How to Trade Like a Politician

The trading week before the last week (October 10-15) might have left you wondering, what is it with the market – everyone screaming for stocks to go down if the CPI data is higher than expected and the unemployment is lower (a sign of hikes not helping), yet, we see SP500 building up a massive 5% hike in the following days.

You are not alone, markets do move in a mysterious way, and sometimes, the Daniel Kruger effect sets in motion what many believe is a sure sign that “the game is rigged”.

Now, you don’t have to be a conspiracy theory person to like the idea of following the US Governors who like and what happened to amas massive holdings in stock trading (over $350 million in 2021 alone).

For instance, Nancy and her husband have raised eyebrows with their impeccably-timed trades – especially given her very prominent position in politics.

The Public Doesn’t Trust Politicians as it’s Used To

Common folk has been losing trust in US politicians for a while now. In fact, Pew Research found that public trust in politicians has dropped from a robust 75% in the 1960s to a puny 19% in 2022.

And the numbers aren’t much better when you zoom in on trading: a Financial Times poll from this January signaled that 76% of the American public believe members of Congress and their spouses have an unfair edge, and only 5% supported them still being able to trade.

The public’s view of trading politicians is more negative than a two-week-old lemon. Despite the Stop Trading On Congressional Knowledge (STOCK) Act being implemented in 2012 to try and improve the ever-weakening trust deficit, it doesn’t seem to be helping.

The act requires politicians and their families to report any purchases or sales of stock with a value of over $1,000 in the last 45 days, but it doesn’t seem to be making a difference.

Even though many critics argue that a ban on congressional trading is necessary, it is unlikely to happen anytime soon.

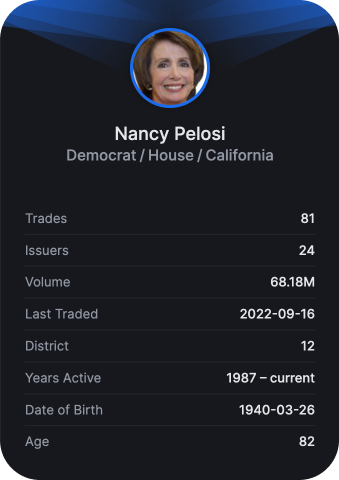

Nancy Pelosi (House Democrats)

Nancy Pelosi’s husband’s savvy investments just before major news stories broke suggest he may have had inside information.

Nancy Pelosi’s husband’s savvy investments just before major news stories broke suggest he may have had inside information.

Just one month before it was announced that Nvidia chips would be used in a US supercomputer, her husband invested in the chipmaker.

And a few weeks before Microsoft’s partnership with the US Army was announced, he exercised options to get 25,000 Microsoft shares.

These well-timed moves resulted in tidy profits. But this isn’t just a Democrat issue: two Republican senators were also quick to sell their stocks before the stock market meltdown in March 2020, after they received private data that highlighted the seriousness of the pandemic.

Senator Kelly Loeffler (House Republicans)

Back in 2020, Kelly tweeted “Appreciate today’s briefing from the President’s top health officials on the novel coronavirus outbreak”

On the same day, Loeffler and her husband sold their joint stake in Resideo Technologies, the Daily Beast reported. According to analysts, the transaction was worth between $50,001 and $100,000.

Then Senator Loeffler from the Republican party bought up Citrix stock, a company that would directly benefit from the pandemic-induced shift toward remote work. It’s no wonder people are losing their cool over this…

The company’s stock price has since plummeted by more than half, largely due to the plunge in oil prices that caused a 7% drop in indices on the New York Stock Exchange. Loeffler and her husband, the CEO of the New York Stock Exchange, proceeded to make a series of additional stock transactions reportedly worth between $1.275 million and $3.1 million through February 14.

Loeffler is the newest and wealthiest member of Congress, with a fortune estimated at $500 million.

How to Bet On Politicians Knowing What They Are Doing (for once 😀)?

Two new exchange-traded funds (ETFs) are set to launch soon, and they’ll offer investors the chance to trade like politicians. The investment case is simple: politicians have privy information at their emails, and retail investors want in.

The Pelosi-namesake NANC ETF will seek to replicate the returns of Democratic members of Congress and their family members. Meanwhile, KRUZ – a not-so-subtle nod to Republican Senator Ted Cruz – will track the equities held by Republican lawmakers and their families.

Each ETF plans to hold a portfolio of between 500 and 600 stocks, according to the regulatory filing.

The ETFs will need to be actively managed to constantly and accurately reflect politicians’ fresh buys and sells, and all that manpower means the ETFs will have a fairly hefty price tag of a 1% expense ratio.

Now, we haven’t yet been told how the ETFs will be weighted, but you could likely get a similarly diversified set of 500 or so stocks with the S&P 500 ETF for a fraction of the cost – just 0.03%. But remember: these ETFs will only give you exposure to stocks, not other assets like crypto and bonds.

You could use Capitol Trades to track senators’, representatives, and their family members’ market transactions. This nifty little site lets you filter by asset class, trade size, and political party, and you can even search for a certain politician or specific single asset. So, mom-and-pop investors, this could be your opportunity to gain an edge by piggybacking off politicians’ trades.

Safe Trading

Team of Elite CurrenSea 🇺🇦❤️

Leave a Reply