The Economic Landscape: Inflation, AI and the Market Outlook

The AI Revolution and the Great Chip Shortage

As the world continues to embrace the digital revolution, the booming Artificial Intelligence (AI) industry is demanding more resources than ever before.

This AI surge is causing an unprecedented chip shortage, akin to the infamous toilet paper crisis during the pandemic. According to SpaceX and Tesla CEO, Elon Musk, acquiring Graphics Processing Units (GPUs) has become harder than scoring illicit substances.

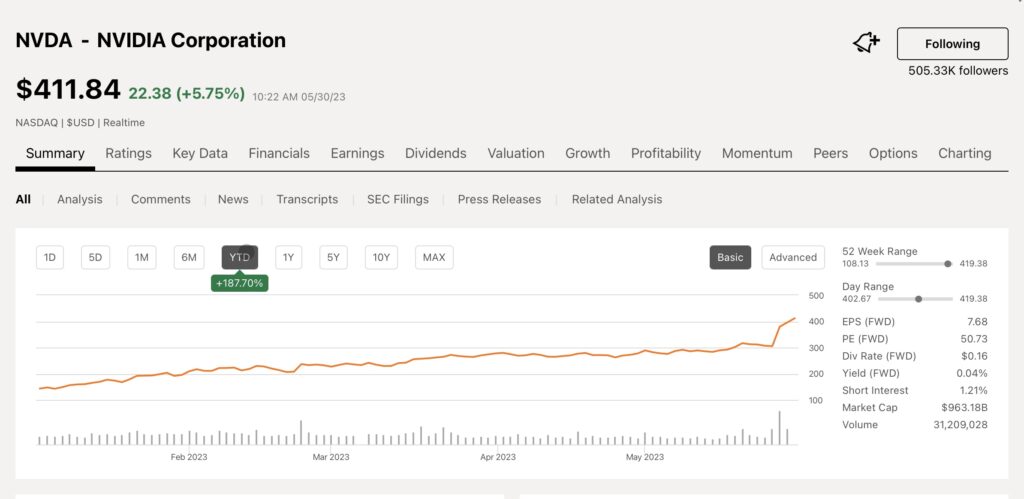

NVIDIA, a trailblazer in the field (duly covered early 2023 buy signal), is on the verge of achieving a $1 trillion market cap, demonstrating the profound impact of this shortage on the industry.

The Debt Ceiling Dilemma and Its Aftermath

In recent political news, President Biden and House Speaker McCarthy have secured an agreement on the debt ceiling. They are now working tirelessly to rally support from lawmakers to get the deal approved by Congress.

The key points of this agreement include nonmilitary spending, military budget augmentation, IRS funding cuts, clawback of unspent Covid aid, and more. A closer look at these aspects reveals the intricate balancing act being played out on the national stage.

The Consumer Spending Spree Continues

Consumer spending continues to be the driving force behind economic growth. Latest data from April showed an unexpected surge in personal spending, far exceeding market expectations.

The impressive 0.8% rise, adjusted for inflation, gives a positive outlook for the economy, bolstered further by the steady growth in personal income.

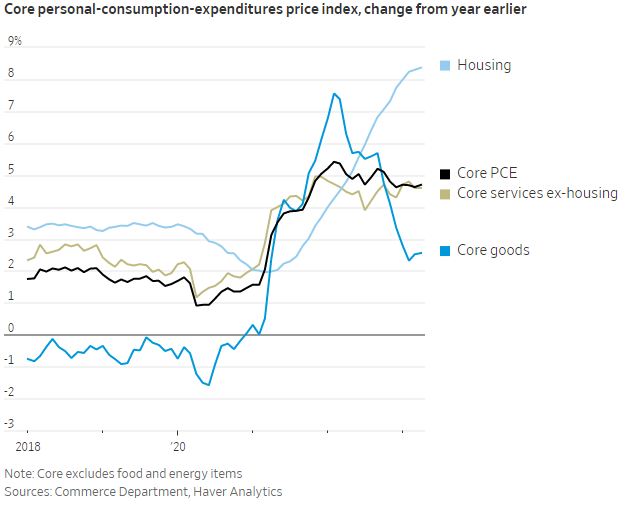

Inflation Worries Loom Over Federal Policies

The economic forecast is not all sunny, however. Persistent inflation is causing headaches for the Federal Reserve as they gear up for their upcoming policy decision.

The rising personal consumption expenditures (PCE) index, combined with the increase in ‘Supercore’ inflation, paints a challenging picture for policy makers.

Tech Stocks Weather the Storm

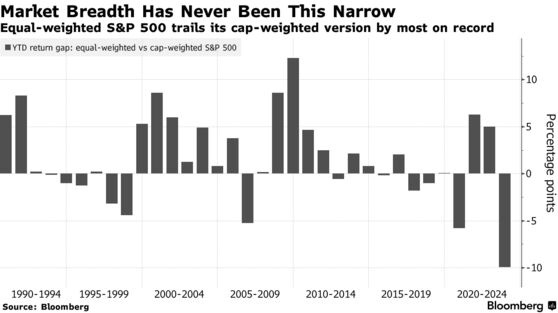

As the economy continues to grapple with uncertainty, investors are flocking to outperforming tech stocks, seeing them as a safe haven.

Healthy balance sheets and a favorable market outlook have resulted in a net inflow of funds into large cap stocks, powering the Russell 1000 index to outperform the Russell 2000 by a substantial margin.

NVIDIA Spearheads the AI Invasion

NVIDIA CEO, Jensen Huang, is capitalizing on the market momentum to place his company at the center of the AI rush.

Huang recently unveiled a suite of new AI products and services, proclaiming a new era in computing. As NVIDIA marches towards the $1 trillion club, the spotlight is on AI-fueled stocks and their impact on the market.

Tensions Rise Ahead of OPEC+ Meet

As OPEC+ gears up for a crucial meeting this week, tensions between member countries Saudi Arabia and Russia are escalating.

Disagreements over oil production cuts and the ongoing conflict with Ukraine are muddying the waters, exerting pressure on the global oil market.

Make sure to check out our flagship multi-asset managed account as a way to diversify your portfolio against more traditional assets like equities, crypto and options.

Safe Trading

Team of Elite CurrenSea

Leave a Reply