Seven Signs that US Inflation Has Peaked

Hi traders, today, we are looking into trading ideas based on the latest analysis of CPI in the US, possible implications on the global markets, and ways to trade the insight.

Trading Idea

| Instrument | Entry | TP/SL | Long/Short | Duration |

| EUR/USD | around 1.08 | 1.05/1.1 | Short | Up to 15 Days |

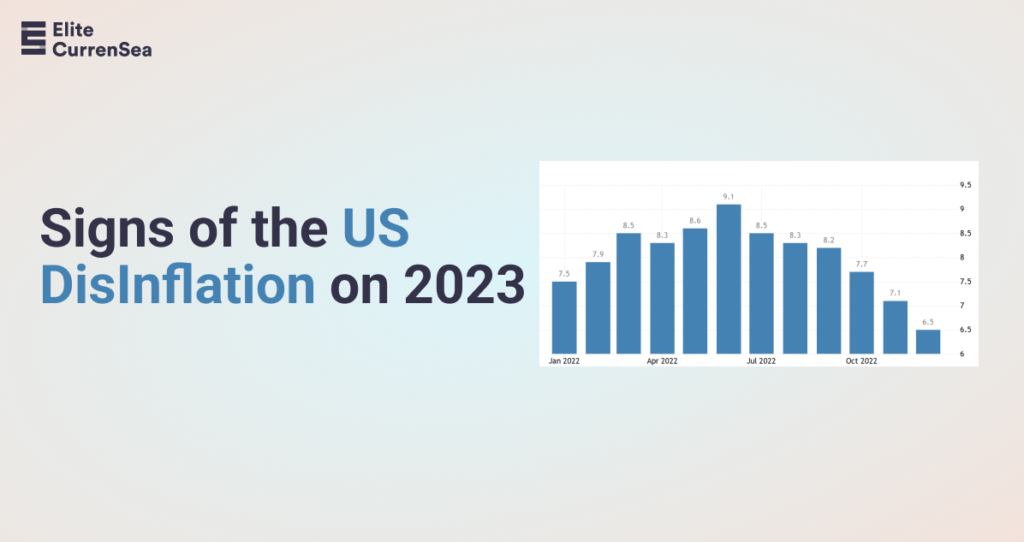

Sign on Disinflation in 2023

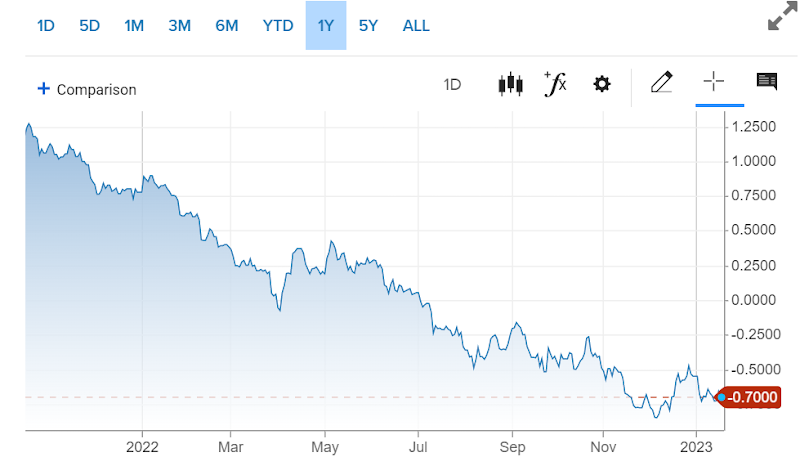

- This year has seen the 10-year yield plummet like a stone; the market anticipates that rates will take a downward turn.

- The US Dollar Index $DXY has taken a dive, and that’s to be expected with the current drop in inflation. When inflation is low, so are interest rates, and that reduces the appeal of the US dollar. As the market reflects that reality, the dollar keeps sinking.

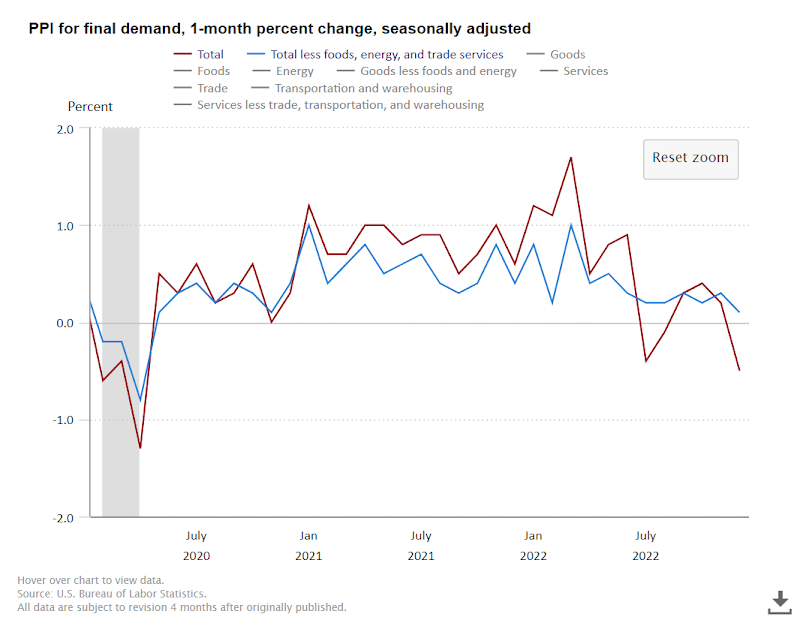

- December saw a 0.5% drop in the Producer Price Index (PPI), a sign that wholesale prices are on the decline, consequently resulting in reduced retail prices.

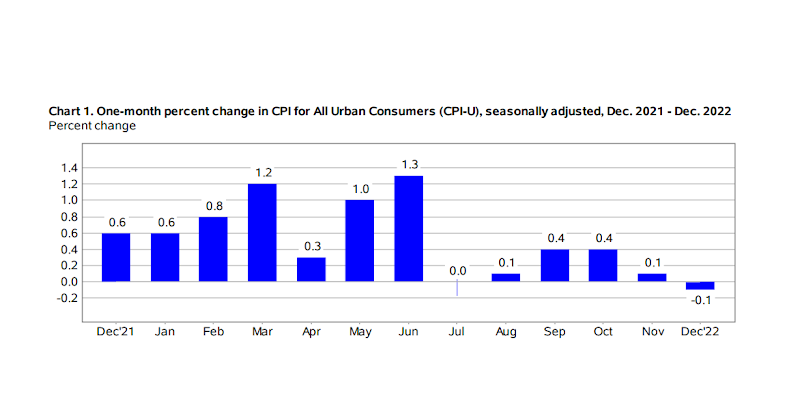

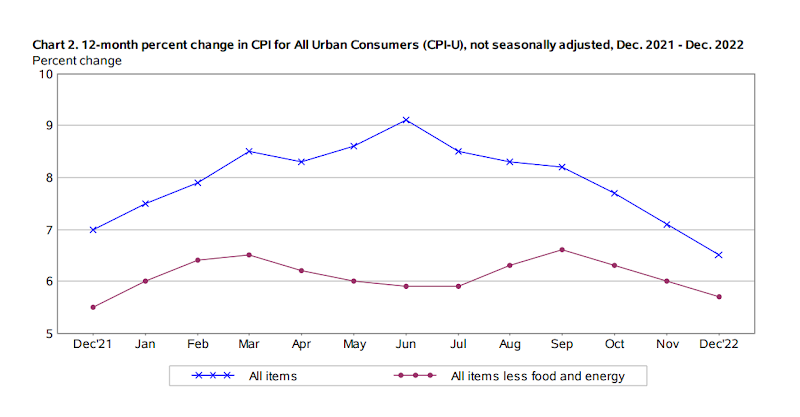

- CPI fell 0.1% month-over-month in December

- The rate of change in CPI year-over-year is falling

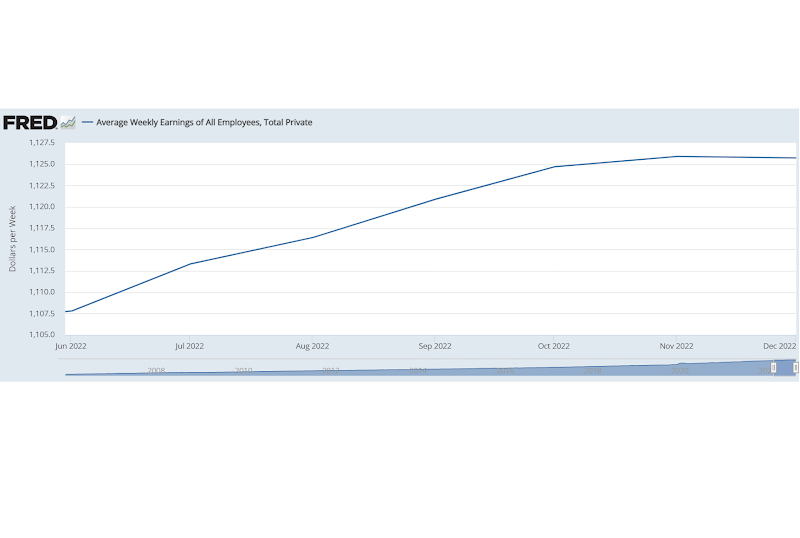

- The labor market is slowing. Wages decreased very slightly in December.

- The 2 year/10 year Treasury yield spread is decreasing. The yield curve is becoming less inverted.

Overall, the inflation rate seems to have eased, now, with all the eyes on unemployment numbers and quarterly reports of major US and International businesses should shed more light on the state of the likely recession.

You can gain exposure to market volatility via Flagship Portfolio ECS (manual, news, and longer term multi-asset trading), as well as our Algo managed account (preview signals here).

Safe Trading

Team of Elite CurrenSea 🇺🇦❤️

Leave a Reply