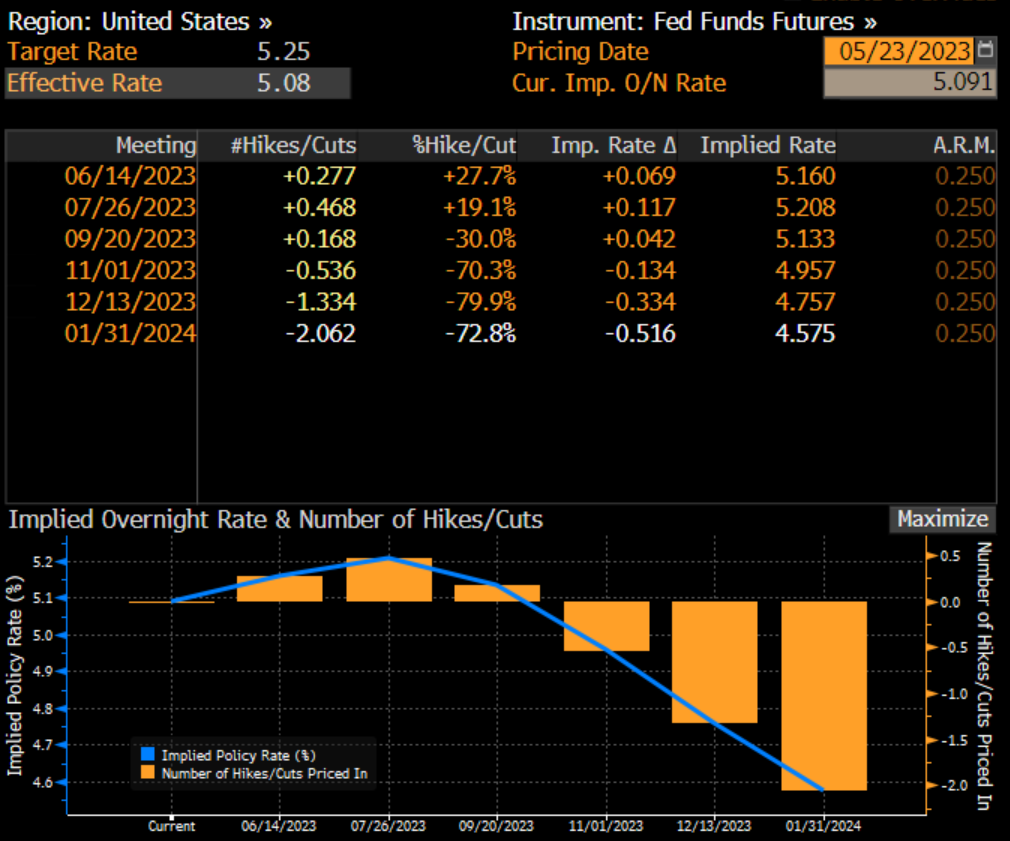

Inflation seems to be cooling and growth shows resilience, but will this balance hold? As the financial market continues to wrestle with an array of complex factors, all eyes are on the Federal Reserve’s next move.

The current upward trend may persist, but the question remains – for how long? Only time will provide the answer to this million-dollar question.

Safe Trading

Team of Elite CurrenSea

Leave a Reply