How to Trade the Dichotomy Between Powell’s November FOMC Notes & Press Conference

Ever since COVID knocked on our door, FOMC meetings turned into something of a Superbowl of finance (albeit a way more frequent one at that).

We are noticing an interesting divergence between what Powell says during the meeting and the post-meeting Q&A session, and the Algos that are increasing the dominating force in trading these events might agree with us.

You see, while the “Robots” seem to have read the FOMC release notes with optimism, a more hawkish tone of the Powell press conference might have as well tanked the markets (NASDAQ 100 tanking 5% intra-day).

Many investors try to read tea leaves in order to skate to where the puck is going when it comes to the decisions made at the meeting. This is because there are so many moving pieces and it can be difficult to keep track of everything.

Expectations and Macro Factors

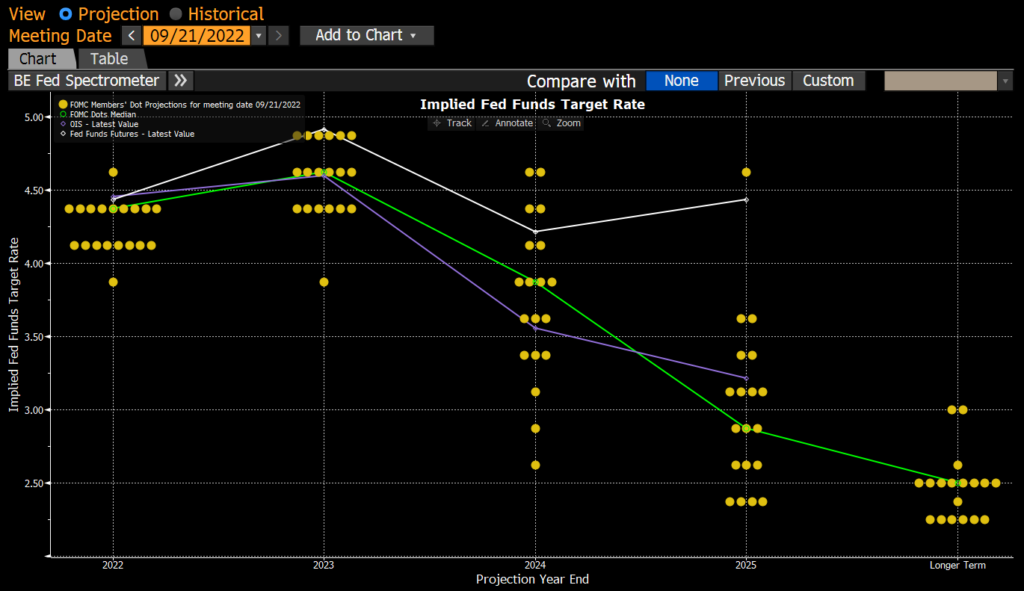

In September Fed updated it’s dot plot, but does it hold true in November? Let’s see if the past meeting gave us any clues.

The key takeaway from this chart is the variance between the green line (FOMC Dots median) and the white line (latest value of Fed fund futures). With the white line significantly above the green line, the expectation has shifted to “higher for longer” instead of what was forecasted back in September.

While a 75bps hike was the consensus going into the meeting, the market debated the terminal rate and when it would be achieved. Some investors point to Bullard’s comments as suggesting that the Fed could do another 75bps in December and then pause.

What will impact the Fed’s decision-making tree most significantly is inflation and the tight labor market. As economic risks become more balanced between growth and inflation, the market will look increasingly for a change to the Fed’s hawkish stance.

A popular view was that we would see a step down from 75bps to 50bps and then to 25bps before this tightening cycle ends. However, any indication from the Fed that the terminal rate is lower or that the tightening cycle ends in 2022 would likely be received positively by the stock market. The biggest risk to this view is if CPI comes in hotter than expected next week or in December.

FOMC Notes Nitpicking

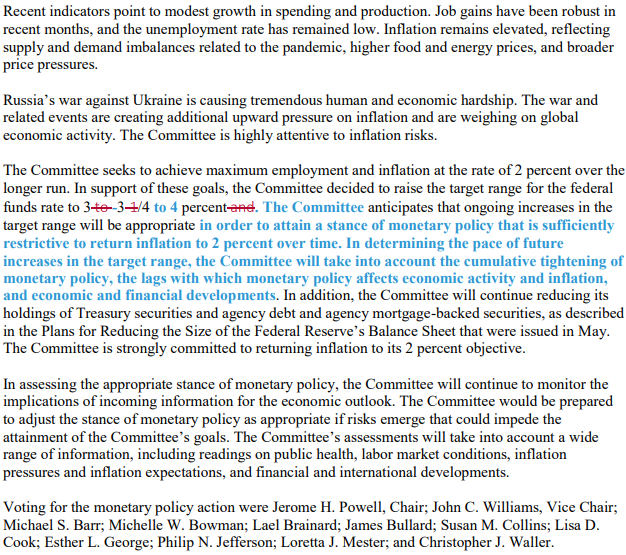

When the release comes out, everyone’s thesaurus comes out and they become English Ph.D.s. When artificial intelligence (AI) is using natural language processing (NLP), the document that they scrap is the strikethrough of the statement to detect any hawkish/dovish language.

This document highlights the changes (i.e. “Net New” information) between meetings. That is why this is important.

In this strikethrough, the phrase “cumulative tightening” was introduced. This means that the Fed is recognizing that they are tightening at a historically rapid pace and are considering the total effect of hikes rather than the net change on a meeting-over-meeting basis.

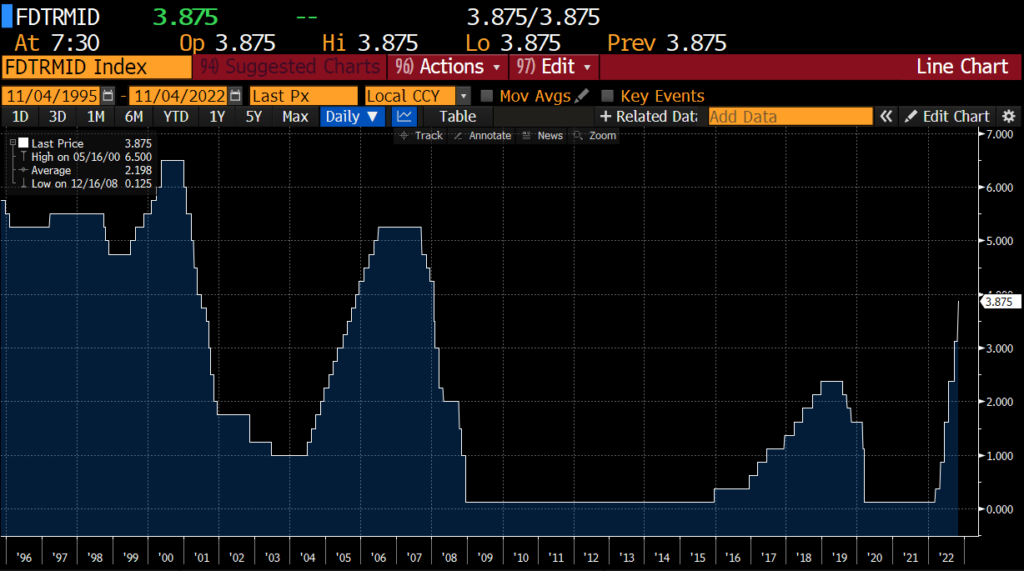

As we can see, this line is much more vertical than the other hiking cycles, which means that the Fed is becoming more aware of the potential effects of their actions.

The next phrase is “the lag with which monetary affects economic activity and inflation, and economic and financial developments.”

This acknowledges that rate hikes can take a while to have an impact on economic indicators. I would argue that there is no such “lag” when it comes to the stock market – it is a real-time pricing machine that can have an immediate impact on stocks.

The news sent stocks soaring when it was released, but unfortunately, the decision-making process isn’t over yet. Powell will be reading the statement and taking questions at 2:30.

Nitpicking Tone & Contents of Powells Press Conference

Instead of using Jay Powell’s soothing voice for meditation or sleep-aid apps, it’s probably causing sleepless nights ahead.

Two quotes seem particularly important:

“With the lags between policy and economic activity, there’s a lot of uncertainty, so that we note that in determining the pace of future increases will take into account the cumulative tightening of monetary policy, as well as the lags with which monetary policy affects economic activity and inflation… that’s why I’ve said at the last two press conferences that at some point it will become appropriate to slow the pace of increases. So that time is coming, and it may come as soon as the next meeting or the one after that.”

“We may ultimately move to higher levels than we thought at the time of the September meeting. The incoming data since our last meeting suggests the ultimate level of interest rates will be higher than previously expected. The risks are asymmetric. If the Fed does too much, it can cut. If it doesn’t tighten enough, then you’re in real trouble… It is very premature to be thinking about pausing… We think we have a ways to go.”

Now to JOLTS & NFP

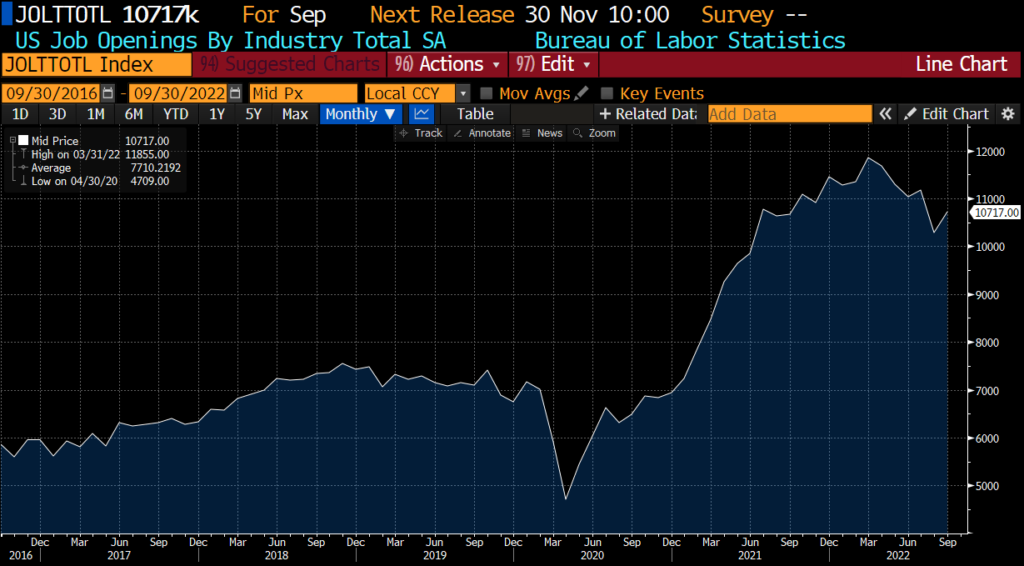

The Fed is clearly data-dependent, and two of the most important data sets they consider are inflation and jobs. This week we get CPI data, but last week we got JOLTS and NFP data, which both went in the wrong direction.

JOLTS showed that employment openings totalled 10.72 million, well above the FactSet estimate for 9.85 million.

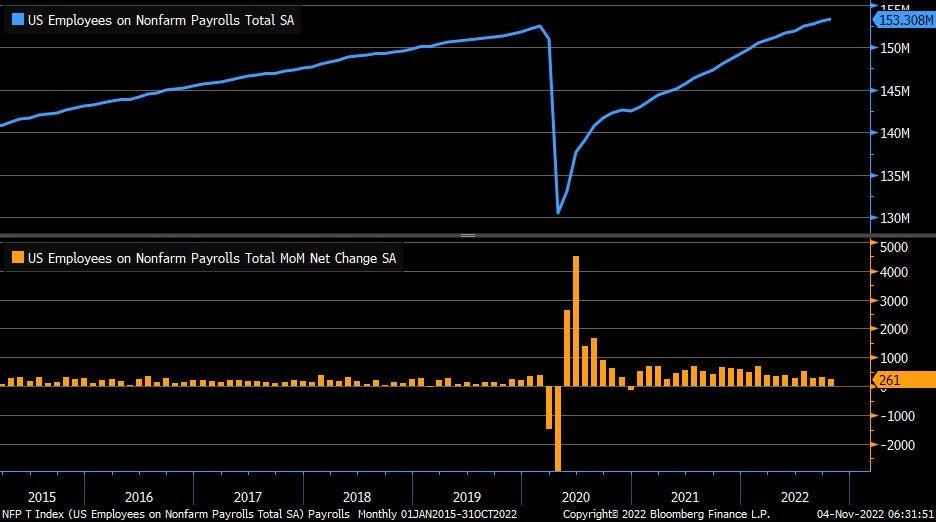

NFP: October nonfarm payrolls are stronger at +261k vs. +193k projected. The strong labor market is no excuse to let off the hiking cycle. Take everything with a grain of salt, though.

Keep in mind that 260k jobs is only 0.0017 of the 153mln people working in the US and, statistically speaking, is still within the margin of error.

What Are the Opportunities Here?

In an extremely volatile market, headlines can have a big impact. While it’s impossible to predict these events, you need to keep the bigger picture in mind.

As Powell expressed, markets will only find a bottom near the end of rate hiking cycles. This end is not yet here.

Your best plays here may be looking into your favorite intraday indicators (as well as our weekly wave analysis 😉, or even better, by using award-winning momentum and wave trading software and methods SWAT & Black Widow) for shorting everything equities and going long on commodities, while at the same time, if you are into longer-term speculations, gradually buying strong US & International Stocks (alternatively, keeping enough margin and going long on SP500).

Safe Trading

Team of Elite CurrenSea 🇺🇦❤️

Leave a Reply