Is it Time to Buy Chinese Stock Again?

The Chinese stock market has made an incredible leap from zero to hero in only a few months! Even though they’ve already demonstrated a remarkable bounce back from their lows, here are five compelling reasons to include them in your portfolio.

| Instrument | Entry | TP/SL | Long/Short | Duration |

| MSCI China ETF (MCHI) | $45-$55 | $80/$25 | Long | Up to 60 days |

| iQIYI, Inn. (IQ) | $3.8-$5.2 | $17/$2.2 | Long | Up to 45 days |

| Pinduoduo Inc. (PDD) | $85-$95 | $115/$75 | Long | Up to 45 days |

| Alibaba Group (BABA) | $120 | $180/$80 | Long | Up to 60 days |

Sign on Disinflation in 2023

Household Savings in Check

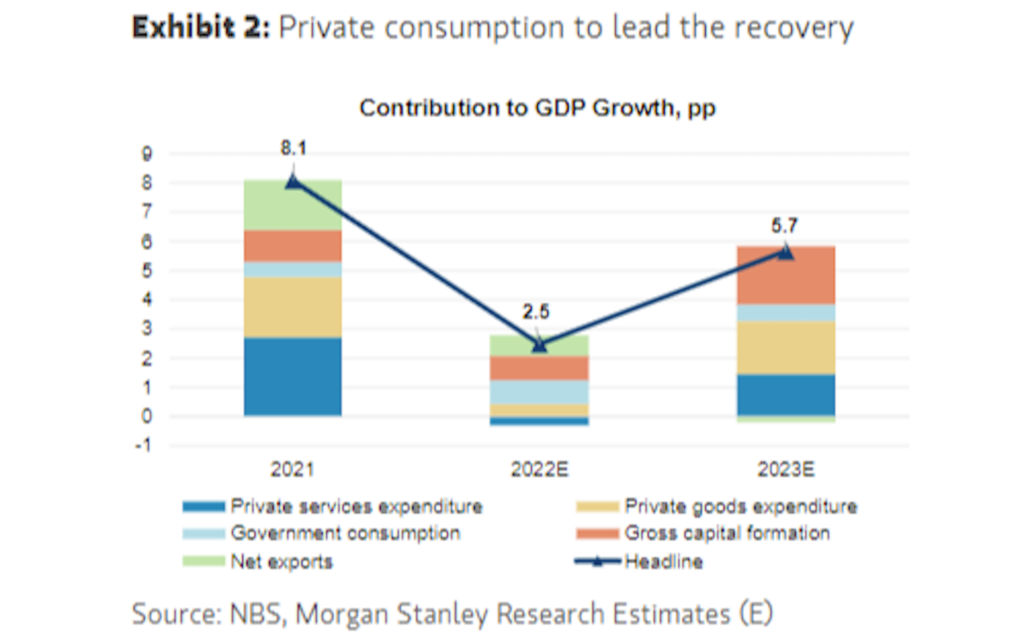

China kept tight Covid-19 restrictions in place throughout most of 2022, much longer than other countries around the world, resulting in a substantial economic impact. But with the full reopening of the country, the government is anticipating a massive economic comeback with a rebound in household consumption and additional investments from the government. With those additional expenditures, China should be able to meet its projected growth rate of approximately 5.5% this year, without requiring more exports than imports.

Last year, property prices took a sharp dip, and it was detrimental to many households’ finances and trust. Chinese customers may be more wary than their American counterparts were in 2021.

However, Chinese shoppers did manage to accumulate excess savings in the course of the pandemic, and there’s a lot of unfulfilled demand to be released. What’s more, it’s unlikely that China’s reopening will lead to steep inflation due to the global economy’s decline and supply chains being well-managed.

The outlook for Chinese companies’ earnings looks highly positive for next year, with an estimated double-digit rise, much faster than almost any other region. Investment banks Goldman Sachs and Morgan Stanley agree that the anticipated improved profits have yet to be reflected in the share prices, leaving plenty of opportunity for investors to gain attractive returns even with just the market expectations being met.

Friendlier Government

Over the past two years, Chinese shares have suffered not only from stringent lockdowns, but also from geopolitical tensions and the government’s suppression of the property and tech sectors. Thankfully, however, the government is taking steps in the right direction by embracing pro-growth strategies, such as taking active stakes in some tech companies, supporting the property sector, and attempting to reconcile its contentious relationships both in the nation and internationally.

It is important to keep in mind that taking away obstructions of one’s own doing is not comparable to the implementation of a huge and vigorous stimulus package.

However, a more market-friendly approach can eliminate an essential risk factor and can possibly pull back hesitant investors little by little.

Historically Low Valuations

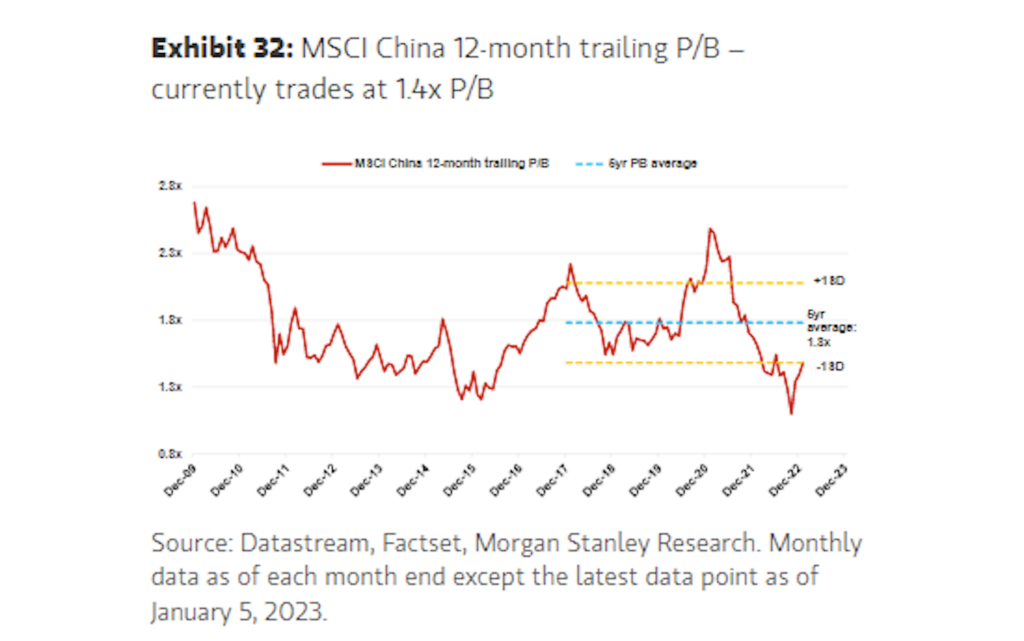

Despite the rebound in stock prices from the bottom prices seen in November, they remain lower than their five and ten year averages, and are nowhere near the peak levels from the past.

Compared to stocks from other developing nations, Chinese stocks can be considered a steal. It is likely that China’s shift to expansionary policies, the reduced potential for political turmoil, and the scarcity of global growth prospects, will cause the gap to close, bringing Chinese stock valuations to at least the average–implying potential gains of more than 10%!

Demand Overshadowing Supply

Investors across the board “capitulated” on Chinese stocks in 2019, including major institutions. The rebound was so rapid that many large, global, long-only investors couldn’t jump back on the bandwagon. As they suffer from FOMO, the demand to reach at least neutral allocation from their current underweight levels is expected to outstrip the supply and thus push prices higher.

Diversification

China is in a fortunate state: while inflation is low, its economy is on the rebound and its policymakers are taking proactive steps to promote growth rather than stifle it. China’s success is largely the product of its own accomplishments, leaving it less exposed to the global economy than many other nations. That’s not to say it’s unaffected by a global recession, but with the challenges many areas of the world are facing, China stands out as a potential source of returns for investors.

How to Trade These Opportunities?

Investing in Chinese stocks has its own inherent risks; any rise in international conflicts, retraction of the government’s development policies, disruption in the real estate market, or an unexpectedly sluggish recovery could lead to a drastic downturn in stock prices. Additionally, considering the scale of the recent surge in prices, a correction could easily occur.

Considering the changes in Covid, economic, and regulatory policies in the near term, the risk-reward for diversifying some US stock exposure with China is currently quite appealing – although the entry point may not be ideal.

Long-term, the low starting point of both valuations and earnings makes a persuasive case for investing in Chinese stocks.

You can take advantage of the iShares MSCI China ETF (ticker: MCHI; expense ratio: 0.58%) to invest in China. On the other hand, Europeans might want to choose the iShares MSCI China A UCITS ETF (CNYA; 0.4%) to make their investments.

For a riskier option, the KraneShares CSI China Internet ETF (KWEB; 0.69%) could be a great choice, as it’s tilted towards tech and consumer discretionary stocks. To invest in individual stocks, Morgan Stanley recommends Alibaba (BABA), as it is undervalued and should benefit from China’s reopening and the influx of foreign investments.

As always, we will be trading china-related assets, you can tap into out flagship trading here.

Safe Trading

Team of Elite CurrenSea 🇺🇦❤️

Leave a Reply