Morgan Stanley is Not So Sure About This Bull Rally

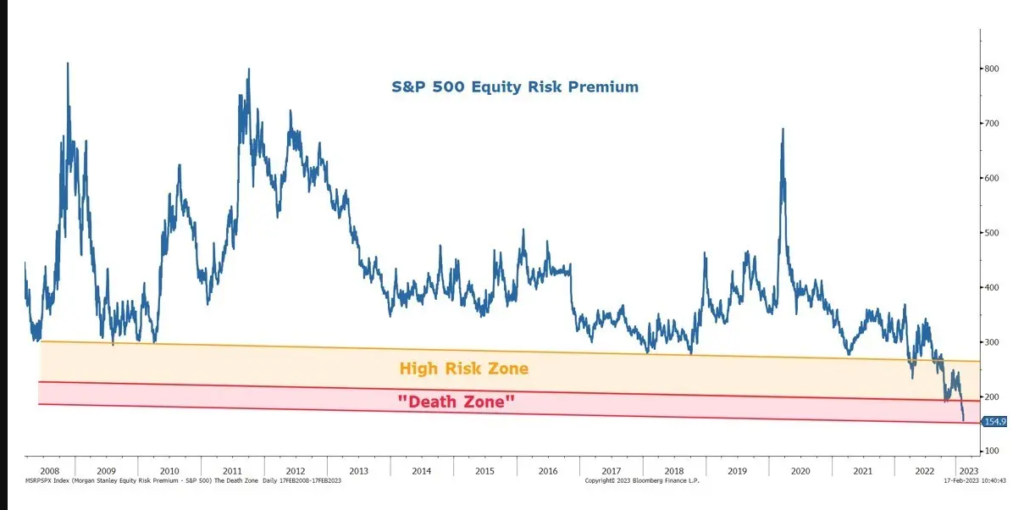

The stock market is a volatile and ever-changing entity that often leaves investors on edge. The current market conditions are no exception, with Morgan Stanley warning that US stocks are in the “death zone,” a term used to describe the altitude at which oxygen levels become so low that even the slightest mistake can be fatal.

The bank has compared this to the current state of the stock market, where valuations are at an all-time high and the equity risk premium (ERP) is at its lowest level since 2007. The ERP is the extra return that stocks are expected to deliver over bonds, and the higher it is, the more “margin of safety” investors have in case something goes wrong.

In October 2021, the P/E ratio was at a relatively safe 15x, and the ERP was close to 3%, encouraging many investors to set their sights on the summit of the market. However, after the P/E ratio reached 18x in December, and with the ERP “oxygen” dropping to a low of 2%, many investors retreated to the safety of the base camp.

However, some investors continue to take risks, loading up on speculative stocks and leading the group back to new highs. P/Es are now at a high 18.6x, and the ERP is still at its lowest level since 2007. This puts stocks further into the “death zone” than they have ever been before and for so long.

The question now is, should traders and short-term investors attempt to climb this high-risk path? The answer is yes, but only if they do not underestimate the risks involved. While it is still possible to reach the summit and come back alive, there is very little room for error. Those with a short-term view should be particularly cautious and have a clear exit strategy in place.

However, for longer-term investors, the current market conditions may be less of a concern. Market volatility is inevitable, and history shows that the market eventually recovers from periods of decline. While it is never possible to predict the exact timing of a market recovery, those with a long-term view should be able to ride out any short-term volatility.

If you are looking to benefit from both approaches, while things may become more complicated Forex and CFD and investing can go hand in hand!

Final Heads Up

The stock market is in the “death zone,” and investors should proceed with caution. Traders and short-term investors must be particularly careful and have a clear exit strategy in place.

If you are looking at it from an investors prospective, the current stock market conditions are a stark reminder that investing requires patience, discipline, and a long-term view. Dollar cost averaging is the safest bet here.

Meanwhile, traders would welcome extra volatility in the market, capitalising on both up-word and downwards moves. Be ready to have your shorts targeting the asset classes that gained the most in anticipation of US equities falling (SP500 short) and USD strengthening again (EUR/USD short).

Less active investors/traders can also join one managed accounts Portfolio Flag (latency, new trading and position trading) and Portfolio Algo (collection of MetaTrader EAs trading breakout, momentum and news trading on Forex, Commodities and Equities).

Remember, both investing and trading is a marathon, not a sprint, and the key to success is to stay the course and stick to your investment strategy.

Safe Trading

Team of Elite CurrenSea 🇺🇦❤️

Leave a Reply