Is Investing in UK Such a Bad Idea Right Now?

Pessimism about “UK plc” has been rampant lately, but that just woke up the contrarian in me. So I decided to look at the corporate UK landscape from a different perspective, searching for any signs of hope. I consulted analyses from JPMorgan and AJ Bell and found three big reasons for optimism in Britain’s largest companies. Here they are…

1. Low Forward Price to Earnings Ratios

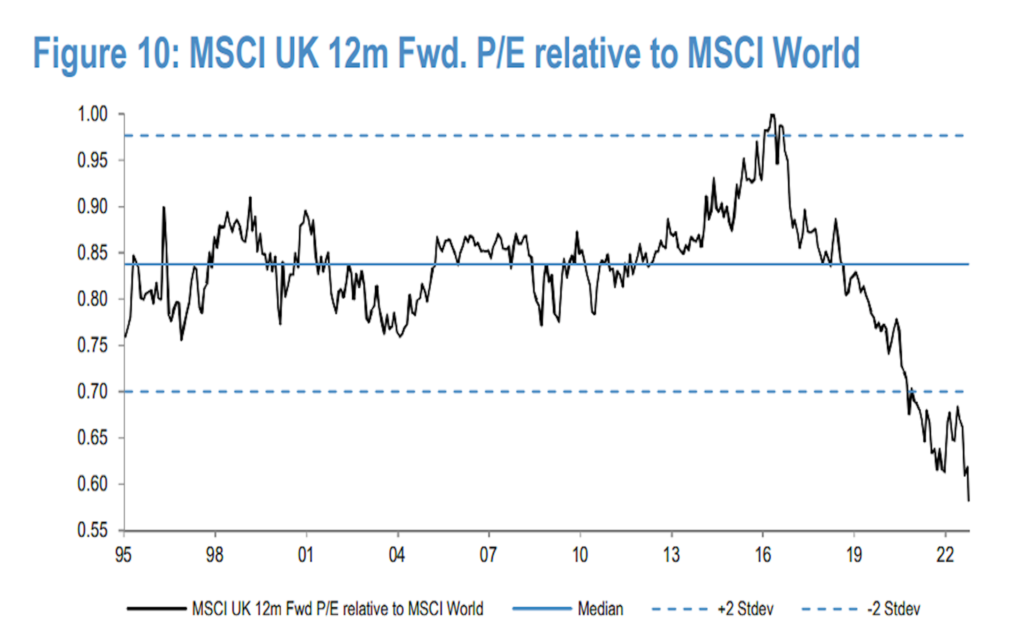

From a valuation perspective, the country’s stocks appear to be attractively priced. The MSCI’s UK index’s forward P/E ratio – the price-to-earnings measure that uses forecasted profits in its calculation – has fallen to a record low relative to the MSCI World index.

And as you can tell from the chart, it has now dipped well below two standard deviations from its usual, or “mean”, level, and is trading at a discount of about 40%. This wide deviation increases the probability that the price will “mean revert”, or return to its long-term average.

There’s no way to pick the bottom without a crystal ball, but investing is all about tilting the odds more in your favor. At a forward P/E multiple of 8.6x, the MSCI UK index’s valuation is less likely to compress further. Let’s be real, the forward P/E of the UK index isn’t just cheap compared to its peers – it’s cheap compared to its own 20-year history too.

2. Very Appetite-Inducing Dividends Yields

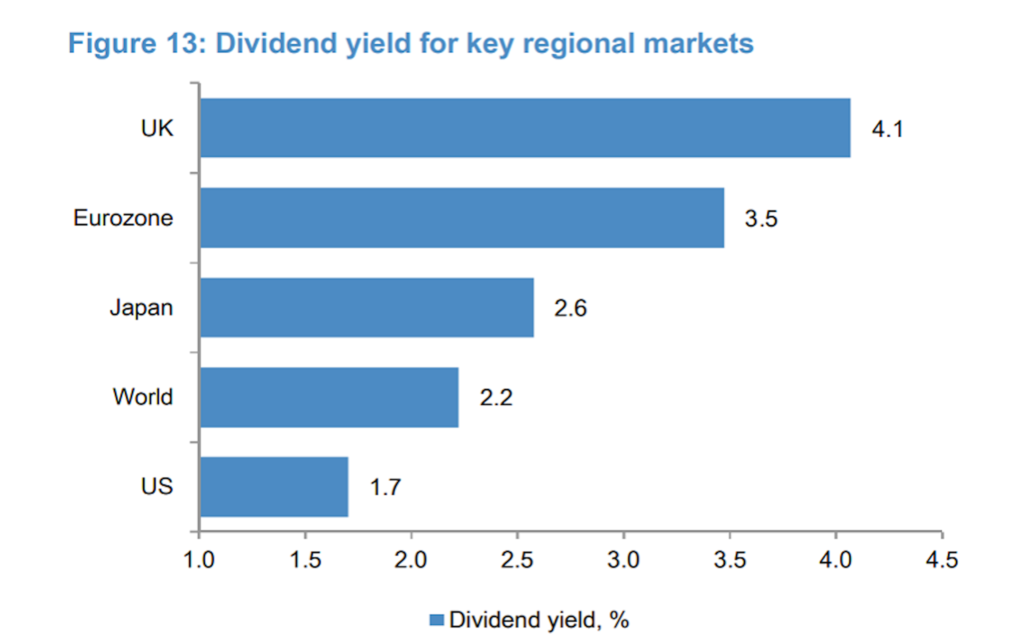

The total return from shares consists of two components: capital appreciation (the increase in stock valuation) and yield from dividend payouts. Capital appreciation is the primary focus when discussing returns from shares, but dividend yield is also an important factor to consider – especially in the UK.

The FTSE 100 provides investors with a yield of 4.1%, which is significantly higher than shares from other advanced economies. And two factors suggest that those yields will continue even as recession fears and earnings’ headwinds grow.

First, the FTSE 100 generates 70% of its revenue from overseas sources, meaning that a weaker pound translates into higher profits when these earnings are repatriated.

Second, the dividend payout ratio has already adjusted lower, currently standing at around 50%. This is a significant drop from its previous peak of 70%.

3. Don’t Discount Buybacks and Foreign Acquisitions

The very cheap share prices of many UK firms has led corporate boards to decide to repurchase their own stocks – to the tune of almost £51 billion ($57 billion) this year, according to an AJ Bell analysis. And when you’re bullish on stocks, it’s not a bad thing having a big player in the market bidding up the share price. Those cheap share prices could drive another factor too: an increase in takeovers of UK companies by foreign players.

Combine very cheap valuations with a weak pound and you hit the sweet spot for the checkbooks to come out. This could provide an extra layer of returns in addition to the yield and valuation components.

How to Grab the Opportunity by the Horns?

The game of speculating is never going to be 100% percent successful, but the key is to find opportunities that are asymmetrical- where the upside potential is higher than the downside potential.

This creates a margin of safety which increases your chances of making solid returns. The FTSE 100 provides a nice long opportunity from this standpoint. There are two ways you can trade the FTSE 100 and FTSE 250.

The first would be a pairs trade, buying the undervalued FTSE 100 and selling the relatively overvalued FTSE 250.

This way, you’re hedged or market neutral and can still make gains whether the market goes up, down, or sideways.

The second would be to go long on the FTSE 100 outright.

UK homebuilders are looking cheap, trading at a roughly 45% discount to the FTSE 100. Given the size of that haircut, it would seem like the expected housing market decline and the general negative sentiment toward the sector have largely been priced in. It’s important to note this sector is also sensitive to Bank of England (BoE) interest rate expectations.

If the BoE adopts fewer hikes than investors expect or if we get a softer landing in the housing market, this could lead to a sharp surge in shares of homebuilders, such as Persimmon (PSN), Vistry Group (VTY), Crest Nicholson (CRST), and Barratt Developments (BDEV).

Safe Trading

Team of Elite CurrenSea 🇺🇦❤️

Leave a Reply